Navigation: Deposits > Deposit Screens > Account Information Screen Group > Account Information Screen > Features/Options tab >

Account Options field group

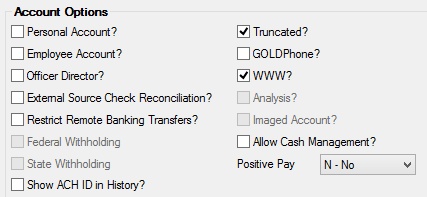

Use this field group on the Features/Options tab of the Account Information screen to view and edit which options are enabled on the customer deposit account.

The fields in this field group are as follows:

Field |

Description |

||

|

Mnemonic: DMPERS |

Use this field to indicate whether the customer account is a personal account. Leaving this field blank indicates that the account belongs to a business. |

||

|

Mnemonic: DMDEMP |

Use this field to indicate whether the customer account belongs to an employee of your institution.

A security option is available to restrict the viewing and processing of employee accounts. See help for FPSDR132 in the Deposit Reports Manual in DocsOnWeb for more information. |

||

|

Mnemonic: DMOFAC |

Use this field to indicate whether the customer account belongs to an officer or director of your institution. |

||

External Source Check Reconciliation?

Mnemonic: DMXSCR |

Use this field to indicate whether the customer account uses external source check reconciliation.

If this field is marked, the cleared checks on this account will be forwarded to the GOLD Services > Check Reconciliation > Check Detail screen. The check's amount and date will be entered on that screen and its status will be changed to "C" (cleared). This will allow you to generate reports from the Check Reconciliation system showing cleared checks, outstanding checks, and exception items.

|

||

Restrict Remote Banking Transfers?

Mnemonic: DMGPXF |

Use this field to indicate whether the customer account allows remote (online) banking transfers. |

||

|

Mnemonic: DMWFED |

Use this field to indicate whether money should be withheld for federal government taxes on the customer account. Accounts may have mandatory withholding or can have withholding processed based on a customer request to prepay their taxes.

Any type of customer account can be set up to withhold, including retirement accounts (which can use withholding on their distributions).

Income tax withholding will be performed on distributions from retirement accounts unless a W4 form is completed by the customer each year. The W4 form states that the customer does not want withholding to be performed.

For more information about withholding, see help for the Deposits > Account Information > Interest Fields screen. |

||

|

Mnemonic: DMWSTA |

Use this field to indicate whether money should be withheld for state government taxes on the customer account. Accounts may have mandatory withholding or can have withholding processed based on a customer request to prepay their taxes.

Any type of customer account can be set up to withhold, including retirement accounts (which can use withholding on their distributions).

Income tax withholding will be performed on distributions from retirement accounts unless a W4 form is completed by the customer each year. The W4 form states that the customer does not want withholding to be performed.

For more information about withholding, see help for the Deposits > Account Information > Interest Fields screen. |

||

|

Mnemonic: M2DAID |

Use this field to indicate whether individual identification will show up in deposit history, Web history, and on customer statements for ACH (PPD) transactions.

If this field is marked, individual identification information will appear in the same CIM GOLD fields as ATM address and point of sale vendor information. |

||

|

Mnemonic: DMTRUN |

This feature is not currently used by GOLDPoint Systems. |

||

|

Mnemonic: DMGBNK |

This field indicates whether the customer account has access to GOLDPhone services.

This field will be automatically marked the first time the customer accesses their account with GOLDPhone services.

This field is only valid if your institution offers GOLDPhone services. |

||

|

Mnemonic: DMWWWA |

Use this field to indicate whether the customer account uses your institution's remote (online) banking feature.

In order to preview inclearing items online for accounts that use remote banking features, Institution Option OP09-IBOC must be enabled. When the option is set and this field is marked, items will be created and displayed online daily for incoming check batches. These items will only be available for the day they are received. |

||

|

Mnemonic: DMAANL |

Use this field to indicate whether the customer account uses account analysis.

If this field is marked, the Deposits > Account Information > Commercial Account Analysis screen can be accessed and used on the account.

Additionally, in order for the Commercial Account Analysis screen to be used on a customer account, institution analysis setup records must first be created. This requires marking the Account Analysis field and placing the appropriate default number in the Analysis Default field (both on the Deposits > Account Information > Additional Fields screen).

Changing this field from marked to blank will delete the account analysis record. Any services already accumulated will be lost. |

||

|

Mnemonic: DMIMAG |

Use this field to indicate that this account has images of checks processed and saved to history. This option can also be adjusted on the Deposits > Account Information > Additional Fields screen.

When this option is set, statements will include a section for deposit check images (see the Deposit Account Statements (FPSDR199) in DocsOnWeb). You can either use a third-party to process check images and send them to GOLDPoint Systems for saving and retrieval, or GOLDPoint Systems can image checks for accounts using information sent back from the FRB.

•Third party: Contact GOLDPoint Systems to designate a third-party check image processor and enable the necessary system features. For a current list of vendors available for this service, see Ancillary Services in the Other section in DocsOnWeb.

•If GOLDPoint Systems processes your imaged statements (institution option OPTU FIMG), only Statement Cycle codes 102-131 can be used with imaged accounts.

To learn more about imaged statements, see help for the Deposits > Account Information > Check Imaging screen as. Imaged statement features can be adjusted for individual customer accounts in the Image Fields field group on the Deposits > Account Information > Statement Fields screen. |

||

|

Mnemonic: DMCSMG |

Use this field to indicate whether the online cash management feature is allowed on the customer account.

The cash management feature is used to manage payments based on invoice terms and other optional data selected by the user.

Listed below are different steps that can be taken using the cash management feature:

1.Determining cash commitment and ability to make payments 2.Selecting invoices to be paid 3.Printing checks 4.Voiding checks 5.Displaying the checks in the register 6.Reconciling to the bank statement 7.Printing control statements 8.Voiding control statements 9.Displaying the control statements in the control statement register

These steps are automated and are generally performed in a sequence. |

||

|

Mnemonic: DMPSPY |

Use this field to indicate whether the customer account uses Positive Pay.

Positive Pay is a GOLDPoint Systems feature that allows customers added security when clearing checks. Positive Pay allows customers to specify which check numbers they choose to allow for withdrawal from their accounts. Any checks not meeting Positive Pay requirements are rejected.

Your customers must specify the check numbers they want to give clearance, either through your banking website or a representative at your institution.

After checking this box, the Deposits > Account Information > Positive-Pay Checklist screen will be available on the account. |