Navigation: Loans > Loan Screens > Transactions Screen Group > Charge Off Transactions Screen >

The Convert Precomputed to Simple tab, which can be accessed from several CIM GOLD locations, is an administrator screen. Only managers and supervisors should be given security access to this screen. This screen is usually accompanied by a bankruptcy or write-off/charge-off. Converting a precomputed loan to a simple-interest (or interest-bearing) loan is part of a final step of recourse in attempting to recover funds from a delinquent account. Some institutions require precomputed loans to be converted to interest-bearing loans before the loan can be bankrupt or charged-off.

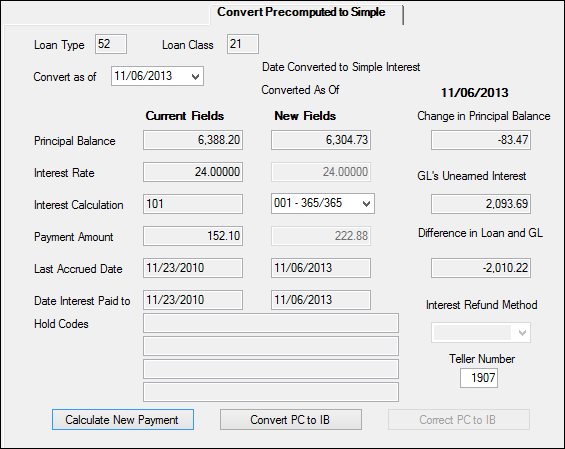

Use this tab to convert precomputed interest (payment method 3) loan accounts to daily simple interest loans (payment method 6). The account's Principal Balance, Interest Rate, and Interest Calculation (see table below) can also be adjusted on this tab.

|

WARNING: You must set up Teller Number 8960 before performing any conversions on this tab. To learn how to set up teller 8960, see help for the Deposits > Definitions > Teller Information screen. In addition, the General Ledger number from which the unearned interest is debited or credited must be set up in the Convert Precomputed Interest Income G/L account on the GOLD Services > General Ledger > G/L Account By Loan Type screen.

The transaction run from this tab only converts a customer's account from precomputed to simple (interest bearing) if the account's original interest rate (as indicated on the Loan Origination Tracking dialog) is less than 100 percent. If the original interest rate on the customer account is greater than or equal to 100 percent, this transaction will convert the account from precomputed to a signature (payment method 16) loan instead. |

|---|

Convert Precomputed to Simple Tab accessed from several screens in CIM GOLD

To perform a conversion, the system calculates the remaining unearned interest on the account. It then debits your institution’s Convert Precomputed Interest Income G/L account on the GOLD Services > General Ledger > G/L Account By Loan Type screen and credits this amount to the loan’s principal balance (principal decrease).

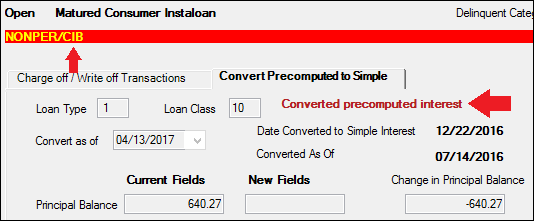

Once all the fields on this screen display the correct information, the conversion is initiated by clicking ![]() . Once the loan has been converted "CIB" will be displayed in the Account Status bar and "Converted precomputed interest" will also be displayed at the top of the screen, as shown below:

. Once the loan has been converted "CIB" will be displayed in the Account Status bar and "Converted precomputed interest" will also be displayed at the top of the screen, as shown below:

Additionally, the following fields are updated:

•Date Last Accrued and Date Interest Paid To fields (on the Loans > Account Information > Account Detail screen) are updated with the Converted As Of date (see table below).

•Payment Method changes from 3 (precomputed) to 6 (interest bearing), unless interest rate is higher than 100 percent. In which case, it changes from 3 to 16 (signature).

•Any Unearned Interest is moved to Earned Interest in the Amortization of Interest to G/L field group on the Loans > Account Information > Precomputed Loans screen (if applicable). See Note below concerning deferments on precomputed loans.

•The Principal Balance on the loan is increased by the amount of precomputed Unearned Interest remaining on the account (if applicable).

•If institution option NLCB is set up for your institution, all Late Charges owing are cleared from the account.

Note: If the precomputed account (payment method 3) has a refundable Deferment Code (e.g., MLDFRC = 11, 30, 34, 35, etc.), and there is a calculated amount for the deferment refund, the Precomputed-to-Simple transaction will rebate the deferment back to the customer based on the effective date of the deferment. Once the account is converted to interest bearing, we use the Date Converted to Simple Interest (MLCNDT) to prevent the deferment from rebating again in the future if the account is paid off.

Correcting the PC-to-IB Transaction

To correct the PC-to-IB transaction, click ![]() , and the system will restore the loan to its condition before it was converted.

, and the system will restore the loan to its condition before it was converted.

Important Note: Corrections to this transaction can only be made in the same month as when the precomputed loan was converted to an interest-bearing account. If users attempt to correct a PC-to-IB transaction after that, the system will return an error. Additionally, if a payment or any other transaction is made to an account once it has been converted, and then you try correcting the interest-bearing account back to a precomputed account, you will receive an error. You will need to reverse off any activity before you can correct the PC-to-IB transaction. You may need to contact your GOLDPoint Systems account manager to assist you with this.

Any changes made on this screen will appear on the Precomputed Converted to Daily Simple Interest Report (FPSRP217). For more information about this report, see the Loan Reports manual on DocsOnWeb.

See below for more information about the institution options pertaining to PC to IB conversions.

|

|

When this option is set up for your institution, running the Convert Precomputed to Simple transaction causes the system to clear late charges from a customer account when the account is converted. |

An institution option is available that, when set, causes the system to not subtract one month from the Converted As Of Date field (see table below) when converting a precomputed loan to an interest-bearing loan using the Convert Precomputed to Simple screen. (Without the option set, the system subtracts one month before doing the interest calculation). If you would like this feature, contact your GOLDPoint Systems account manager and have them turn on institution option OP29 CIBI (Calc CIB Int Using Convert As Of Date). |

|

Accelerated Balance Option |

An Accelerated Balance option is available to your institution. This option allows for an accelerated rate of calculation to compute any precomputed interest due back to the customer at the time the conversion transaction is processed. See the Interest Refund Method field in the table below for more information. |

Update Function 93 |

If this Update Function is set up, the system will automatically convert precomputed loans to interest bearing once the original and/or current Maturity Dates are in the past. |

The fields on this tab are as follows:

Field |

Description |

|||

|

Mnemonic: LNTYPE, LNCLAS |

The Loan Type field displays the type of customer loan account. This information is pulled from the Loans > Account Information > Account Detail screen. Use this information when setting up the Convert Precomputed Interest Income G/L account on the GOLD Services > General Ledger > G/L Account By Loan Type screen. This is the G/L account your institution uses to store precomputed interest.

The Loan Class field displays the classification of the loan account. This information is pulled from the Loans > Account Information > Account Detail screen. Loan classifications are institution-defined and can also be used on reports for loan servicing convenience. |

|||

|

Mnemonic: CVASOF |

Use this field to indicate the date the account will begin accruing interest once the conversion is complete. This date cannot be set prior to the loan's Opened Date. If a date prior to the Opened Date is entered in this field, an error message will appear and the screen will need to be refreshed. See below for more information.

|

|||

Date Converted to Simple Interest

Mnemonic: MLCNDT |

This field indicates the date the conversion took place. This is the true conversion date. Generally, this date is the same as the Converted As Of date below.

Note: If the precomputed account (payment method 3) has a refundable Deferment Code (e.g., MLDFRC = 11, 30, 34, 35, etc.), and there is a calculated amount for the deferment refund, the Precomputed-to-Simple transaction will rebate the deferment back to the customer based on the effective date of the deferment. Once the account is converted to interest bearing, we use the Date Converted to Simple Interest (MLCNDT) to prevent the deferment from rebating again in the future if the account is paid off. |

|||

|

Mnemonic: N/A |

This field displays the date the account began accruing interest once the conversion was completed. It is the date when the precomputed-to-simple-interest transaction takes affect on the loan.

If

An institution option is available that, when set, causes the system to not subtract one month from the Converted As Of Date field when converting a precomputed loan to an interest-bearing loan using the Convert Precomputed to Simple screen. (Without the option set, the system subtracts one month before doing the interest calculation). If you would like this feature, contact your GOLDPoint Systems client solutions specialist and have them turn on institution option OP29 CIBI (Calc CIB Int Using Convert As Of Date). |

|||

Principal Balance (Current/New)

Mnemonic: LNPBAL, NEWPBAL |

This field displays two values: Current and New.

The Current unpaid principal balance of the loan is pulled from the Loans > Account Information > Account Detail screen.

The New Principal Balance is the unpaid principal balance of the loan once the precomputed-to-interest-bearing conversion is complete. To view the new principal balance, enter information in the Convert as of, New Interest Rate, and New Interest Calculation fields on this tab and click |

|||

|

Mnemonic: LNRATE, NEWRATE |

This field displays two values: Current and New.

The Current interest rate on the loan is pulled from the Loans > Account Information > Account Detail screen.

The New Interest Rate is the new interest rate of the loan you are converting to a simple-interest loan. Entering information in this field, as well as the Convert as of and New Interest Calculation fields on this tab, will affect the calculation of the rest of the fields on this screen. Click

If you want to designate a new payment amount to be applied after the precomputed-to-simple-interest conversion takes place, enter the new amount in the New Payment Amount field below. |

|||

Interest Calculation (Current/New)

Mnemonic: LNIBAS, NEWIBAS |

This field displays two values: Current and New.

The Current interest rate calculation method on the loan is pulled from the Loans > Account Information > Account Detail screen.

The New Interest Calculation is the new interest rate calculation method on the loan once the conversion is complete. Select the new method to be applied to this account from this drop-down list. Additionally, enter information the New Interest Rate and Convert as of fields above, then click |

|||

|

Mnemonic: LNPICN, NEWPICN |

This field displays two values: Current and New.

The Current Payment Amount is the regular payment amount for the loan, including principal and interest. This information is pulled from the PI Constant field on the Loans > Account Information > Account Detail screen.

The New Payment Amount is the the regular payment amount for the loan once the conversion is complete. If you have security to enter information in this field, you can enter the new payment amount for the loan, then click

If you want to set up a new interest rate, enter information in the New Interest Calculation, New Interest Rate, and Convert as of fields on this tab and click |

|||

Last Accrued Date (Current/New)

Mnemonic: LNDLAC, NEWDLAC |

This field displays two values: Current and New.

The Current Last Accrued Date field displays the present date for which interest was last accrued on the loan. This information is pulled from the Date Last Accrued field on the Loans > Account Information > Account Detail screen.

The New Last Accrued Date on the loan displays once the conversion is complete. This field is updated with the date entered in the Convert as of field above after the account has been converted (the |

|||

Date Interest Paid To (Current/New)

Mnemonic: LNPDTO, NEWPDTO |

This field displays two values: Current and New.

Current Date Interest Paid To displays the present date up to which interest has been paid on the loan. This information is pulled from the Date Interest Paid To field on the Loans > Account Information > Account Detail screen.

The New Date Interest Paid To on the loan displays once the conversion is complete. This field is updated with the date entered in the Convert as of field above after the account has been converted (the |

|||

|

Mnemonic: LNHLD1, LNHLD2, LNHLD3, LNHLD4 |

These fields display all hold cods currently active on the loan. This information is pulled from the Hold Code fields on the Loans > Account Information > Account Detail screen. |

|||

|

Mnemonic: NEWPBAL - LNPBAL |

This field displays the difference between the Current and New Principal Balance values (see above) after the conversion takes place (the |

|||

|

Mnemonic: UNERNED |

This field displays the amount of interest on a precomputed loan that has not been earned or amortized to the General Ledger. This amount plus any additional interest being credited back to the loan (due to the Convert as of field above being set to a past date) comprises the total amount that the principal on the loan will be reduced to after the conversion (the

To perform a conversion, the system calculates the remaining unearned interest on the account. It then debits your institution’s Convert Precomputed Interest Income G/L account on the GOLD Services > General Ledger > G/L Account By Loan Type screen. and credits this amount to the loan’s principal balance (principal decrease). |

|||

Difference in Loan and GL Amortization Calculations

Mnemonic: (NEWPBAL - LNPBAL) - UNERNED |

The value in this field added to or subtracted from the G/L’s Unearned Interest (see above) equals the funds amount by which the principal balance on the loan will be reduced following the conversion (the |

|||

|

Mnemonic: MRRULE |

This field displays the interest refund rule applied to the loan at payoff. Possible selections in this field must be set up on the Loans > System Setup Screens > Client Code Setup > CIB Interest Refund Method screen. See help for that screen for more information. See below for further details about this field.

|

|||

|

Mnemonic: TLTLLR |

Enter your teller number in this field. If you need any help with setting up tellers, please refer to the Teller Information in the Deposits in CIM GOLD manual on DocsOnWeb for more information.

The conversion runs a debit to the Convert Precomputed Interest Income G/L account on the GOLD Services > General Ledger > G/L Account By Loan Type screen and a credit to the loan principal, both by journal. Since both sides are run (debit and credit), the teller is always in balance. To verify teller totals for this teller, see the Deposits > Definitions > Teller Information screen in CIM GOLD. |