Navigation: Loans > Loan Screens > Bankruptcy and Foreclosure Screen Group > Bankruptcy Detail Screen > Field Descriptions > Actions and Dates field group > Reaffirmation >

The Standard Reaffirmation allows you to set up the reaffirmation amount of the loan the borrower will be required to pay back. You can also set the interest rate, the payment amount based on the payment frequency, the number of payments, and any amount to be written off. The terms of the reaffirmation are usually negotiated between your institution and the borrower filing for bankruptcy. Establishing a reaffirmation allows the borrower to keep their collateral, while still making payments. See Effects of Reaffirmation below for details on how a reaffirmation affects the loan. Reaffirmation of debt is only available for Chapter 7, 11, and 12 bankruptcies. If you try to reaffirm debt with a Chapter 13, you will receive the following error message:

"INVALID CHAPTER CODES ENTERED! MUST BE 7, 11 OR 12."

The following steps explain how to establish a reaffirmation using the standard method. Note: If the Display Reaffirmation Dates Only option is not selected on the Loans > Bankruptcy and Foreclosure > Bankruptcy Options screen, the standard Reaffirmation process is used. See Reaffirmation: Simplified for a simpler method of reaffirming debt.

Steps for Reaffirming Debt Payments (Standard Method)

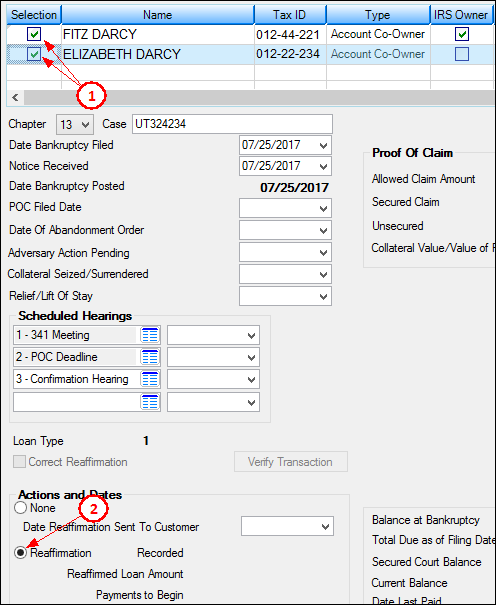

1.Once a loan has been designated as bankrupt (see Placing a Customer in Bankruptcy), check the Selection box for each person listed in the bankruptcy who you want to assign a reaffirmation in the top list view on the Bankruptcy Detail screen (see below).

2.Select the Reaffirmation radio button (see above). The Reaffirmation dialog box is displayed (shown below).

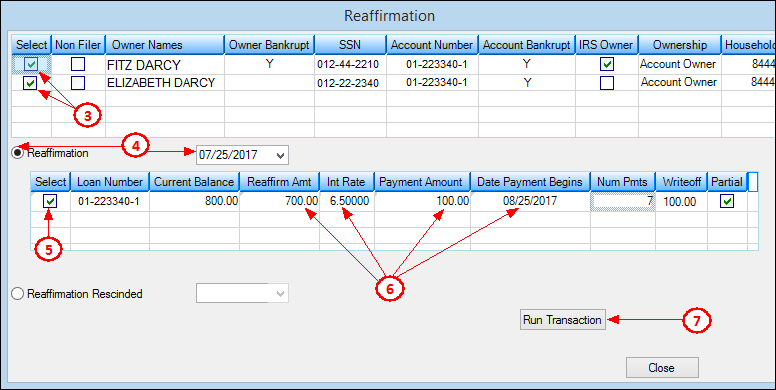

3.Select the names in the top list view for who you want to apply the reaffirmation of debt.

4.Select the Reaffirmation radio button, then select the date the reaffirmation will take affect. Note: The Reaffirmation date cannot be prior to the Date Bankruptcy Filed; however, it can be the same date as the Date Bankruptcy Filed.

5.Click the Select box for the account you want to apply the reaffirmation plan.

6.In the columns in the grid table, enter the details of the reaffirmation. The system will automatically enter the Loan Number and Current Balance. You will need to enter information in the following columns:

•Reaffirm Amt: Enter the agreed upon reaffirmation amount to be paid by the borrower. Your institution can determine how much the borrower must owe. It could be the full amount, (which is displayed in the Current Balance column), or your institution may choose to waive any fees, late charges, or even a small amount of the interest due or principal balance. This is entirely up to your institution's discretion and the amount allowed by the Bankruptcy Courts.

•Int Rate: If you want to maintain the current interest rate, enter that rate in this column. If you want to reduce or increase the interest rate, enter the amount here. This will be the interest rate on the loan for the remainder of the reaffirmation period.

•Payment Amount: Enter the agreed-upon payment amount of the loan between your institution and the borrower. This will be the amount the borrower will pay each frequency going forward.

•Date Payment Begins: This is the date the reaffirmation payments will begin. This will transfer to the next Due Date once the transaction is run. This date cannot be prior to the date of Reaffirmation (see step 4 above); however, it can be the same date as the Reaffirmation.

•Num Pmts: This field is automatically calculated by the system once the Reaffirm Amt and Payment Amount are entered. For example, if the Reaffirm Amt is $700 and the Payment Amount is $100, the Num Pmts will be 7 (700 divided by 100 is 7).

•Writeoff: This field is automatically calculated by the system once the Current Balance and Reaffirm Amt fields are entered. This is the difference between the Current Balance and Reaffirm Amt. This is the amount that will be written off by your institution, if applicable.

•Partial: If some of the Current Balance is written off (as displayed in the Writeoff field), this box will be checked. This indicates a part of the loan was written off during reaffirmation.

| 7. | Click <Run Transaction>. The reaffirmation is now applied to the loan. |

See the following example detailing these steps:

When a reaffirmation transaction is processed, the following changes occur on the account:

•Bankruptcy Reaffirmed Date (BBFIRD) is set.

•If the interest rate was changed during the reaffirmation, the new rate is displayed in the Interest Rate field on the Account Detail screen.

•If the Payment Amount was changed during reaffirmation, the new payment amount is displayed in the Next Payment Due field on the Account Detail screen. Additionally, the P/I Constant is changed to the new payment amount you entered.

•If the Date Payment Begins was changed, the new date will be reflected in the Due Date field. Note: The Due Date Day does not change.

•If the Num Pmts was changed, the new number of payments left on the account is reflected in the Term in Months field. Note: The Maturity Date does not change.

•"Reaffirm" is displayed in the Loan Identifier Line at the top of the screen. The "BKRPT" alert status is removed from the account.

•Hold Code 4 or 5 (bankruptcy) is cleared. Essentially, the loan is no longer considered bankrupt, because the debt is still being paid off.

•The Do Not Send Statements for This Account box is unchecked. Note: An option must be set to resume sending statements. See Options below.

•The Advertise box is checked. Note: An option must be set to resume advertising. See Options below.

•Late Charge Code (LNLTCD) is put back from bankruptcy history.

•The Phone Restriction field will be changed to "0 - No Restrictions" indicating employees can call the borrower. Note: An option must be set to clear the Phone Restriction, as described in Options below.

•The Email Restriction field will be changed to "0 - No Restrictions" indicating employees can call the borrower. Note: An option must be set to clear the Email Restriction, as described in Options below.

•Bankruptcy Consumer Information Indicator and date changes to "R - Reaffirmation of Debt" and date of the reaffirmation, respectively. The account will be reported as such to the credit repositories during monthend Credit Reporting (see the Credit Reporting help for more information).

During reaffirmation, if any amount of the loan was written off, the following occurs on the account in addition to everything above:

•The amount written off is subtracted from the Principal Balance.

•The Written Off amount on the Actions/Holds/Event Letters screen is updated with the amount written off during reaffirmation and in the Partial Written Off Amount field on the Bankruptcy Detail screen.

•"PRTWRTOFF" is displayed in the Alert Status at the top of the screen.

•When a partial write-off occurs during reaffirmation of debt, the system reports the written off amount in a secondary tradeline (account) during monthend credit reporting (FPBY record).

•The write-off amount is updated accordingly:

oNew tradeline with a new account number is reported to credit repositories. This new tradeline reports the Principal Balance as the written-off amount. The Original Balance is reported with the original balance of the loan.

oSince the written off amount is included with the bankruptcy, the Consumer Information Indicator is reported as the bankruptcy with which the account is filed. For example, if the account was a Chapter 7 petition, the written off amount would be reported with Consumer Information Indicator of "A - Petition for Chapter 7 Bankruptcy."

oThe Account Status is reported with the same code as before the Bankruptcy transaction was run.

See Reaffirmation Rescinded if the Bankruptcy Court, your institution, or the borrower rescinds on the repayment plans of the reaffirmation. Additionally, if the courts permit a relief/lift of stay, run the Relief/Lift of Stay transaction.

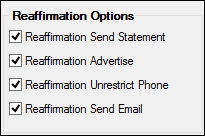

You can set up additional options that affect the results of the Reaffirmation transaction through the Bankruptcy Options screen in the Reaffirmation Options field group. See the following descriptions:

Reaffirmation Options Field Group on the Bankruptcy Options Screen

Reaffirmation Send Statement

Mnemonic: BIRESS |

When the Bankruptcy transaction is run, the system checks the Do Not Send Statement field. In other words, the account owner no longer receives statements. If this box is checked and then you run the Reaffirmation transaction, the system will uncheck the Do Not Send Statement field and the account owner will resume receiving statements, if applicable. |

Advertise Mnemonic: BIREAD |

When the Bankruptcy transaction is run, the system checks the Advertise field. In other words, the account owner no longer receives advertisements. If this box is checked and then you run the Reaffirmation transaction, the system will uncheck the Advertise field and the account owner will resume receiving advertisements, if applicable. |

Unrestrict Phone

Mnemonic: BIREUP |

When the Bankruptcy transaction is run, the system flags phone numbers with a restriction of "13 - Contact Attorney Only." However, if this box is checked, and then you run the Reaffirmation transaction, the system will change the Phone Restriction to "0 - No Restrictions." Therefore, your employees and collectors can continue calling the borrower concerning late or missed payments. |

Send Email

Mnemonic: BIRESE |

When the Bankruptcy transaction is run, the system flags email addresses with a restriction of "1 - No Email Allowed." However, if this box is checked, and then you run the Reaffirmation transaction, the system will change the restriction to "0 - No Restriction." Therefore, your employees and collectors can continue emailing the borrower concerning late or missed payments, advertisements, or notices. |