Navigation: Loans > Loan Screens > Account Information Screen Group > Payment Information Screen >

Important: The Recurring Information tab is only available for one institution. We are phasing out support for this tab. Instead, use the Recurring Payments function in the Loans > Transactions > EZPay screen to set up recurring payments. |

|---|

Note: The Cycle Code field (LNACYC) must be set to 255 (ACH) for recurring payments sent by GOLDPoint Systems to work with FPRA. The Cycle Code field isn't found on any screen in CIM GOLD (after version 7.9.3). Your GOLDPoint Systems account manager can init that field for accounts.

Be aware of a few options that affect recurring payments. |

|

Fee Amount |

If your institution collects a fee for each recurring payment, you need to set up the General Ledger account for the fee to be credited to on the GOLD Services > General Ledger > G/L Account By Loan Type screen using the EZPay Fee field and EZPay Offset field. However, if institution option EGPO (EZPay G/L Posting By Office) is set, the system uses the G/L account in the ACH Fee and ACH Offset fields for the account's office on the G/L Accounts tab of the GOLD Services > Office Information screen. See the Fees topic in the EZPay help for more information. |

Modified Payments |

If this loan has a modified payment schedule set up (using the Loans > Transactions > CP2 screen, Payment Schedule tab), the amount defaulted into the Payment Amount field on that screen for recurring payments will reflect the amount from the payment schedule. This is ignored when the Override Payment Amount is used with a recurring payment. |

Maturity Date |

An option is available that stops recurring payments once the loan is past the Maturity Date (see Stop Recurring Payment if Past Maturity on the Loan Information tab of this screen). If that option is set and a loan is past the Maturity Date when a recurring payment is attempted on the account, the payment will be rejected and the account will appear on the Afterhours Processing Exceptions Listing report (FPSRP013). Make a habit of checking that report every morning. You'll need to manually handle those accounts, such as contacting the borrower and asking for a final payment; running a payoff transaction through the Loans > Payoff screen; sending an event letter to the customer about a final payoff amount; or whatever other methods your institution requires.payment. |

Hold Codes |

Recurring payment transactions are not allowed on loans that are severely delinquent, such as loans that have been charged off or are in bankruptcy. The following Hold Codes will cause the ACH payment to reject if they are on the account. (The accounts with rejected automatic/recurring payments will show on the Afterhours Processing Exceptions Listing report (FPSRP013).)

•2, 4, 5, 6, 7, 8, 9, 27, 48, 86, or 94-99 |

Locked for Payoff |

If the loan is locked for payoff on the Loans > Payoff screen, and the loan is not unlocked before afterhours is run the night the recurring payment is pulled, the recurring payment will be rejected and show on the Afterhours Processing Exceptions Listing report (FPSRP013) with the message: "LOAN LOCKED IN FOR PAYOFF." You will need to manually handle the account at that point, such as unlocking the payoff; calling the customer for a final payment; running a manual payment through CIM GOLDTeller; or however else your institution wants to handle the account. |

Balloon Payment Due |

Some loans require a final balloon payment, which is more than the regular recurring amount. Action Code 1 with an Action Date on or after the recurring payment effective date will cause the recurring payment to reject and show on the Afterhours Processing Exceptions Listing report (FPSRP013). |

1. |

Make sure the Due Date is today's date or in the future. If this is not the case, a payment or deferment (if your institution allows deferments) will need to be made on the account in order to advance the due date properly. |

||||||||||

2. |

At the bottom of the Recurring tab, click <Start Recurring>. The required fields will display an error provider icon

|

||||||||||

3. |

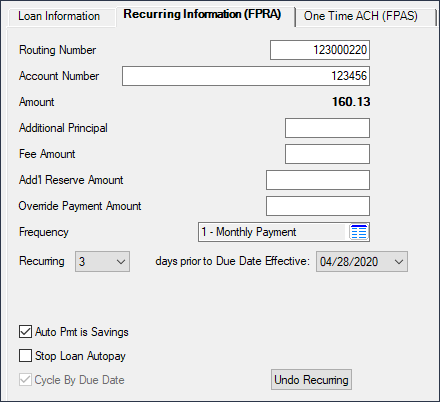

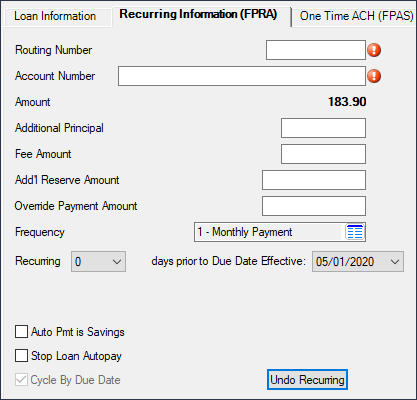

Enter the Routing Number and Account Number of the financial institution for the recurring payment. After you click <Save Changes>, the system will notify you if the routing number entered is not an approved ABA routing number by displaying an error provider icon

|

||||||||||

4. |

The regular payment amount (P/I Constant) is defaulted into the Amount field and cannot be changed. However, you can enter any additional amount this borrower would like to go toward principal, fees, or reserve amount in the designated fields below the Amount field. Or you can enter an amount in the Override Payment Amount field to override this default amount.

|

||||||||||

5. |

The Frequency field defaults to the value of the established loan Frequency and indicates the frequency of the recurring payment schedule. |

||||||||||

6. |

Set the number of days before the effective Due Date in the Recurring...days prior to Due Date Effective field. The system will pull the ACH payment on the designated days before the effective Due Date. |

||||||||||

7. |

Select any of the recurring option boxes, as described below:

|

||||||||||

8. |

Click <Save Changes> to save the recurring payment record. |

||||||||||

|

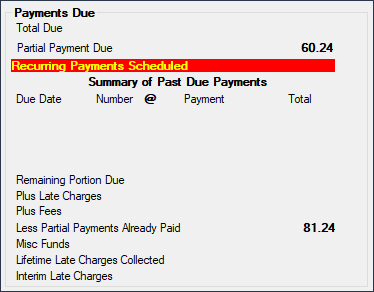

In the Payments Due field group on the Loan Information tab, the message "Recurring Payments Scheduled" will be displayed, as shown below.

Additionally, the routing and account number you set up are saved on the ACH Accounts (FPEA) tab, if your institution uses that tab. |

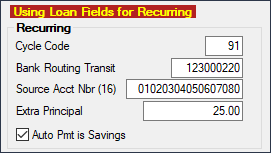

Use this simplified version of the Recurring field group on the Loan Information tab to set up recurring payments for accounts that use the legacy loan record, which means the Cycle Code is not equal to 255 (ACH) or 254 (cards).

Note: This field group only shows for certain institutions. These are legacy fields that are being phased out, and instead, the FPRA (recurring payments) record is used, as set up on the Loans > Transactions EZPay screen. See the Recurring Payments topic in the EZPay user's guide for more information on setting up recurring payments using that FPRA record.

|

The following paragraphs describe the fields on the Recurring Information tab.

|