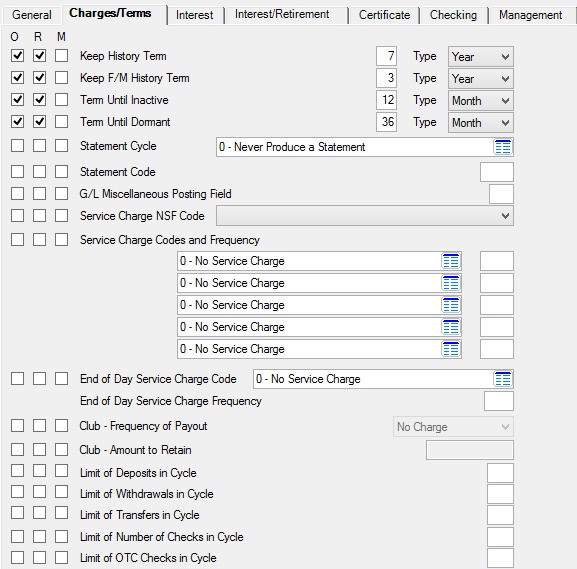

Navigation: Deposits > Deposit Screens > Definitions Screen Group > Product Codes Screen >

Use this tab to view and edit information about charges and terms for the product being created/edited. For more information about creating product codes, see the Entering Product Codes help page. Service charges must first be set up on the Deposits > Definitions > Service Charges screen before they can be used on this screen.

Deposits > Definitions > Product Codes Screen, Charges/Terms Tab

The fields on this tab are as follows:

Field |

Description |

|||||||||

|

Mnemonic: PCHSTS |

This field indicates when history should be purged from the system. Use this field in conjunction with the corresponding Type field to indicate the time period for the system to retain history on the product. Use this field to enter a numeric value and the Type field to indicate whether the term is expressed in Days, Months, or Years.

This feature can be adjusted for individual customer accounts in the Retention Periods field group on the Deposits > Account Information > Additional Fields screen. |

|||||||||

|

Mnemonic: PCFSTS |

This field indicates when file maintenance history should be purged from the system. Use this field in conjunction with the corresponding Type field to indicate the time period for the system to retain file maintenance history on the product. Use this field to enter a numeric value and the Type field to indicate whether the term is expressed in Days, Months, or Years.

This feature can be adjusted for individual customer accounts in the Retention Periods field group on the Deposits > Account Information > Additional Fields screen. |

|||||||||

|

Mnemonic: PCISTS |

This field indicates how long a product can go without activity before its status changes. See below for more information.

|

|||||||||

|

Mnemonic: PCDSTS |

This field indicates how long a product can go without activity before its status changes. Once an account is declared dormant, it may not be able to have any transactions or other activity processed against it, depending on Transaction Condition Overrides (found on the Deposits > Definitions > Transaction Options screen). See below for more information.

|

|||||||||

|

Mnemonic: PCSCYC |

Use this field to indicate when the system should produce statements on the product. This value can be adjusted for individual customer accounts on the Deposits > Account Information > Account Information and Additional Fields screens. See Statement Cycle for more information. |

|||||||||

|

Mnemonic: PCSTCD |

This field is not currently in use by GOLDPoint Systems. |

|||||||||

G/L Miscellaneous Posting Field

Mnemonic: PCGLPF |

Use this field to indicate a General Ledger posting number for the product. A G/L posting number must be set up on the GOLD Services > General Ledger > Autopost Parameters screen before it can be used in this field. |

|||||||||

|

Mnemonic: PCSNSF |

Use this field to indicate what the system should do if there is not enough funds available to a product to cover a service charge. See below for more information.

|

|||||||||

Service Charge Codes and Frequency

Mnemonic: PCSVCD, PCSCFQ |

Use these fields to indicate any service charge codes that will be applied to the product as well as the frequency code to define how often each service charge will be assessed. Frequency code numbers are identical to Statement Cycle codes (see above).

Up to five service charges can be designated on this screen. Service charges must first be set up on the Deposits > Definitions > Service Charges screen before they can be used on this screen. This option can be adjusted for individual customer accounts on the Deposits > Account Information > Service Charge Fields screen. |

|||||||||

End of Day Service Charge Code/Frequency

Mnemonic: PCSVC1, PCCSFY |

Use these fields to indicate a service charge code that will be applied to the product daily. If a daily service charge is being established in these fields, the Frequency field must be set to 255 (Service charge assessed daily). Service charges must first be set up on the Deposits > Definitions > Service Charges screen before they can be used on this screen. This option can be adjusted for individual customer accounts on the Deposits > Account Information > Service Charge Fields screen.

This option should not be used for service charges that use cycle-to-date fields. |

|||||||||

|

Mnemonic: PCPOFQ |

Use this field to indicate how often how often an automated withdrawal will occur on the product, if the product is a Club Account. Available frequencies are Monthly, Bi-Monthly, Quarterly, Semi-Annually, and Annually. Club account features can be adjusted for individual customer accounts in the Club Account Fields field group on the Additional Fields screen.

Club accounts are accounts used to save funds for a specific purpose, such as a holiday. Customers make deposits to the account throughout the year, and then a check is created and sent to them on a predefined date. |

|||||||||

|

Mnemonic: PCPOKP |

Use this field to indicate the balance the system should keep on the product when automatically conducting a payout withdrawal, if the product is a Club Account. If the amount held back is greater than the current balance of the club account at payout time, no payout will occur. Club account features can be adjusted for individual customer accounts in the Club Account Fields field group on the Additional Fields screen.

Club accounts are accounts used to save funds for a specific purpose, such as a holiday. Customers make deposits to the account over time, and then a check is created and sent to them on a predefined date. |

|||||||||

|

Mnemonic: PCLDPC |

Use this field to indicate the maximum number of deposits allowed on the product during a Statement Cycle (see above). Interest posting is not considered a deposit. See below for more information.

|

|||||||||

|

Mnemonic: PCLWDC |

Use this field to indicate the maximum number of withdrawals allowed on the product during a Statement Cycle (see above). Your institution will decide whether further withdrawals are rejected or charged a service fee. Service charges must first be set up on the Deposits > Definitions > Service Charges screen before they can be used on this screen.

This information can be adjusted for individual customer accounts in the Cycle Limits field group of the Deposits > Account Information > Activity Information screen. |

|||||||||

|

Mnemonic: PCLXFC |

Use this field to indicate the maximum number of transfers allowed on the product during a Statement Cycle (see above). Your institution will decide whether further transfers are rejected or charged a service fee. Service charges must first be set up on the Deposits > Definitions > Service Charges screen before they can be used on this screen.

This information can be adjusted for individual customer accounts in the Cycle Limits field group of the Deposits > Account Information > Activity Information screen. |

|||||||||

Limit of Number of Checks in Cycle

Mnemonic: PCLMCK |

Use this field to indicate the maximum number of checks allowed to clear against the product during a Statement Cycle (see above). Your institution will decide whether further checks are rejected or charged a service fee. Service charges must first be set up on the Deposits > Definitions > Service Charges screen before they can be used on this screen.

This information can be adjusted for individual customer accounts in the Cycle Limits field group of the Deposits > Account Information > Activity Information screen. |

|||||||||

|

Mnemonic: PCOTCL |

Use this field to indicate the maximum number of over-the-counter checks allowed to clear against the product during a Statement Cycle (see above). Your institution will decide whether further checks are rejected or charged a service fee. Service charges must first be set up on the Deposits > Definitions > Service Charges screen before they can be used on this screen.

This information can be adjusted for individual customer accounts in the Cycle Limits field group of the Deposits > Account Information > Activity Information screen. |