Navigation: Deposit Screens > Account Information Screen Group >

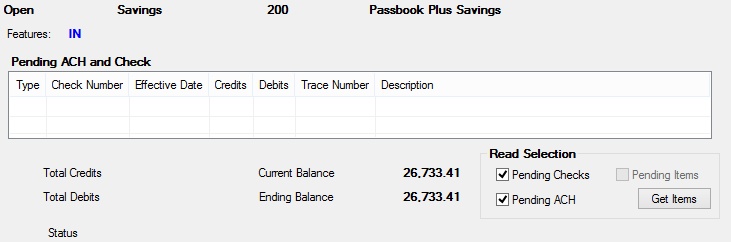

Use this screen to view information about pending ACH and check items on the customer deposit account. Pending items are transaction items that have not yet been processed for the customer account.

The list view on this screen displays information about any pending ACH or check items on the customer account once <Get Items> is clicked. This information includes the pending item Type (ACH or Check), Check Number, Effective Date, Credits/Debits amount, Trace Number (as sent by the originator), and Description of the pending item.

Deposits > Account Information > Pending Items Screen

The fields on this screen are as follows:

Field |

Description |

|

Mnemonic: PATAMT |

The total amount of credits for any pending items on the customer account. |

|

Mnemonic: DNAMOU |

The total amount of debits for any pending items on the customer account. |

|

Mnemonic: DMCRBL |

The current balance of the customer account. This field does not factor in any pending items. |

|

Mnemonic: N/A |

The balance of the customer account after pending items are factored in. This field is calculated by adding the value in the Total Credits field and subtracting the value in the Total Debits field from the value in the Current Balance field |

|

Mnemonic: N/A |

The current status of this screen. After marking fields and clicking <Get Items> in the Read Selection field group, a message will appear in this field that reads "Reading pending ACH records." If no pending items are found, then "No pending items located" will appear in this field. |

|

Mnemonics: N/A |

Use these fields to indicate which pending items should appear in the Pending ACH and Check list view above when <Get Items> is clicked. Pending ACH, Pending Checks, either, or both can be selected using their checkbox fields.

The Pending Items field indicates whether pending inclearing checks will be shown on your institution's website for the customer account. Costed item codes #60 (checklist service fee) and #61 (checklist transaction fee) can be used in conjunction with this feature to charge for each check and/or the use of the service (to learn more about costed services, see help for the Deposits > Account Information > Commercial Account Analysis screen). Institution option INCW (Create Check List for WWW Checking Accounts) must be enabled for this feature to be available. |

In order to use this screen, your institution must:

•Subscribe to it on the Security > Subscribe To Mini-Applications screen.

•Set up employees and/or profiles with either Inquire (read-only) or Maintain (edit) security for it on the CIM GOLD tab of the Security > Setup screen. |