Navigation: Deposit Screens > Definitions Screen Group > Product Codes Screen >

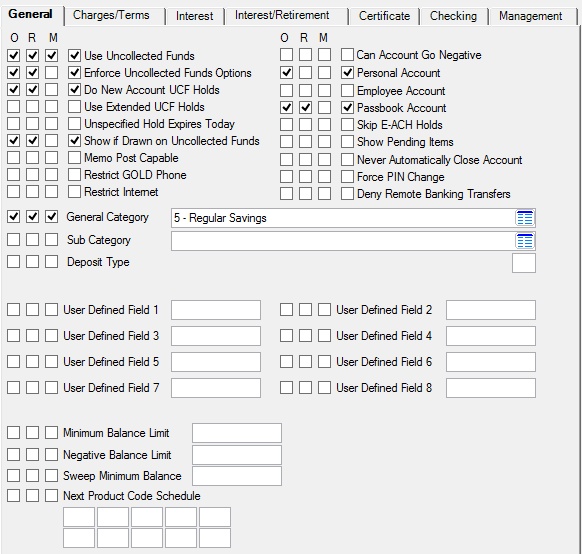

Use this tab to indicate the basic features and options of the product being created/edited. For more information about creating product codes, see the Entering Product Codes help page.

Deposits > Definitions > Product Codes Screen, General Tab

The fields on this tab are as follows:

Field |

Description |

|

|

Mnemonic: PCDUCF |

Use this field to indicate whether the product uses uncollected funds (UCF).

To learn more about UCF, see the Uncollected Funds Types and Options help page. UCF are set up on individual customer accounts from the Uncollected Funds and Deposit Delay tab of the Deposits > Account Information > Funds Holds screen as well as the Uncollected Funds Options field group on the Deposits > Account Information > Additional Fields screen. |

|

Enforce Uncollected Funds Options

Mnemonic: PCDSFH |

Use this field to indicate whether the product enforces uncollected funds (UCF) options.

To learn more about UCF, see the Uncollected Funds Types and Options help page. UCF are set up on individual customer accounts from the Uncollected Funds and Deposit Delay tab of the Deposits > Account Information > Funds Holds screen as well as the Uncollected Funds Options field group on the Deposits > Account Information > Additional Fields screen. |

|

|

Mnemonic: PCDSNH |

Use this field to indicate whether the product uses new account uncollected funds (UCF) holds.

To learn more about UCF, see the Uncollected Funds Types and Options help page. UCF are set up on individual customer accounts from the Uncollected Funds and Deposit Delay tab of the Deposits > Account Information > Funds Holds screen as well as the Uncollected Funds Options field group on the Deposits > Account Information > Additional Fields screen. |

|

|

Mnemonic: PCDSEH |

Use this field to indicate whether the product uses extended uncollected funds (UCF) holds.

To learn more about UCF, see the Uncollected Funds Types and Options help page. UCF are set up on individual customer accounts from the Uncollected Funds and Deposit Delay tab of the Deposits > Account Information > Funds Holds screen as well as the Uncollected Funds Options field group on the Deposits > Account Information > Additional Fields screen. |

|

Unspecified Hold Expires Today

Mnemonic: PCDSUT |

Use this field to indicate whether the product holds unspecified amounts for one day. If an uncollected funds (UCF) hold is entered during a transaction that is not specified as local or non-local, that hold will expire at the end of the present day if this field is left blank. If this field is marked, the unspecified hold will be ignored.

To learn more about UCF, see the Uncollected Funds Types and Options help page. UCF are set up on individual customer accounts from the Uncollected Funds and Deposit Delay tab of the Deposits > Account Information > Funds Holds screen as well as the Uncollected Funds Options field group on the Deposits > Account Information > Additional Fields screen. |

|

Show if Drawn on Uncollected Funds

Mnemonic: PCSHUF |

Use this field to indicate whether the user of the product is informed when withdrawals are made on uncollected funds (UCF) in GOLD ExceptionManager.

To learn more about UCF, see the Uncollected Funds Types and Options help page. UCF are set up on individual customer accounts from the Uncollected Funds and Deposit Delay tab of the Deposits > Account Information > Funds Holds screen as well as the Uncollected Funds Options field group on the Deposits > Account Information > Additional Fields screen. |

|

|

Mnemonic: PCDMEM |

Use this field to indicate whether the product is capable of memo posting. In memo posting, transaction tickets are collected, scanned, and sent in a file to GOLDPoint Systems for processing in the afterhours.

This feature can be adjusted for individual customer accounts in the Account Options field group of the Deposits > Account Information > Additional Fields screen. |

|

|

Mnemonic: PCGDPH |

Use this field to indicate whether the product will allow GOLDPhone usage. This feature can be adjusted for individual customer accounts in the Remote Banking Fields field group on the Deposits > Account Information > Additional Fields screen. |

|

|

Mnemonic: PCGDIN |

Use this field to indicate whether the product will allow the use of your institution's online banking feature. This feature can be adjusted for individual customer accounts in the Remote Banking Fields field group on the Deposits > Account Information > Additional Fields screen. |

|

|

Mnemonic: PCDNEG |

Use this field to indicate whether the product is allowed to go negative. The Negative Balance Limit field below determines how low a product account balance is allowed to go. This information can be adjusted for individual customer accounts in the Negative Fields field group on the Deposits > Account Information > Account Information screen. |

|

|

Mnemonic: PCPERS |

Use this field to indicate whether the product is a personal account. If this field is left blank, the product will be classified as a business or non-personal account. This information can be adjusted for individual customer accounts in the Account Options field group on the Deposits > Account Information > Account Information screen. |

|

|

Mnemonic: PCDEMP |

Use this field to indicate whether the product is an account for employees at your institution. This information can be adjusted for individual customer accounts in the Account Options field group on the Deposits > Account Information > Account Information screen. |

|

|

Mnemonic: PCPSBK |

Use this field to indicate whether the product is a passbook account. This information can be adjusted for individual customer accounts in the Account Options field group of the Deposits > Account Information > Additional Fields screen.

A passbook is a physical book that is used to log in transactions. A passbook account is a savings account that normally requires no minimum balance, no minimum term, no specified frequency of deposits, and no notice or penalty for withdrawals. Each institution can use a passbook for any non-checking account. |

|

|

Mnemonic: PCSEMH |

Use this field to indicate whether the product skips placing e-ACH monetary holds (ACH batches originated through the GOLD HomeBanker). If Institution Option MHEA (place monetary holds on ACH batches) is disabled, then this field is not applicable to your institution.

Monetary holds are entered for individual customer accounts using an amount and a description for each individual hold on the Deposits > Account Information > Funds Holds screen. Holds will automatically drop in the afterhours processing the morning of the expiration date. |

|

|

Mnemonic: PCPNIC |

Use this field to indicate whether pending inclearing checks and incoming ACH transactions on the product will appear on your institution's website for customers to view. See below for more information.

|

|

Never Automatically Close Account

Mnemonic: PCNACL |

Use this field to indicate whether the product will automatically close if its balance becomes zero. See below for more information

|

|

|

Mnemonic: PCGDFP |

Use this field to indicate whether the product forces a PIN change on customers. If this field is marked, a PIN change will be forced the first time a customer accesses remote banking options (GOLDPhone or GOLD HomeBanker through your institution's website), if GOLDPhone and Internet usage isn't restricted (see above). |

|

|

Mnemonic: PCGPXF |

Use this field to indicate whether the product will allow remote banking transfers (through GOLDPhone or your institution's website), if GOLDPhone and Internet usage isn't restricted (see above). |

|

|

Mnemonic: PCGENL |

Use this field to indicate the major classification of the product. See below for more information.

|

|

|

Mnemonic: PCSUBC |

Use this field to indicate a sub-category classification of the product for use in regulatory reporting. This is not a required field. See below for more information.

|

|

|

Mnemonic: PCDPTP |

Use this field to indicate a code number classification of the product's account type. This field is generally used as a posting field for the General Ledger and in sorting and subtotaling on reports. A G/L posting number must be set up on the GOLD Services > General Ledger > Autopost Parameters screen before it can be used in this field.

Possible values in this field are numbers 1-99. This code number is institution-defined. |

|

|

Mnemonic: PCUSER |

Use these fields to indicate any additional numeric data your institution would like to include in the creation of the product. There are eight User Defined fields on this screen. |

|

|

Mnemonic: PCMBNL |

Use this field to indicate the lowest balance your institution allows for the product. This amount is used as a threshold amount or limit when processing transactions against this account. See Minimum Balance Limit Information for more information. |

|

|

Mnemonic: PCNGLM |

Use this field to indicate the lowest account balance the product will be allowed to reach if it is allowed to go negative (the Can Account Go Negative field above is marked). See below for more information.

|

|

|

Mnemonic: PCMNSW |

Use this field to indicate the lowest account balance the product will be allowed to reach before the system transfers funds from another customer account to bring the product's account balance to the value in the Minimum Balance Limit field above. Open the link below for more information. See Minimum Balance Limit Information for more information. |

|

|

Mnemonic: PCNXPC |

Use these fields to indicate a roll schedule for the product. See below for more information.

|