Navigation: Deposit Screens > Account Information Screen Group > Additional Fields Screen > Additional Fields tab >

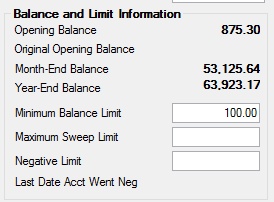

Balance and Limit Information field group

Use this field group to view and edit balance and limit information on the customer deposit account.

The fields in this field group are as follows:

Field |

Description |

|

Mnemonic: DMOPBL |

This field contains the initial amount deposited to the customer account. On savings and Checking accounts (as indicated on the Deposits > Account Information > Account Information screen), this field's value does not change over the life of the account. On Certificate accounts, the name of this field changes to Beginning of Term Balance at maturity or renewal. If a customer deposits or withdraws money during the grace period, this field will be updated to the beginning of the next term. Features for individual customer certificate accounts can be adjusted on the Certificate Fields tab and in the Certificate Fields field group on the Account Information screen. |

|

Mnemonic: M2OPBL |

This field contains the original opening balance of the customer account. This field is populated when an account is opened (tran code 1100/1200) and will never change. For checking accounts (the Checking field on the Deposits > Account Information > Account Information screen is marked), this field and the Opening Balance field above will always be the same. This amount is different from the Opening Balance field only on certificate accounts (the Certificate field on the Account Information screen is marked). Features for individual customer certificate accounts can be adjusted on the Certificate Fields tab and in the Certificate Fields field group on the Account Information screen. |

|

Mnemonic: DMMEBL |

This field contains the customer account's balance as of the previous monthend. The account's current balance is moved into this field as part of monthend processing and can be either a positive or negative amount. |

|

Mnemonic: DMEYBL |

This field contains the account balance as of the previous year-end. The customer account's current balance is moved into this field as part of yearend processing and can be either a positive or negative number. |

|

Mnemonic: DMMNBL |

Use this field to indicate the lowest balance your institution allows for the customer account. This amount is used as a limit when processing transactions against the account and will be factored into sweeps. See Minimum Balance Limit information to learn more. |

|

Mnemonic: DMMXBL |

Use this field to indicate the resulting balance on the customer account once a sweep in or out has occurred. If payments cause the balance on the customer account to go below the amount entered in the Minimum Balance Limit field above, money will be swept in from another account to make the balance equal to the amount entered in this field. See Maximum Sweep Limit information to learn more. |

|

Mnemonic: DMNGLM |

Use this field to indicate the lowest account balance the product will be allowed to reach, if it is allowed to go negative (the Can Account Go Negative field is marked). The following conditions will cause a customer account to appear in GOLD Exception Manager:

•Institution option OPTM (Force Post Without Warning) •Overriding a condition on customer accounts with negative balances

This information can be also adjusted for individual customer accounts in the Negative Fields field group on the Deposits > Account Information > Account Information screen. This field is necessary to set up a sweep account. To learn more about the configuration and function of sweep accounts, see the Sweep CDTs help page. |

|

Mnemonic: DMDTNG |

This field contains the date the customer account balance changed from positive to negative. It is only populated when the account balance is negative. For customer accounts using overdraft codes 8, 9, or 10, this field will be cleared when the current balance is not negative. It will, however, be updated with a date when the customer account has gone negative during the day. Overdraft features can be adjusted for individual customer accounts on the Deposits > Account Information > Overdraft & Secured Loans screen. For the transaction, institution, and CIM GOLD features that pertain to the use of the overdraft feature, see the Overdrafting Conditions and Options help page. In order to use the overdraft function on a customer account, the Overdraft field on the Deposits > Account Information > Account Information screen must be marked. |