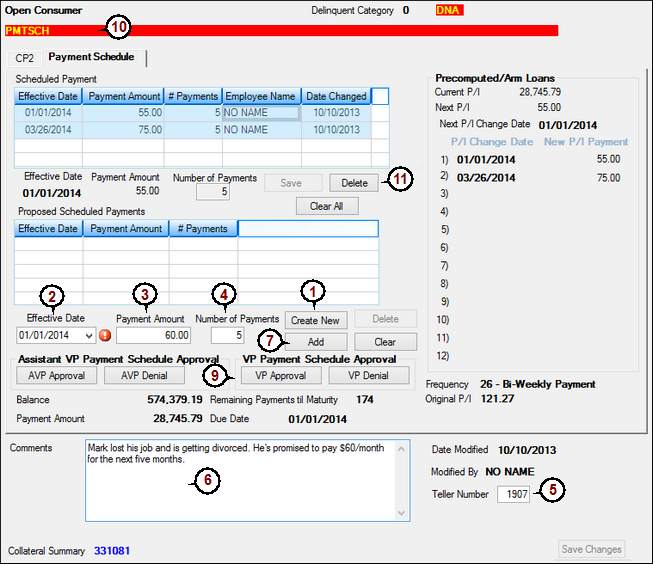

Navigation: Loans > Loan Screens > Transactions Screen Group > CP2 Screen >

Use this tab to set up modified payment schedules for the customer. This feature should be used if the customer is delinquent on the loan or has contacted your institution about a hardship and wants to reduce their payment amount. The number of frequencies for payment can be altered for approved loan payment schedules. When the term for the modified payment is over, the system returns to the original principal and interest payment on the loan. Multiple payment schedules can be set up for each account.

For Example: a customer promises to pay $100 for the next three payments, $200 for three payments after that, and then return to the regular payment of $400. Two payment schedules would be set up on this screen: One for $100 for three payments, and one for $200 for three payments, starting on the Due Date after the first three payments.

The fields at the bottom of this tab (above the Comments fields) display basic information about the loan for reference purposes. This information includes the outstanding principal Balance, the current Payment Amount, the Remaining Payments til Maturity, the current Due Date, the loan payment Frequency, and the Original P/I amount. More P/I information about the account is displayed in the Precomputed/Arm Loans field group on the right side of this tab.

Loans > Transactions > CP2 Screen, Payment Schedule Tab

To set up a new payment schedule on this tab, follow the instructions below:

1. |

Click <Create New>. The Effective Date, Payment Amount, Number of Payments, and Teller Number fields will be enabled and display an error provider icon |

||

2. |

Enter the date when the new payment schedule will take effect in the Effective Date field. Depending on the loan frequency (monthly, weekly, bi-weekly, etc.), the effective date must land on a Due Date day. For example, if the loan is processed bi-weekly on every other Tuesday, the Effective Date must be a Tuesday on the bi-weekly week of the Due Date.

|

||

3. |

Enter the amount the customer is willing to pay in the Payment Amount field. This amount will be reflected in the Next P/I and Recurring Payment Amount fields (if the customer is set up with recurring payments). |

||

4. |

Enter the number of payments for the amount the customer is willing to pay for the designated frequency in the Number of Payments field. For example, if "3" is entered, the customer will be responsible for making the next three payments for the indicated Payment Amount. |

||

5. |

Enter a Teller Number. |

||

6. |

Enter any necessary comments to a manager about why the loan payment schedule is being modified in the Comments field. |

||

7. |

Click <Add>. The payment schedule will appear in the Proposed Scheduled Payments list view, which is the bottom list view on this tab.

The Proposed Scheduled Payments list view displays all modified payment schedules set up on this tab awaiting a supervisor's approval. Select a payment schedule in this list view to view that schedule's information in the Effective Date, Payment Amount, and Number of Payments fields underneath the list view. |

||

8. |

Notify a supervisor about the modified payment schedule requiring their approval. The GOLDTeller chat function can be used to quickly send a supervisor a notification.. |

||

9. |

When the supervisor is ready to approve the scheduled payment, they will need to access this tab, enter a comment in the Comments field (if necessary), and click

|

||

10. |

Once the payment schedule has been approved, it will be displayed in the Scheduled Payment list view at the top of this tab, and the message "PMTSH" will display in the message line at the top of the screen to indicate to all users that this account has a payment schedule set up (see the screen example below).

The Scheduled Payment list view displays information about all payment schedules that have previously been approved and set up for the customer loan account. Select a payment schedule in this list to view that schedule's information in the Effective Date, Payment Amount, and Number of Payments fields underneath the list view. |

||

11. |

To delete a payment schedule, select it in the Scheduled Payment list view at the top of this tab and click <Delete>. |