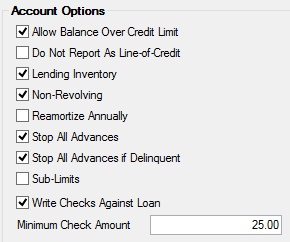

Navigation: Loans > Loan Screens > Account Information Screen Group > Consumer Line-of-Credit Screen > Options tab >

Account Options field group

Use this field group to view and edit options for the customer line-of-credit (LOC) loan account.

To learn more about how LOC loans function, see the Line-of-Credit Loan Information help page. The fields in this field group are as follows:

Field |

Description |

||

Allow Balance Over Credit Limit

Mnemonic: LNRLOC |

Use this field to indicate whether the system allows transactions to increase the credit balance on the customer loan account even if a transaction would exceed the credit limit.

|

||

Do Not Report As Line-of-Credit

Mnemonic: LNDLOC |

Use this field to indicate whether the customer loan account will be reported as a line-of-credit loan on the TFR CC Report (FPSRP171), lines 410, 420, 430, or 435. |

||

|

Mnemonic: LNRLLI |

Use this field to indicate whether the customer loan account uses lending inventory. Lending inventory allows your institution to track individual collateral items that make up a line of credit. Your institution can enable Sub-Limits (see below) or lending inventory, but not both. |

||

|

Mnemonic: LNNLOC |

Use this field to indicate whether the customer loan account is a revolving loan. |

||

|

Mnemonic: LNAMZ6 |

Use this field to indicate whether the amortization of fees on the customer loan account should be reevaluated and recalculated each year. See Reamortize P/I for more information. |

||

|

Mnemonic: LNRLST |

Use this field to indicate whether principal increases are allowed on the customer loan account. See below for more information.

|

||

Stop All Advances if Delinquent

Mnemonic: LNRLDS |

Use this field to indicate whether principal increases are allowed on the customer loan account if the account is in a state of delinquency. See below for more information.

|

||

|

Mnemonic: LNSUBL |

Use this field to indicate whether the customer loan account uses sub-limits. Your institution can enable sub-limits or Lending Inventory (see above), but not both. |

||

|

Mnemonic: LNRLWC |

Use this field to indicate whether the customer loan account is allowed to be increased by check drafts. If this field is not marked, any checks that attempt to clear against the loan will be rejected. They will appear on the Afterhours Exception Listing (FPSRP013). Use the account number and add "70" to the check digit on the draft for inclearing checks. Open the link below for more information.

|

||

|

Mnemonic: LNRLMA |

Use this field to indicate the minimum value your institution allows for checks written against the customer loan account. The Write Checks Against Loan field above must be marked in order for this field to be available. |