Navigation: Deposit Screens > Account Information Screen Group >

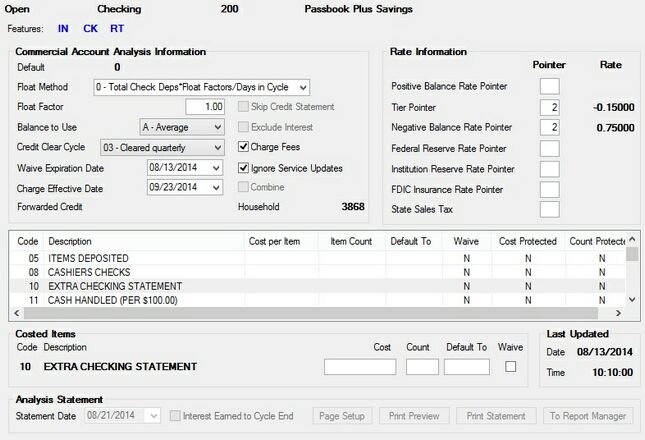

Use this screen to view and edit the commercial checking services your institution wants to charge on the customer deposit account.

The list view on this screen displays costed items available to access for the customer account. See Costed Items list view details for more information. For more information about setting up defaults and calculating estimates for account analysis, see help for the Defaults and Estimate screens.

This screen also maintains and displays Account Analysis, which is used to determine the monthly fee for the commercial checking account. Account Analysis is also used to charge for services and compensate accounts for collected balances in the form of a monthly earnings credit or forwarded credit (see the Forwarded Credit field). In order for this screen to be used on a customer account, institution analysis setup records must first be created and an option enabled on the account. This process is explained on the Account Analysis Setup help page.

Deposits > Account Information > Commercial Account Analysis Screen

Up to 10,000 different Account Analysis defaults (0-9999) are available to allow for a variety of service charge offerings at your institution. For example, small businesses and large commercial businesses can choose different services because of their transaction and cash differences. Account Analysis defaults (see the Default field) are set up by GOLDPoint Systems for your institution.

This screen is also used to file maintain the item count for services used in the current cycle for any of the codes available on the customer account. The item count can also be updated in GOLDTeller by processing teller transaction 1900-02; 10 codes and item counts can be updated with one teller transaction. Procedures should be in place for tellers so they know when services will be automatically updated and when they should process an update manually. The automatic services are described on the Defaults help page.

Time periods to retain analysis information in the system can be adjusted for your institution on the Deposits > Definitions > System History Retention screen.

The field groups on this screen are as follows:

Commercial Account Analysis Information field group

Analysis Statement field group

|

Record Identification: The fields on this screen are stored in the FPAA record (Account Analysis). You can run reports for this record through GOLDMiner or GOLDWriter. See FPAA in the Mnemonic Dictionary for a list of all available fields in this record. Also see field descriptions in this help manual for mnemonics to include in reports. |

|---|

In order to use this screen, your institution must:

•Subscribe to it on the Security > Subscribe To Mini-Applications screen.

•Set up employees and/or profiles with either Inquire (read-only) or Maintain (edit) security for it on the CIM GOLD tab of the Security > Setup screen.

•Set up the desired field level security in the FPAA record on the Field Level Security screen/tab. |