Navigation: Loans > Loan Screens > Bankruptcy and Foreclosure Screen Group > Bankruptcy Detail Screen >

When your institution receives notice that a borrower is filing for bankruptcy, the first step is to run the applicable Bankruptcy transaction. This will flag the account as bankrupt. See the following steps on how to place a borrower in bankruptcy.

|

Note: An option is available on the Bankruptcy Options screen that requires precomputed loans (payment method 3) to be converted to interest-bearing loans (payment method 6) before the Bankruptcy transaction can be processed. See Require PC to IB at Petition on the Bankruptcy Options screen for more information. |

|---|

As the bankruptcy proceedings move along, see the Action and Dates field group for further actions you will need to take on the account.

To place a customer in bankruptcy using the Bankruptcy Detail screen:

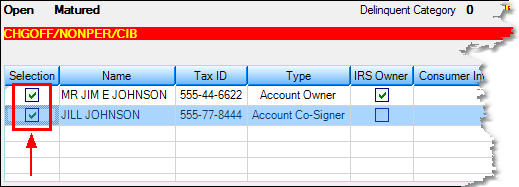

| 1. | Select the customer's name who is filing for bankruptcy in the Bankruptcy list view at the top of the Bankruptcy Detail screen (if there is only one name attached to a customer account, that name will automatically be selected when processing bankruptcy information on this screen). You should check the Selection box next to their name. If more than one person on the account is filing for bankruptcy, select the Selection box for all applicable names, as shown below: |

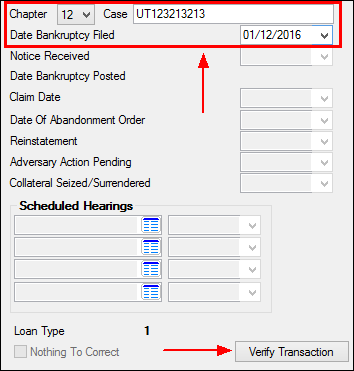

| 2. | Indicate the bankruptcy chapter in the Chapter field, the Bankruptcy Court case number in the Case field, and the date the bankruptcy was filed in the Date Bankruptcy Filed field. |

| 3. | Click <Verify Transaction> to open the Verify Accounts dialog, as shown below: |

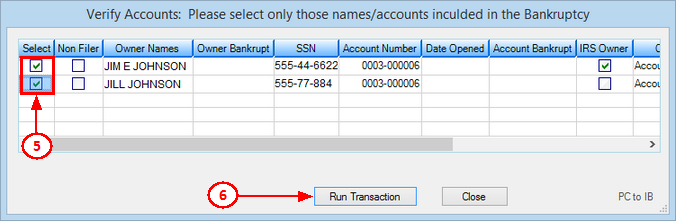

| 4. | Use the checkbox fields in the Select column to indicate which account owners the Bankruptcy transaction is being run for. |

| 5. | Click <Run Transaction>. |

|

Note: A Bankruptcy transaction cannot be processed if a customer account has ten active Action Codes and four active Hold Codes (in other words, the maximum allowed number of each type of code). The account must have at least one slot available for each type of code so that the system can apply an Action and Hold Code pertaining to bankruptcy.

CIM GOLD does not automatically remove an existing Hold or Action code to make room for the bankruptcy transaction codes. Your institution is responsible for deciding which codes to remove manually. Train your employees on procedures if they encounter instances of bankrupting accounts that already have full code lists.

See help for the Actions, Holds and Event Letters screen for more information about Action and Hold Codes. |

|---|

| 6. | Click <Close> to return to the Bankruptcy Detail screen. The fields on the screen will be available for file maintenance. |

See Results of Bankruptcy on Accounts for information on how the account is affected.

A bankruptcy can be undone, but only before monthend is run for the first time on the bankrupt account. After monthend, an action code and date will be needed to report any change to credit reporting agencies.

See also:

Reporting an Account in Bankruptcy in the Credit Reporting manual.