The alert status displays alerts on the account, so users can instantly identify that the account is in trouble or needs attention (as shown below).

GOLDPoint Systems Alerts

Some alerts are established by GOLDPoint Systems when certain account activity takes place on the account. The following table describes these types of alerts.

Alert Status

|

Reason

|

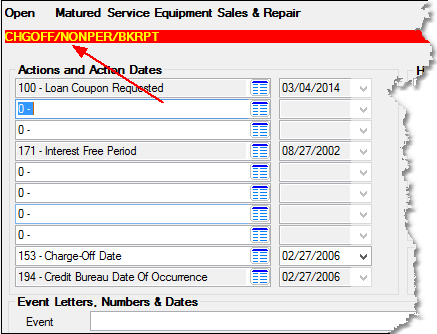

CHGOFF

|

The loan has been charged off and General Category 80, 82, 83, 84, 86, 87, 88, or 89 has been set on the account. Also, Hold Code 2 establishes the CHGOFF alert.

For more about charge-offs, see the Loans > Transactions > Charge Off Transactions screen help.

|

DISPUTE

|

If Hold Code 62, Account in Dispute, is set up on the account, this status will appear. This hold code is manually set on the account by a user when the account is in dispute for any reason. If this hold code is set up, the following occurs on the account:

•"DISPUTED" appears in red in the Status bar at the top of the screen, so users instantly know the loan is in dispute. •Users cannot make payments on the account from CIM GOLDTeller or EZPay (or any other payment transaction screen). If users attempt to make a payment on a disputed account, the message "Account is in Dispute" will appear and they will not be able to finish processing the payment (unless the hold code is removed). •Borrowers will not be able to make payments from your website (GOLDAccount Center). They will receive an error message.

After establishing this hold code, you need to also set the Compliance Code, so the account is reported properly during monthend Credit Reporting. The Compliance Code gives a reason for the dispute, such as:

XF - Account in Dispute under Fair Credit Billing Act

XB - Account Information Disputed by Customer

The Compliance Code is set up on the Credit Reporting screen > Reporting Codes & Original Information tab. See the Compliance Code help for more information. Compliance Codes are reported in Base Field 20 of the Credit Report transmission. Accounts with Compliance Codes are also reported in the Credit Report (FPSRP184) generated on a monthly basis through GOLDView.

|

PRTL CHGOFF

|

This loan has been partially charged off and General Category 80, 83, 84, 86, 87, 88, or 89 has been set on the account. A partial charge-off balance (Charged Off Amount field) exists that is less than the Principal Balance.

|

REPO

|

The loan has had collateral that has been repossessed, which means General Category 81 or 85 has been applied.

|

NONPER

|

The loan is considered non-performing, which means the Non-Performing field is checked. This is a behind-the-scenes field with the mnemonic LNNONP found in the CFLN record (Loan Master). The system automatically assigns the non-performing status to loans that are delinquent by a specified number of days (see Options below). You can add this field to reports in GOLDWriter, GOLDMiner, or SQL.

Options: An option (afterhours update function 59) is available that automatically changes performing loans to non-performing loans if the loan is 93 or more days delinquent. This change takes place only at monthend. Each month, for all loans that exceed being delinquent by 93 days, the system will enter a check in the Non-Performing field. If the loan becomes less than 93 days delinquent, the system unchecks the field at monthend. The system does not look at line-of-credit loans (payment method 5) with a zero principal balance. If you would like this option set up for your institution, send in a work order with your request.

Action code 59 stops the Non-Performing field from changing on a loan-by-loan basis, if the option mentioned above (update function 59) is used. No action date is required.

An institution option (OPTV NPDY) is available that allows you to control how many days delinquent a loan must be before it is automatically classified as non-performing. If this option is not used, the system will use 93 or more days.

|

BKRPT

|

The loan is in bankruptcy, which means Hold Code 4 or 5 has been assessed.

|

JGMNT

|

Hold Code 90 or Action Code 99 has been assessed on the loan.

|

WRTOF

|

The Write-off transaction (tran code 2510-05) has been run against this account. When this transaction is run, the amount written off is placed in a behind-the-scenes field called LNAPRM (Written off) in the CFLN record (Loan Master). You can add this field to reports.

|

PRTLWRTOFF

|

The Partial Write-off transaction (tran code 2510-00) has been run against this account. The Partial Write-off transaction reduces the principal balance on a loan by the amount of the transaction. The partial amount written off is displayed in the Written Off Amount field (LNPWOA) on the Loans > Actions/Holds/Event Letters screen. For more information on the Partial Write-off transaction, see Loans > Loan System > Appendix A.2 > Partial Write-off in DocsOnWeb.

|

CIB

|

The loan has been converted from a precomputed loan to an interest-bearing loan. For more information on this process, see the Convert Precomputed to Simple help.

|

PMTSCH

|

This alert means a new payment schedule has been set up for the account. Modified payment schedules are set up on the Loans > Transactions > CP2 screen > Payment Schedule tab.

|

CCALRT

|

The CCALRT (also known as alert 6500) is reserved for credit card payments that have been rejected by the system. The card could be rejected for many reasons, including the card has expired, the limit has been reached, etc. This alert appears automatically on accounts set up with recurring credit card payments when the system encounters a rejected credit card payment.

See the Set Alerts topic on the Actions/Holds/Event Letters screen (tab).

|

PAYOFF DUE

|

This means the account has reached maturity and is now due for payoff.

This alert is also triggered if the account balance becomes less than the amount of three payments (LNPICN x 3). For example, if the payment amount is $100.00 and the account balance becomes $299.99 or less, the PAYOFF DUE alert ( ) is displayed. ) is displayed.

|

LEGAL

|

This means a legal hold (Hold Code 9) has been set up on the account. When this occurs, the account is frozen.

|

LGL

|

This means the Legal Status field (LNLGLS) is checked on the Actions/Holds/Event Letters screen. This alert is different from the LEGAL alert in that it does not freeze the account; it's for informational purposes only.

|

BAAS: INVALID INTEREST CALC METHOD

|

This means the account has an invalid Interest Calculation Method (LNIBAS) on the Loans > Account Information > Account Detail screen > Interest Detail tab.

|

OUTPRO

|

This alert means out for repossession. It occurs when a user-defined Action Code for repos is applied to the account.

|

FRAUD

|

This alert means that the Suspected ID Fraud box has been checked on either the Actions/Holds/Event Letters screen or on the Loans > Cards and Promotions screen > Account Status tab.

|

DT LST AC > DUEDT

|

This alert shows if the Date Last Accrued (LNDLAC) is greater than the next payment Due Date (LNDUDT). If this alert is displayed, the user cannot save any information changed on the account until the Due Date is changed to be greater than the Date Last Accrued. This generally only appears for payment method 0 loans (conventional).

|

User-defined Alerts

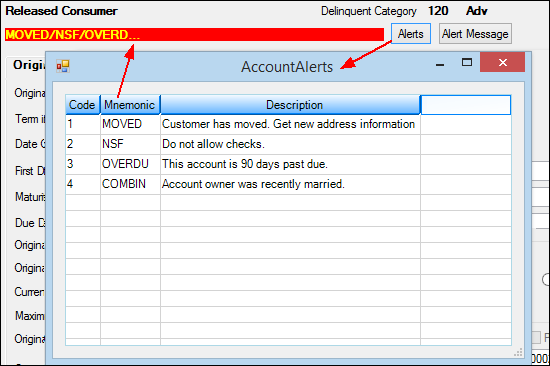

Other alerts are defined by your institution, as explained in the help for the Loans > System Setup Screens > Client Defined Alerts screen.

Due to length restrictions, only three to four alerts are shown in this line on screens. The account can have many more alerts, however. Users need to click the  button to see the other alerts, as shown below: button to see the other alerts, as shown below:

Additionally, you can assign messages to alerts, so users can click the  button and read a message concerning the account, such as "Obtain new phone number from this customer. Last letter was returned." button and read a message concerning the account, such as "Obtain new phone number from this customer. Last letter was returned."

|