Navigation: Loans > Loan Screens > Bankruptcy and Foreclosure Screen Group > Bankruptcy Screen >

Use the Repayment Plan tab on the Bankruptcy screen to view and edit court-ordered repayment plans for bankruptcies on the customer loan account. Because this is not the actual (contractual) loan payment amount, repayment plans can be tracked separately from the contractual repayment terms.

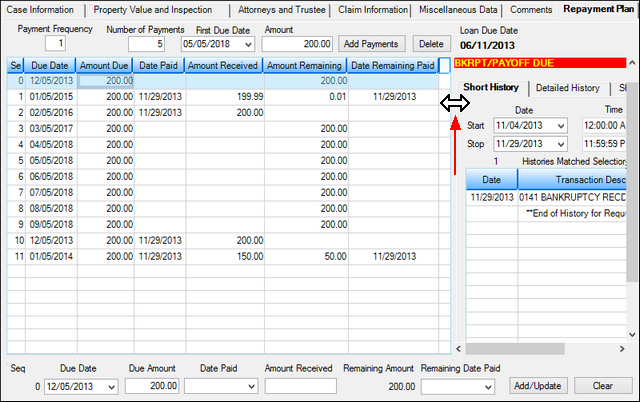

This tab is divided into two sections: Repayment plan activity on the left and loan history on the right. The loan history section appears and functions identically to the Loans > History screen. The dividing line between these two sections can be dragged to adjust the screen display, as shown below:

Loans > Bankruptcy and Foreclosure > Bankruptcy Screen, Repayment Plan Tab

The main list view in the left section of this tab displays information about the repayment plan for the customer loan account. It includes the due date, amount due, date paid, amount received, amount remaining, and date remaining paid.

•To add a payment schedule to this list view, enter information in the fields on this tab and click <Add Payments>.

•To record payments made, select an item from this list view, enter information in the fields on this tab, and click <Add/Update>.

•To remove a payment plan from the list, select the payment plan then click <Delete>.

See below for more information about repayment plan setup and history.

|

|

|

Field Descriptions

The fields on the left section of this tab are as follows:

Field |

Descriptions |

||

|

Mnemonic: BKFREQ |

Use this field to indicate the payment frequency for the bankruptcy repayment plan ordered by the court for the customer loan account.

The number entered here corresponds to the number of months for each payment. For example, entering "1" in this field causes a payment due each month up to the Number of Payments (see below). Entering "2" causes a payment due every other month. Entering "3" creates a payment due every third month, etc. |

||

|

Mnemonic: BKNPMT |

Use this field to indicate the number of payments the court ordered to pay back the customer loan account during bankruptcy proceedings.

This value corresponds with the Payment Frequency field above. For example, If the court orders 5 monthly payments, enter "5" in this field and "1" in the Payment Frequency field to indicate monthly payments. |

||

|

Mnemonic: BK1STD |

Use this field to indicate the first due date required by the bankruptcy court to start payments on the ordered repayment plan for the customer loan account. |

||

|

Mnemonic: BKAMPT |

Use this field to indicate the amount the customer is required to pay for every Frequency of the bankruptcy repayment plan. |

||

|

Mnemonic: PNDUED |

Use this field to indicate the date the repayment plan payment (or partial payment) selected in the list view was made on the customer loan account.

|

||

|

Mnemonic: PNDUAT |

Use this field to indicate the payment amount for the repayment plan being created (or view the due amount for the repayment plan selected in the list view). |

||

|

Mnemonic: PNPDDT |

Use this field to indicate the date the customer paid the court-ordered repayment plan amount on the repayment plan selected in the list view.

Example: A $600.00 payment is due 5/1/14. On 5/15/14, the borrower pays $400.00. Enter "5/15/14" in this field and "400.00" in the Amount Received field below. The system will calculate and display 200.00 in the Remaining Amount field below. When the borrower pays the remaining $200.00, enter "600.00" in the Amount Received field below and the date in this field. The system recalculates the Remaining Amount field to be zero. |

||

|

Mnemonic: PNPDAT |

Use this field to indicate the amount the customer has paid the court-ordered repayment plan selected in the list view. |

||

|

Mnemonic: PNDUAT - PNPDAT |

This field displays the remaining amount due on the repayment plan selected in the list view. It is calculated by subtracting the Amount Received from the Due Amount (see above).

Example: A $600.00 payment is due 5/1/14. On 5/15/14, the borrower pays $400.00. Enter "5/15/14" in the Date Paid field above and "400.00" in the Amount Received field. The system will calculate and display 200.00 in this field. When the borrower pays the remaining $200.00, enter "600.00" in the Amount Received field and the date in the Date Paid field. The system recalculates this field to be zero. |

||

|

Mnemonic: PNREMD |

Use this field to indicate the date the remaining payment of a repayment plan was made, if your institution wants that date on record. This field cannot be entered once a full payment is recorded. See below for more information.

|