Navigation: Loans > Loan Screens > Account Information Screen Group > Reserves Screen Group >

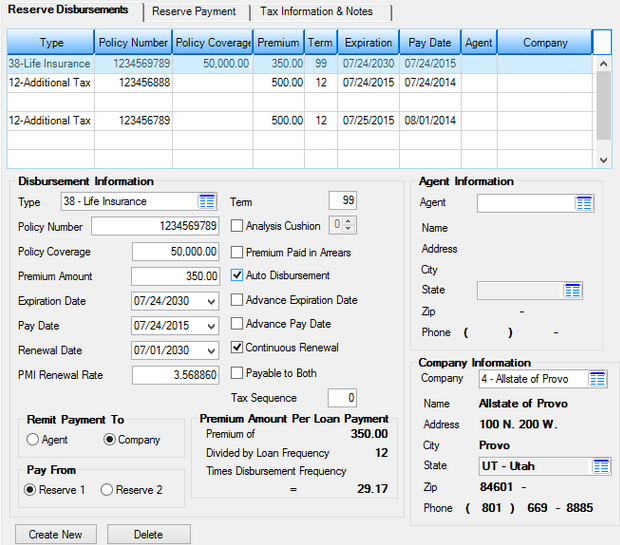

Reserve disbursements happen automatically as requested by the reserve disbursement records for each loan. These may be for mortgage insurance payments, fire insurance, taxes, etc. See below for a list of the capabilities of GOLDPoint Systems' reserve disbursement module.

GOLDPoint Systems' reserve disbursement module is capable of the following features:

•Automated printing of reserve disbursement checks.

•The ability to control reports to include: 1.Remittance advice form to send with checks 2.Check register 3.Company sequence of detail items 4.Loan account number sequence of detail items

•Disbursements can be made to a Company or an Agent within a company.

•The service center concept allows multiple control points within your institution for printing checks and reports for the offices assigned to that service center.

•Print reserve reports from GOLDView (Reserve Analysis Statement, FPSRP339; Auto Reserve Disbursement, FPSRP306; Reserve Disbursement Posting Journal, FPSRP033).

•Online inquiry and file maintenance for: 1.Setting up tax service centers. 2.Entering company/agent information.

•Online control records for displaying status of daily processing for user control. This gives a flexible schedule for production of checks and reports daily.

•Online company/agent histories to show checks created for that company or agent.

•Online printing of company/agents on file.

•Online printing of history for all company/agents on file.

The functions pertaining to the reserve disbursement module are found under Loans > Reserves menu and the Loans > Check Printing > Reserve Checks screen in the left tree navigation in CIM GOLD. |

Loans > Account Information > Reserves > Account Reserve Detail Screen

Use the Loans > Account Information > Reserves > Reserve Analysis Options screen to set up system-wide options for when you want to create yearly reserve analysis and send out statements, excess checks, etc.

To view an online analysis for a loan once reserves are set up or changed, use the Loans > Account Information > Reserves > Reserve Analysis screen. This screen shows how any new reserves or reserve information that has been changed affects the loan payment. Additionally, the Reserve Effective date on that screen determines when the loan should have reserve analysis processed and new loan payment amounts updated, if needed.

The tabs on this screen are as follows:

Negative Reserve Interest tab (This tab is only available in certain circumstances. See the tab help to learn more)

The Collateral Detail field at the bottom of this screen displays the user-defined Collateral information entered on the Loans > Account Information > Account Detail screen.

See also:

Reserve Disbursement Posting Journal (FPSRP033)

Auto Reserve Disbursement Report (FPSRP306)

Reserve Analysis Statement (FPSRP339)

|

Record Identification: The fields on this screen are stored in the FPRD, FPBA, FPLN, FPNI, and FPLT records (Reserve Disbursement, Account Bankruptcy Info, Loan Master, Interest on Negative Reserves, Loan Tax and Stat). You can run reports for these records through GOLDMiner or GOLDWriter. See FPRD, FPBA, FPLN, FPNI, and FPLT in the Mnemonic Dictionary for a list of all available fields in these records. Also see field descriptions in this help manual for mnemonics to include in reports. |

|---|

In order to use this screen, your institution must:

•Subscribe to it on the Security > Subscribe To Mini-Applications screen.

•Set up employees and/or profiles with either Inquire (read-only) or Maintain (edit) security for it on the CIM GOLD tab of the Security > Setup screen.

•Set up the desired field level security in the FPRD, FPBA, and FPLT records on the Field Level Security screen/tab. |