Navigation: Loans > Loan Screens > Bankruptcy and Foreclosure Screen Group > Bankruptcy Detail Screen >

You can only undo a bankruptcy before monthend is run. After monthend, when the account has been reported to credit repositories as bankrupt (Consumer Information Indicator code), you must run a different transaction to indicate further developments with the bankruptcy, such as:

•Close (Run this transaction if the Bankruptcy petition transaction was run in error.)

To undo a bankruptcy before monthend:

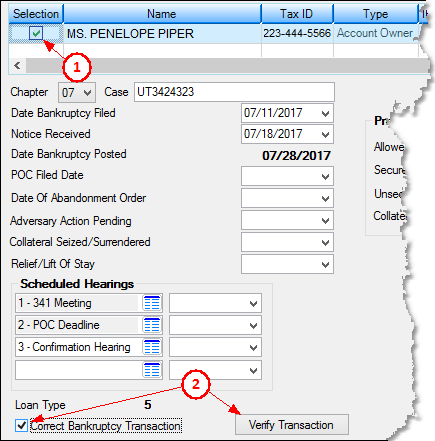

| 1. | Select the bankrupt customer's name in the Bankruptcy list view at the top of the Bankruptcy Detail screen. |

| 2. | Mark the Correct Last Transaction field, then click <Verify Transaction>, as shown below: |

|

Note: If this box is not enabled, you will not be able to correct the bankruptcy transaction through these steps. You will need to contact your GOLDPoint Systems account manager to do an init, or use the Withdrawn transaction. See the help for the Withdrawn transaction for more information, as this will still affect credit reporting unless you change some fields. |

|---|

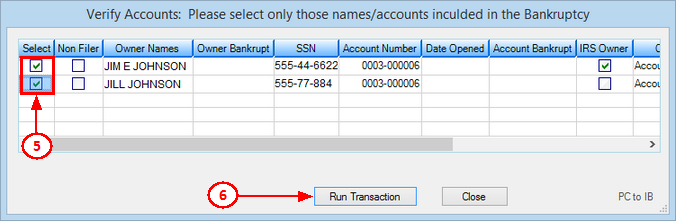

| The Verify Accounts dialog (as shown below) is displayed with “Undo Bankruptcy” listed under the Action column. |

| 3. | Check the box next to the name for who you are undoing the bankruptcy, then click <Run Transaction>. The Error column will display any errors that occurred, or the Processed column will display “Succeeded” if the bankruptcy was successfully cancelled. |

An afterhours report (FPSRP208) shows all accounts that have a bankruptcy status (hold code 4 (Chapter 7, 11, 12) or 5 (Chapter 13)).

When you undo a bankruptcy, the Number Of Bankruptcy Filings field increases by 1, as the system counts any transaction having to do with bankruptcies (including undoing bankruptcies).

When a bankruptcy is reversed in this manner, the following changes occur on the account:

•Clears bankruptcy Chapter and Case.

•Clears Date Bankruptcy Filed.

•Clears the Consumer Information Indicator.

•Clears Hold Codes 4 (Chapter 7, 11, 12) or 5 (Chapter 13).

•Clears Action Code 94 if the Bankruptcy transaction put it on.

•Any automatic or Recurring payments that were previously set up on the account will need to restarted again. You can restart recurring payments using the Loans > Transactions > EZPay screen by clicking <Discontinue Recurring Payment> or the Payment Information screen by unchecking the Stop Loan Autopay box.

•If late charges were waived as part of the Bankruptcy transaction (must not have Institution Option BKLC enabled), the Remove Bankruptcy transaction will add them back on.