Navigation: Deposit Screens > Account Information Screen Group > Additional Fields Screen > Additional Fields tab >

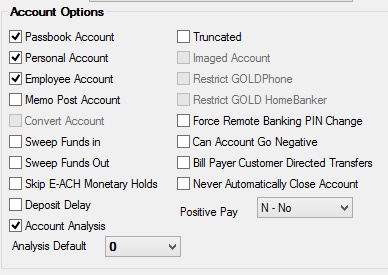

Account Options field group

Use this field group to view and edit information about basic options on the customer deposit account.

The fields in this field group are as follows:

Field |

Description |

|

|

Mnemonic: DMPSBK |

Use this field to indicate whether the customer account is a passbook account. If this field is marked, the system will include the passbook balance on the screens for the account. This option can be used for any non-checking account (the Checking field on the Deposits > Account Information > Account Information screen is left blank). A passbook is a physical book that is used to log in transactions. A passbook account is a savings account that normally requires no minimum balance, no minimum term, no specified frequency of deposits, and no notice or penalty for withdrawals. |

|

|

Mnemonic: DMTRUN |

This feature is not currently used by GOLDPoint Systems. |

|

|

Mnemonic: DMPERS |

Use this field to indicate whether the customer account is a personal account (rather than a different type of account, such as a business or trust). The status of this field may affect whether the account shows up on reports, such as the Reg-E Report/Notices (FPSDR060). |

|

|

Mnemonic: DMIMAG |

Use this field to indicate whether imaged statements will be created for the customer account. This option can also be adjusted on the Deposits > Account Information > Account Information screen.

|

|

|

Mnemonic: DMDEMP |

Use this field to indicate whether the customer account belongs to an employee at your institution. A security option is available to restrict the viewing and processing of employee accounts. See help for FPSDR132 in the Deposit Reports Manual in DocsOnWeb for more information. |

|

|

Mnemonic: DMGDPH |

Use this field to indicate whether GOLDPhone should be restricted on the customer account. This feature is only available if your institution uses GOLDPhone. Deposit report FPSDR117 is available for your institution to view GOLDPhone activity. |

|

|

Mnemonic: DMDMEM |

Use this field to indicate whether the customer account is a memo post account. This field is only used when an institution is performing memo posting (also known as proof transactions or shadow posting) on an account. In memo posting, transaction tickets are collected, scanned, and sent in a file to GOLDPoint Systems for processing in the afterhours.

See the Note About Viewing Information For Memo Post Accounts on the main screen help for information about how memo post information is displayed on this screen. |

|

|

Mnemonic: DMGDIN |

Use this field to indicate whether GOLD HomeBanker is restricted on the customer account. This option is only available if your institution uses GOLD HomeBanker. |

|

|

Mnemonic: DMDCON |

Use this field to indicate whether the customer account is being converted to another system. This field is generally for institutions selling branches (or portions of branches) to another institution. |

|

Force Remote Banking PIN Change

Mnemonic: DMGDFP |

Use this field to indicate whether a PIN change will be enforced on the first online access of the customer account. |

|

|

Mnemonic: DMSWPI, DMSWPO |

Use these fields to indicate whether funds should be transferred to (in) or from (out) the customer account from/to another account if the balance falls below the value specified in the Minimum Balance Limit field (see help for that field to learn how loan sweeps are processed). To maintain an account at the Minimum Balance, mark both the Sweep Funds in and Sweep Funds Out fields. Funds will then sweep in or out as needed to maintain the Minimum Balance. Funds can only be swept to or from accounts that have been properly set up in CIM GOLD.

To learn more about the configuration and function of sweep accounts, see the Sweep CDTs help page. |

|

|

Mnemonic: DMDNEG |

Use this field to indicate whether the customer account is allowed to go negative. |

|

Bill Payer Customer Directed Transfers

Mnemonic: DMBPAY |

Use this field to indicate whether the customer account is eligible to pay bills through the Customer Directed Transfers screen using Bill Payer as the Distribution Type. This field must be marked before Bill Payer records can be set up for the customer account. |

|

|

Mnemonic: DMSEMH |

Use this field to indicate whether to skip monetary holds for individual accounts when posting eACH batches (ACH batches originated through GOLD HomeBanker). If Institution Option MHEA is enabled, the program will automatically place monetary holds on all your institution's account eACH batches. Marking this field stops monetary holds for eACH batches from being placed on a specific account. If Institution Option MHEA is disabled, monetary holds will never be placed on any of your institution's eACH batches, and this field is not applicable.

For more information about holds, see help for the Deposits > Account Information > Funds Holds screen. |

|

Never Automatically Close Account

Mnemonic: DMNACL |

Use this field to indicate whether a customer account with balance of zero (0) will automatically close. Marking this field also allows your institution to open a customer account with a balance of zero (0). If this field is marked, an account can still be closed using a closing withdrawal or file maintenance transaction in GOLDTeller. If Institution Option OPTU-ACZB is enabled, this field will not be file maintainable for checking accounts (the Checking field on the Deposits > Account Information > Account Information screen). |

|

|

Mnemonic: DMDDEP |

Use this field to indicate whether the customer account uses deposit delay. Deposit delay requires all checks deposited into the customer account to be held a specified number of days before the customer can use the funds. When this field is marked, no interest is calculated during the hold. See below for more information.

|

|

|

Mnemonic: DMPSPY |

Use this field to indicate the Positive Pay status of the customer account. See below for more information.

|

|

|

Mnemonic: DMAANL |

Use this field to indicate whether the customer account uses account analysis. Once this field is marked, the Deposits > Account Information > Commercial Account Analysis screen can be used. This also requires that institution analysis setup records be created, which necessitates placing the appropriate default number in the Analysis Default field below. Changing this field from marked to blank will delete any existing account analysis record and any related services already accumulated. |

|

|

Mnemonic: DMDEFL |

Use this field to indicate a valid analysis default number to use on the customer account. This will be the default analysis used when setting up costed services on the Deposits > Account Information > Commercial Account Analysis screen for an account. The possible values for this field are numbers 0-9999.

If the Account Analysis field is marked above, this field will be file maintainable. In order for the Commercial Account Analysis screen to be used on an account, institution analysis setup records must first be created. This requires changing the Account Analysis field from blank to marked and placing the appropriate default number in this field. |