Navigation: Loans > Loan Screens > Account Information Screen Group > Renewals & Modifications & Extensions Screen >

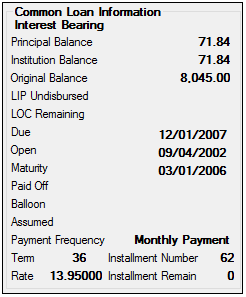

The fields in the Common Loan Information field group contain common loan information such as principal balance, original balance, and the dates the loan was opened and paid off. This field group is found on several Loan screens within CIM GOLD.

The fields in this field group are as follows:

Field |

Description |

||

|---|---|---|---|

|

Mnemonic: LNPBAL |

This is the unpaid principal balance of the loan. It can only be entered or changed by teller transactions. Depending on the kind of loan, a transaction may either reduce or increase this balance.

Line-of-credit loans (payment method 5 for consumer loans, and 9 or 10 for commercial loans) can be opened with a zero principal balance. |

||

|

Mnemonic: WKIBAL |

This field displays the institution's portion of the principal balance. It is calculated as follows:

Principal Balance X Portion Sold = Investor's portion Principal Balance - Investor's Portion = Institution's Portion

|

||

|

Mnemonic: LNOBAL |

This field contains the original amount of the loan. On precomputed loans (payment method 3), this amount will include the loan principal plus the add-on amounts. This field is originally entered through a teller transaction; however, the user is allowed to file maintain this field if necessary on the Loans > Account Information > Additional Loan Fields screen

|

||

|

Mnemonic: LNLBAL |

This field contains the amount of funds not yet disbursed from the LIP account. It is increased by a 510 credit transaction and decreased by a 500 debit transaction, an interest charged transaction, or construction disbursement 430 or 431 transactions from within the GOLDTeller System.

When GOLDWriter mnemonic LNUNDISB is used, it will display the undisbursed balance for either LIP or line-of-credit payment method 5, 9, or 10 loans. This mnemonic gives you the ability to display the undisbursed amounts for both LIP or line of credit loans in the same column.

For LIP loans, the mnemonic will display the LIP undisbursed balance by reading this field. The LIP method code must be greater than 0.

For line-of-credit loans, the undisbursed amount is calculated as follows: Credit Limit - Principal Balance = Undisbursed.

|

||

|

Mnemonic: WKRLOC |

This field displays the remaining line of credit. It is calculated differently depending on whether it is a revolving or non-revolving line of credit:

Revolving

LINE-OF-CREDIT LIMIT - PRINCIPAL BALANCE = REMAINING LINE

Non-Revolving

LINE-OF-CREDIT LIMIT - LINE-OF-CREDIT USED = REMAINING LINE |

||

|

Mnemonic: LNDUDT |

This is the date in MMDDYYYY format that the next regular payment is due. It is determined by the system from the Payment Frequency code, but you can file maintain this field on the Loans > Account Information > Account Detail screen. This field can be used in conjunction with the Due Date Day field on the Account Detail screen. The system requires a due date to be on the loan before the loan can be opened.

File maintaining the Due Date field will change the Due Date Day field to match the day portion of the due date.

For an LIP loan, this is the date to which the payments have been received. If interest is charged against the LIP, the due date and the LIP Next Bill or Charge Date should always agree. If the LIP interest is billed, the LIP Next Bill or Charge Date will roll when the interest is billed and the due date will roll when the payment is collected.

For line-of-credit loans (payment method 5, 9, or 10) with a zero balance, a balance increase transaction will update the loan due date by adding the number of days before the finance charge date to the current run date.

An online error message will appear when file maintenance occurs on this field. If the interest calculation code is a 1, 2, or 3, the system will not allow the due date to be anything except one payment frequency ahead of the date last accrued. For LIP loans with an interest calculation code of 1, 2, or 3 and an LIP method code of 2 or 102 the error message will also appear. The error message will be "NO F/M - DATE LAST ACCRUED NOT 1 FREQ BEHIND DUE DATE."

If Institution Option DD27 is set, the due date day will not be allowed to be greater than 27. |

||

|

Mnemonic: LNOPND |

This field displays in MMDDYYYY format the date the loan was opened or funded. The system automatically supplies this information when a new loan (680 tran code) is performed. For precomputed loans (payment method 3), this field is one of the keys for calculating rebates. Although the system enters the data for this field, it is file maintainable on the Account Detail screen. |

||

|

Mnemonic: LNMATD |

This field contains in MMDDYYYY the date for when the last payment is due and when the loan should be paid off. All loans must have a maturity date, except payment methods 5, 8, 9 or 10, or the payment cannot be posted.

Institution Option CLZB automatically closes zero balance payment method 5 loans. At the time the loan is closed, the payoff date is also updated. The "close" transaction is a file maintenance tran code 22 to field 999. At the same time, the system will update the payoff date. The loan will automatically close on the night of the maturity date.

Monetary balances that must be zero are: principal balance, reserve balance, partial payments, miscellaneous funds, late charges, loan fees, accrued interest, accrued interest on reserves, and accrued interest on negative reserves. In addition, the loan cannot have an LIP method code greater than zero.

For loan advances (tran code 500 field debit), if a loan is past the maturity date, a principal advance (increase) will not be allowed. The error message "LOAN PAST MATURITY, ADVANCES NOT ALLOWED" will be displayed in the Teller System. If there is no maturity date, advances will continue to process. This action occurs for all payment methods.

Institution Option APML allows a principal increase to be processed if a loan is past the maturity date. It requires a supervisor override (SOV).

Institution Option APCO allows allows a loan payment (transaction code 600/608) or an optional loan payment (transaction code 690/698) to be processed if a loan has been charged off (hold code 2). |

||

|

Mnemonic: LNCLDT |

This field is entered by the system, but can be file maintained. The date is the date this loan was paid off and is the same date as the Payoff Date on the Loans > Payoff screen, regardless of what date the payoff was actually posted. This field will be updated when a payoff transaction code 580 is processed. A payoff correction code 588 will blank the field out.

Backdating a Payoff

If a payoff transaction is backdated, the date in this field is still the same as the Payoff Date.

Example: Payoff Calculation screen calculates the payoff to 1-20 (that date appears in the Payoff Date field). The payoff was processed on 1-26 and backdated to 1-23. The date in this field will be 1-20.

Institution Option CLZB automatically closes zero balance payment method 5 loans. At the time the loan is closed, the payoff date is also updated. The close transaction is a file maintenance tran code 22 to field 999 performed in GOLDTeller. The loan will automatically close on the night of the maturity date. If the maturity date is on a weekend or holiday, the loan will close on the night of the first business day following the maturity date.

Monetary balances that must be zero in order to process a payoff are principal balance, reserve balance, partial payments, miscellaneous funds, late charges, loan fees, accrued interest, accrued interest on reserves, accrued interest on negative reserves, customer balance, LIP balance, and, for payment method 5 loans, the prior and current finance charge. In addition, the loan cannot have an LIP method code greater than zero. |

||

|

Mnemonic: WKBLDT |

This field displays the balloon date. Once a loan has reached the balloon date, payments will no longer be drafted under the following conditions:

•If the run date is less than or equal to the balloon date •If the balloon date is greater than or equal to the loan due date

If either of these conditions exists, the night the payment would have drafted, the loan will be placed on the Afterhours Processing Exceptions Report (FPSRP013).

|

||

|

Mnemonic: LNASDT |

This field stores the date this loan was last assumed, if applicable, and controls the interest being reported for the new borrower. Only interest paid after this date will be reported for the new borrower. If the loan was assumed, this field is updated by the assumption date once the assumption is completed.

|

||

|

Mnemonic: LNFREQ |

This field displays how often a payment is due on this loan. Depending on the type of loan this is, you can change the payment frequency from the Loans > Account Information > Payment Information screen. |

||

|

Mnemonic: LNTERM |

This field contains the term of the loan in months. It is used in calculating rebates on loans with precomputed interest (payment method 3), and in determining the remaining term of ARM (payment method 7) loans.

|

||

|

Mnemonic: LNINNO |

This field contains the total number of regular customer installments made since the beginning of the loan. The system adds 1 to the field with each full payment.

If a loan has an LIP method code of 1 or 101 or is a payment method 5, the installment number does not change.

Institution option KIST does not change the installment number to 0 when running the open loan transaction 680. Use this for bulk purchases where payments have been made prior to the loans being purchased. |

||

|

Mnemonic: N/A |

This is the annual interest rate to the nearest three decimal places. It is the rate entered or calculated at which the payment is being made.

For ARM loans (payment method 7), you must enter the interest rate in the Current Rate on the Loans > Account Information > ARM Information screen for interest to be calculated on this loan. This is generally used with a rate pointer other than "255." If the rate is file maintained on daily simple interest loans (payment method 5 or 6), the accrued interest is recalculated to the current date using the old rate, and the date last accrued is changed to today's date. |

||

|

Mnemonic: WKREMN |

This field displays the number of installments remaining for the loan. The loan term divided by the frequency, less the installment number, gives the number of payments remaining on the loan.

For bi-weekly payments (payments every two weeks), the remaining term is calculated as follows:

Term in Months / 12 X 26 – Installment Number = Remaining Term

Example:

Term = 255 Installment number = 176

255 / 12 X 26 – 176 = 376.5 ~ 377 |