Navigation: Deposits > Deposit Screens > Account Information Screen Group > Funds Holds Screen >

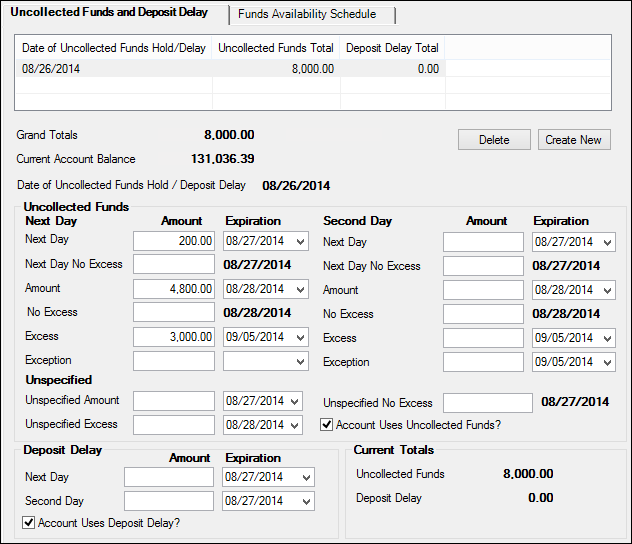

Use this tab to view and edit information about uncollected funds (UCF) on the customer deposit account. Uncollected funds are usually entered when checks are deposited through GOLDTeller (see the Deposit Transaction Hold Setup help page for more information). However, users with proper security clearance can also enter funds holds on this tab. Only one UCF record is displayed on the screen at a time and each screen displays one day's data.

In order to access UCF options, the Account Uses Uncollected Funds field on this or the Deposits > Account Information > Additional Fields screen must be marked. To learn more about UCF, see the Uncollected Funds Types and Options help page. UCF are set up on customer accounts from this tab as well as the Uncollected Funds Options field group on the Additional Fields screen.

Deposits > Account Information > Funds Holds screen, Uncollected Funds and Deposit Delay tab

The list view at the top of this screen displays a record of UCF holds and deposit delays that have been set up for the customer account. Select a UCF/Deposit Delay item in this list to view and edit that item's information in other fields on this screen. Click <Create New> to use the fields on this screen to create new uncollected funds and deposit delay records to add to the list.

The Grand Totals field (mnemonic DMUFCH) beneath the list view displays the grand totals for UCF and deposit delays that have been set up for the customer account (and have not yet expired). If new UCF and deposit delay records are created, the totals in this field will adjust accordingly.

The Current Account Balance field (mnemonic DMCRBL) displays the current balance of the customer account. See below for more information.

For any account type, a zero (0) displayed in this field means that either the account has no money or a hold code with an override attached (overrides can be maintained on the Customer Relationship Management > Special Instructions screen). An asterisk (*) will appear to the right of the value in this field, and a message will appear just below this field indicating why the available amount is zero. Only one error can be shown on this screen. If multiple errors are present, no asterisk will appear.

If the customer account needs to allow overdrafting to occur at the teller window, ATM, or through your institution's banking website, all hold codes on the account must be either MOV (message override) or NOV (no override) . Override levels are set up on the Deposits > Definitions > Hold Code Definitions screen.

•If "D-Deposit Account" is selected in the Account Type field, this field contains the amount currently available in the designated savings or checking account. If the overdraft account is a savings account, this amount is reduced by .01 so that overdrafting can never take the savings account to zero (0) and close the account.

•If "L-Loan Account" is selected in the Account Type field, this field contains the line-of-credit limit minus the principal balance for revolving LOCs and the line-of-credit limit minus the credit used for non-revolving LOCs.

•If "G-General Ledger Account" is selected in the Account Type field, no amount is displayed in this field because General Ledger transfers have no limit.

If a credit card is tied to the overdraft account, a zero (0) is displayed in this field because the balance and available credit are unknown.

For the transaction, institution, and CIM GOLD features that pertain to the use of the overdraft feature, see the Overdrafting Conditions and Options help page. |

The Date of Uncollected Funds Hold/Deposit Delay field (mnemonic DUDTUF) displays the date of the selected UCF or deposit delay record.

The field groups on this tab are as follows: