Navigation: Loans > Loan Screens > Bankruptcy and Foreclosure Screen Group > Bankruptcy Detail Screen > Field Descriptions > Actions and Dates field group > Reaffirmation >

The simplified method of reaffirming debt does not allow you to write-off any part of the loan. Additionally, the loan keeps it's current interest rate, payment amount, and payment due date. Establishing a reaffirmation usually allows the borrower to keep their collateral, while still making payments. See Effects of Reaffirmation below for details on how a reaffirmation affects the loan. Reaffirmation of debt is only available for Chapter 7, 11, and 12 bankruptcies. If you try to reaffirm debt with a Chapter 13, you will receive the following error message:

"INVALID CHAPTER CODES ENTERED! MUST BE 7, 11 OR 12."

The following steps explain how to establish a reaffirmation using the simplified method. Note: In order to use this method, the Display Reaffirmation Dates Only option must be selected on the Loans > Bankruptcy and Foreclosure > Bankruptcy Options screen. If this option is not selected, use the standard reaffirmation process.

Steps for Reaffirming Debt Payments (Simplified Method)

1.Select the box next to the name in the top list view table for which you want to dismiss the bankruptcy. Note: A bankruptcy transaction should have already been run on the account. See Placing a Customer in Bankruptcy for more information.

2.Select the Reaffirmation radio button in the Actions and Dates field group.

3.Enter a transaction date in the field to the right of the radio button. Note: The Reaffirmation date cannot be prior to the Date Bankruptcy Filed; however, it can be the same date as the Date Bankruptcy Filed.

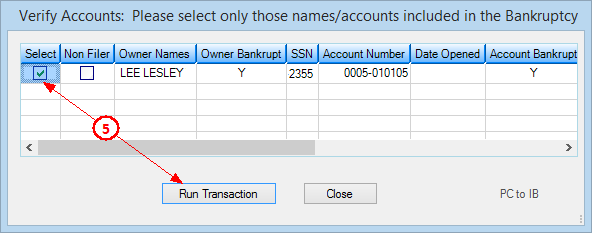

4.Click <Verify Transaction> to open the Verify Accounts dialog, as shown below.

5.Select the appropriate names to apply this reaffirmation to, and then click <Run Transaction>.

The reaffirmation status will be applied to the account.

When a reaffirmation transaction is processed, the following changes occur on the account:

•Bankruptcy Reaffirmed Date (BBFIRD) is set.

•"Reaffirm" is displayed in the Loan Identifier Line at the top of the screen.

•The "BKRPT" alert status is removed from the account.

•Hold Code 4 or 5 (bankruptcy) is cleared. Essentially, the loan is no longer considered bankrupt, because the debt is still being paid off.

•The Do Not Send Statements for This Account box is unchecked. Note: An option must be set to resume sending statements. See Additional Options below.

•The Advertise box is checked. Note: An option must be set to resume advertising. See Additional Options below.

•Late Charge Code (LNLTCD) is put back from bankruptcy history.

•The Phone Restriction field will be changed to "0 - No Restrictions" indicating employees can call the borrower. Note: An option must be set to clear the Phone Restriction, as described in Additional Options below.

•The Email Restriction field will be changed to "0 - No Restrictions" indicating employees can call the borrower. Note: An option must be set to clear the Email Restriction, as described in Additional Options below.

•Bankruptcy Consumer Information Indicator and date changes to "R - Reaffirmation of Debt" and date of the reaffirmation, respectively. The account will be reported as such to the credit repositories during monthend Credit Reporting (see the Credit Reporting help for more information).

See Reaffirmation Rescinded if the Bankruptcy Court, your institution, or the borrower rescinds on the repayment plans of the reaffirmation.

Additional Options

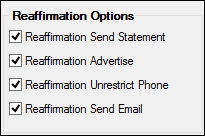

You can set up additional options that affect the results of the Reaffirmation transaction through the Bankruptcy Options screen in the Reaffirmation Options field group. See the following descriptions:

Reaffirmation Options Field Group on the Bankruptcy Options Screen

Reaffirmation Send Statement

Mnemonic: BIRESS |

When the Bankruptcy transaction is run, the system checks the Do Not Send Statement field. In other words, the account owner no longer receives statements. If this box is checked and then you run the Reaffirmation transaction, the system will uncheck the Do Not Send Statement field and the account owner will resume receiving statements, if applicable. |

Advertise Mnemonic: BIREAD |

When the Bankruptcy transaction is run, the system checks the Advertise field. In other words, the account owner no longer receives advertisements. If this box is checked and then you run the Reaffirmation transaction, the system will uncheck the Advertise field and the account owner will resume receiving advertisements, if applicable. |

Unrestrict Phone

Mnemonic: BIREUP |

When the Bankruptcy transaction is run, the system flags phone numbers with a restriction of "13 - Contact Attorney Only." However, if this box is checked, and then you run the Reaffirmation transaction, the system will change the Phone Restriction to "0 - No Restrictions." Therefore, your employees and collectors can continue calling the borrower concerning late or missed payments. |

Send Email

Mnemonic: BIRESE |

When the Bankruptcy transaction is run, the system flags email addresses with a restriction of "1 - No Email Allowed." However, if this box is checked, and then you run the Reaffirmation transaction, the system will change the restriction to "0 - No Restriction." Therefore, your employees and collectors can continue emailing the borrower concerning late or missed payments, advertisements, or notices. |

See also: