The Loans > Marketing and Collections screen is used to track all marketing and collection efforts by employees to bring delinquent accounts current.

Click to expand.

Fields

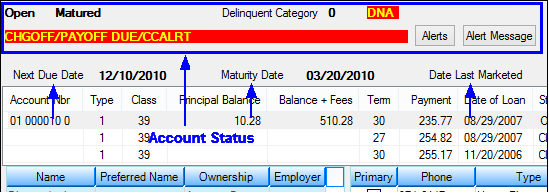

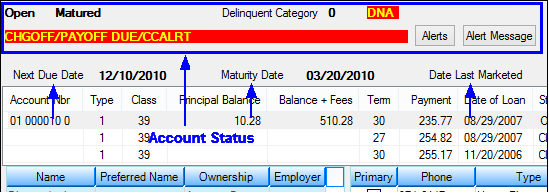

The Account Status line and four basic account information fields are visible at the top of this screen. The Collateral Summary and Last Solicitation fields are visible at the bottom of this screen. These fields are all visible regardless of which tab is selected on this screen. See below for more information about these fields.

Field

|

Description

|

Next Due Date

Mnemonic: LNDUDT

|

This is the date the next regular payment is due. It is determined by the system from the account's payment frequency. This field can be used in conjunction with the Due Date field. The system requires a due date to be on the loan before the loan can be opened.

For an LIP loan, this is the date to which the payments have been received. For payment method 5 loans with a zero balance, a balance increase transaction will update the loan due date by adding the number of days before the finance charge date to the current run date.

If Institution Option DD27 is set, the due date day will not be allowed to be greater than 27.

|

Maturity Date

Mnemonic: LNMATD

|

This field displays the date the last payment is due on the customer loan account (and the date the loan should be paid off). All loans must have a designated maturity date except payment methods 5 (revolving line-of-credit) and 8 (rental accounts), otherwise payments cannot be posted.

Institution Option CZLB automatically closes zero balance payment method 5 loans. At the time the loan is closed, the payoff date is also updated. The "close" transaction is a file maintenance tran code 22 to field 999. The loan will automatically close on the night of the maturity date. If the maturity date is on a weekend or holiday, the loan will close on the night of the first business day following the maturity date. Monetary balances that must be zero are: Principal balance, reserve balance, partial payments, miscellaneous funds, late charges, loan fees, accrued interest, accrued interest on reserves, and accrued interest on negative reserves. In addition, the loan cannot have an LIP (loan-in-process) method code greater than zero.

Loan advances (tran code 500 field debit to principal) are typically not allowed if a loan is past the maturity date. The error message "LOAN PAST MATURITY, ADVANCES NOT ALLOWED" will be displayed both in GOLDTeller and the "daily rejects" for line-of-credit loans. If there is no maturity date, advances will continue to process. This applies to all payment methods. Institution Option APML allows a principal increase to be processed if a loan is past the maturity date. This requires a supervisor override (SOV).

Institution Option APCO allows a loan payment (tran code 600/608) or an optional loan payment (tran code 690/698) to be processed if a loan has been charged off (hold code 2).

|

Date Last Marketed

Mnemonic: CIDLMK

|

This field displays the date an employee at your institution last contacted this customer for marketing purposes. In order to market (sell) loans to a borrower, the user must select "MK - Marketed for Renewal" from the Comment Code field on the Contact tab.

|

Sort Open Loans to Top

Mnemonic: N/A

|

If this optional checkbox field is marked, open loans will automatically be sorted to the top of the Marketing and Collections Account Information list view. This is helpful for those account owners who have had many accounts with your institution.

|

Collateral Summary

Mnemonic: LNCLDS

|

This field displays the collateral of the loan, or whatever information your institution wants to store here. This field is not file maintainable on this screen, but it is file maintainable on the Loans > Account Information > Account Detail screen. Most users store the short name of the loan recipient and/or the property address for real estate loans. For loans other than real estate, this usually contains a short description of the collateral held as security for the loan. Consumer loans, such as a car loan, may list the make and serial number of the car. GOLDTrak files transfer collateral data from the CL23N5 field to the Loan system.

|

Last Solicitation

Mnemonic: M1LSPO

|

This field displays the last solicitation offered to this account owner by your third-party vendor. The information in this field is pulled from a file generated by GOLDPoint Systems from your third-party vendor. This field displays the 10-digit account number and 10-character solicitation code. The solicitation code is defined by your institution.

This field is unlabeled. It appears between the Collateral Summary field (see above) and the <Save Changes> button at the bottom of this screen.

|

|

List Views

Four list views are visible at the top of this screen (beneath the account information fields explained above) regardless of which tab is selected, as shown below. See Marketing and Collections list views for more information about these list views.

Tabs

This screen contains 10 tabs. See below for basic descriptions of each tab and links to each tab help page.

•The Delinquent Payments tab displays the total amount due on the loan to bring it current, any bankruptcy information, and other pertinent fields concerning the lateness of this account.

•The Contact tab is used to record all employee actions made on this account to market or collect deficient funds, such as phone calls made, letters of intent, and whether the employee made contact with the borrower, attorney, or relatives.

•The Customer Comments tab is where collectors or employees for your institution can record any comments by the customer concerning his or her account. This tab functions identically to the Customer Relationship Management > Comments screen.

•The CIF tab is available to enter general information for the IRS owner and any additional owner. The IRS owner is the individual or business name and tax ID number that is used to report information to the IRS. Each account can have only one IRS owner. Note: In order to be the IRS owner for an account, the member must have a social security or federal identification number entered on the system to report to the IRS.

•The Financial Summary tab displays a summary of the financial history of this account.

•The Collateral tab displays the collateral tied to this loan, as entered on the Loans > Collateral screens.

•The Personal References tab allows you to enter personal references connected to this loan borrower, including address and phone numbers of the references.

•The Loan Disclosure History tab displays history information regarding transactions and changes made to this account.

•The Actions/Holds/Events tab is used to enter actions that have taken place on this account; any holds assigned to the account; and any event letters sent. This tab functions identically to the Loans > Account Information > Actions, Holds and Event Letters screen.

•The Account Identifiers tab only appears if Institution Option HLAI is set up for your institution. This tab functions identically to the Loans > Account Information > Account Identifiers screen.

|

Record Identification: The fields on this screen are stored in the FPLN, FPND, CSEI, CSCI, FPM1 and FPMR records (Loan Master, CIF Name, Employment Information, Customer Information, Miscellaneous Loan Record Fields, Mortgage Servicing Rights). You can run reports for these records through GOLDMiner or GOLDWriter. See FPLN, FPND, CSEI, CSCI, FPM1, and FPMR in the Mnemonic Dictionary for a list of all available fields in these records. Also see field descriptions in this help manual for mnemonics to include in reports.

|

In order to use this screen, your institution must:

•Subscribe to it on the Security > Subscribe To Mini-Applications screen.

•Set up employees and/or profiles with either Inquire (read-only) or Maintain (edit) security for it on the CIM GOLD tab of the Security > Setup screen.

•Set up the desired field level security in the FPND, CSEI, CSCI, FPM1, and FPMR records on the Field Level Security screen/tab. |