Navigation: Loans > Loan Screens > Bankruptcy and Foreclosure Screen Group > Bankruptcy Detail Screen > Field Descriptions >

Actions and Dates field group

Declaring an account bankrupt (see Placing a Customer in Bankruptcy) is just the first step of a bankruptcy. As the bankruptcy proceedings move along, other actions are usually decided, such as a judge's dismissal, completing or discharging the bankruptcy, or closing a bankruptcy. You can apply additional bankruptcy actions using this field group.

|

Note: If CIM GOLD has been set up to interface with third-party bankruptcy transmissions at your institution, automatic bankruptcy processing is available. See help for the Auto Process File field on the Loans > Bankruptcy and Foreclosure > Bankruptcy Options screen for more information. |

|---|

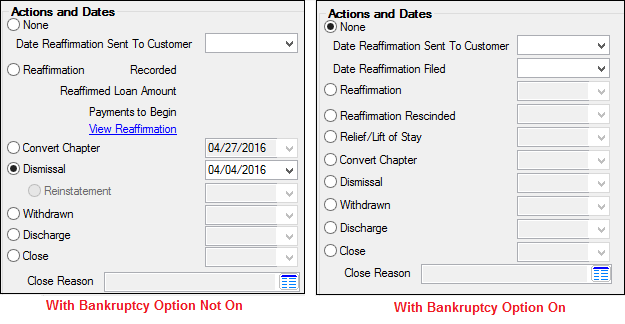

The appearance of this field group changes slightly depending on the status of the Display Reaffirmation Dates Only field on the Bankruptcy Options screen. See Reaffirmation for more information.

Each one of these Action radio buttons is capable of running a transaction that will affect the bankruptcy. These actions will update the Credit Reporting information sent to credit repositories at monthend. For example, if a Bankruptcy transaction is reported one month, and then the next month the debt was paid in full, you would need to run a Withdrawn transaction, so the credit reporting process reports the account as withdrawn (see Consumer Information Indicator).

See the following help pages for information concerning each possible transaction:

|

WARNING: If your institution is using Institution Option BKLC (waive late charges when the bankruptcy transaction is run), you must have teller number 8960 set up. |

|---|