Navigation: Deposit Screens > Account Information Screen Group >

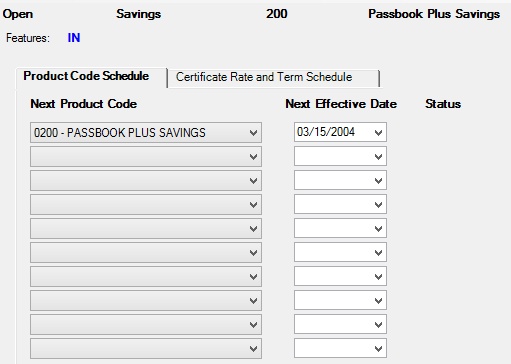

The Roll Schedules screen has two tabs: Product Code Schedule and Certificate Rate and Term Schedule.

Deposits > Account Information > Roll Schedules Screen

•Use the Product Code Schedule tab to set up a schedule of up to 10 roll events to automatically take place on the customer deposit account once certain conditions are met (for example, the conversion of an interest-free checking account to an interest-bearing checking account after a specified number of months have passed). Only valid product codes that have been entered through the Deposits > Definitions > Product Codes screen will be available to select in the Next Product Code fields on this tab. Using this tab prevents the use of the Certificate Rate and Term Schedule tab on certificate accounts (the Certificate field on the Deposits > Account Information > Account Information screen is marked).

•Use the Certificate Rate and Term Schedule tab to automatically roll rates or rate and tier pointers, and generate renewal and/or maturity notices for a certificate account during the life of the certificate of deposit or rolling checking account (for example, rolling the account from a 12-month CD to a 36-month CD). The system allows for up to 10 Periods (events) for the user to specify on the customer account.

These functions happen in the afterhours processing according to the Effective Date entered for each event.

Retirement accounts (as designated on the Account Information screen) cannot be rolled to non-retirement accounts, and non-retirement accounts cannot be rolled to retirement accounts. If you roll an active customer overdraft account into a customer checking account that does not have the Overdraft feature (as designated on the Account Information screen) set, the overdraft feature will remain on the customer checking account that was rolled into. Unwanted overdraft features must be removed manually on this screen. Overdraft features can be adjusted for individual customer accounts on the Deposits > Account Information > Overdraft & Secured Loans screen. For the transaction, institution, and CIM GOLD features that pertain to the use of the overdraft feature, see the Overdrafting Conditions and Options help page.

|

Record Identification: The fields on this screen are stored in the FPDM and FPCD records (Deposit Master and CD Rate Term Schedule). You can run reports for these records through GOLDMiner or GOLDWriter. See FPDM and FPCD in the Mnemonic Dictionary for a list of all available fields in these records. Also see field descriptions in this help manual for mnemonics to include in reports. |

|---|

In order to use this screen, your institution must:

•Subscribe to it on the Security > Subscribe To Mini-Applications screen.

•Set up employees and/or profiles with either Inquire (read-only) or Maintain (edit) security for it on the CIM GOLD tab of the Security > Setup screen.

•Set up the desired field level security in the FPDM record on the Field Level Security screen/tab. |