Navigation: Deposit Screens > Account Information Screen Group >

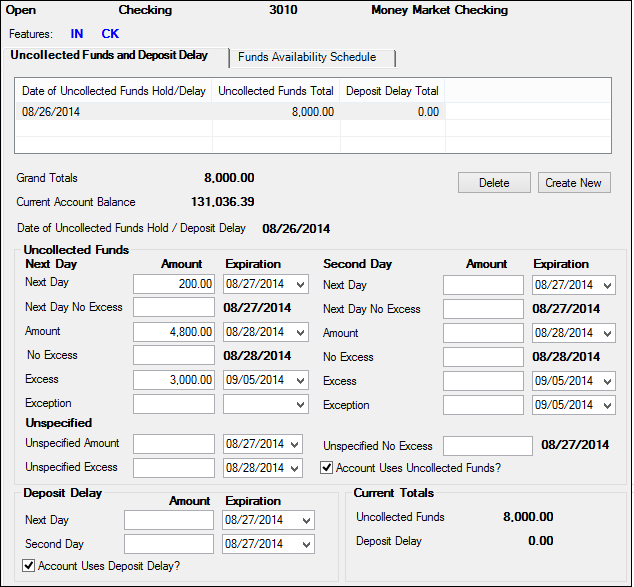

Use this screen to view and edit information about funds holds on the customer deposit account.

Uncollected funds is the term used to describe checks received by your institution that are put on hold until they are cleared. Regulation CC (Availability of Funds and Collection of Checks), which is governed and set up by the Federal Reserve Board, specifies amounts and lengths of time deposited checks can be put on hold. Uncollected funds (UCF) holds are entered on check deposit transactions in GOLDTeller using the Local Amount, Non-local Amount, or Unspecified Amount fields. To learn more about UCF, see the Uncollected Funds Types and Options help page.

In order for the system to automatically set up holds for particular checks, a number of options must be set up. These options are found on an institution level, an account level, and on each deposit transaction.

Institution-level Options: Your GOLDPoint Systems client account specialist can enable institution options that apply to UCF holds for your entire institution. Therefore, when certain holds are placed on checks (Local, Non-local, Unspecified), the system automatically enters the Expiration Date for those holds as determined by the option. To learn more about these institution options, see the Deposit Funds Holds Options help page.

Account-level Options: Account-level UCF holds options are set up in the Uncollected Funds Options field group on the Deposits > Account Information > Additional Fields screen. These options can be adjusted for each customer account.

Transaction-level Options: UCF holds options can be set directly from the Deposit transaction in GOLDTeller. Two fields are available: Extended Holds and Large Excess. These fields affect how long the system holds the funds before allowing the customer to use them. For more information on these options, see the Transaction-Level Options help page. For information on how to set up a hold on a deposit transaction, see the Deposit Transaction Hold Setup help page.

In order to access deposit delay options, the Account Uses Deposit Delay? field must be marked. When that field is marked, no interest is calculated for the checks deposit, based on the number of days your institution uses for Next Day (Local) or Second Day (Non-local) checks.

Certain institution options must be enabled for deposit delay to work properly on the customer account. A work order must be submitted to GOLDPoint Systems to activate these options, which are explained in greater detail on the Deposit Delay Institution Options help page. |

Deposits > Account Information > Funds Holds screen

The tabs on this screen are as follows:

Uncollected Funds and Deposit Delay tab

Funds Availability Schedule tab

|

Record Identification: The fields on this screen are stored in the FPDU and FPDM records (Uncollected Funds, Deposit Master). You can run reports for these records through GOLDMiner or GOLDWriter. See FPDU and FPDM in the Mnemonic Dictionary for a list of all available fields in these records. Also see field descriptions in this help manual for mnemonics to include in reports. |

|---|

In order to use this screen, your institution must:

•Subscribe to it on the Security > Subscribe To Mini-Applications screen.

•Set up employees and/or profiles with either Inquire (read-only) or Maintain (edit) security for it on the CIM GOLD tab of the Security > Setup screen.

•Set up the desired field level security in the FPDU and FPDM records on the Field Level Security screen/tab. |