Navigation: Loan Screens > Account Information Screen Group > Payment Information Screen > Loan Information tab > Recurring field group >

Recurring field group - FPRA set

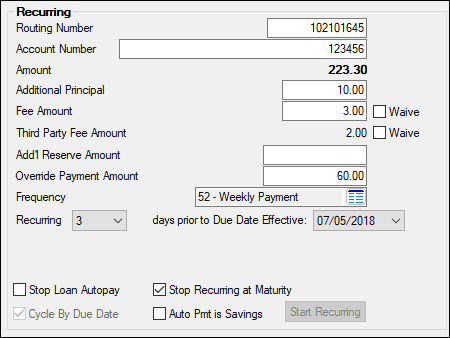

If Institution Option FPRA is set, the Recurring field group appears as shown below and the Recurring Information (FPRA) tab (which functions identically) is available on the Payment Information screen.

Loans > Account Information > Payment Information Screen > Loan Information Tab > Recurring Field Group

See Setting Up Recurring Payments for step-by-step instructions on how to set up recurring payments using the fields in this field group.

Additionally, the routing and account number you set up are saved on the ACH Accounts (FPEA) tab.

The fields in this field group are as follows:

Field |

Description |

|||||

|

Mnemonic: RAABNK |

After clicking <Start Recurring>, enter the routing number of the financial institution for the recurring payment. After you click <Save Changes>, the system will notify you if the routing number entered is not an approved ABA routing number by displaying an error provider icon

|

|||||

|

Mnemonic: RAACH# |

Enter the account number of the financial institution for the recurring payment. |

|||||

|

Mnemonic: RAACH$ |

When you click <Start Recurring> to set up a recurring payment record, the system automatically enters the regular payment amount in this field. You cannot make changes to this field. However, if the borrower wants to pay more than the regular payment, you can enter the additional amount in the Additional Principal field below, or you can enter an amount in the Override Payment Amount field below to override this default amount.

|

|||||

|

Mnemonic: RAOPMT |

If the customer wants to set up additional funds to include in recurring payments, enter that amount in this field. This amount will go directly toward paying down the principal, not the interest. |

|||||

|

Mnemonic: RAFAMT |

If your institution charges a fee amount each time a recurring payment occurs, enter that amount in this field. This fee is credited to the EZPay Fee General Ledger account set up on the GOLD Services > General Ledger > G/L Account By Loan Type screen each time the recurring payment occurs. Mark the adjacent Waive checkbox field to waive this fee for the selected account.

This field will be automatically entered for you if the fee amount is set up in the EZPay options. Additionally, field-level security may restrict you from making changes to this field, as well as waiving the fee.

|

|||||

|

Mnemonic: RAFAMT |

If an additional third-party fee amount is charged each time a recurring payment occurs, that amount will appear in this field. This amount goes directly to the third-party payment processor. Third-party payments require set up on GOLDPoint Systems part, and set up by your third-party payment processor. Mark the adjacent Waive checkbox field to waive this fee for the selected account.

If your institution does not use a third party for ACH payment processing, this field will not appear in this field group.

|

|||||

|

Mnemonic: RAR1PM |

If the borrower would like to include any additional amount for reserve payments, enter that amount in this field. This will go toward the Reserve Balance reflected on the Loans > Account Information > Reserves > Account Reserve Detail screen (Reserve 1 only). |

|||||

|

Mnemonic: RAREQA |

If the customer cannot pay the regular payment amount reflected in the Amount field above, you can enter a different amount in this field for the recurring payment. Each time the recurring payment is processed, it will use this amount, even if the amount is lower than the regular payment amount (in which case, the Due Date will not roll properly). Reserve and fee amounts are still added to the total. |

|||||

|

Mnemonic: RAFREQ |

The Frequency field in this field group defaults to the value of the established loan Frequency.

You cannot make changes to this field in this field group. See the Changing the Loan Frequency topic for more information.

|

|||||

Recurring days prior to Due Date Effective

Mnemonic: RADYSB |

This field is only used with the following loan frequencies:

13 - Floating Payment 24 - Semi-monthly Payment 26 - Bi-weekly Payment 52 - Weekly Payment

Select from the Recurring field the number of days prior to the Due Date Effective date that you want the recurring payment to occur.

For example, if you select "2" in the Recurring field, and the Due Date Effective date is set for "10/08/2018," then two days before the new effective Due Date (10/6/2018), the system will debit the account entered above, and apply that amount to the loan payment.

This field can be used with any payment if the Cycle By Due Date field below is checked. |

|||||

Recurring Effective Date/Cycles on

Mnemonic: RAPCYC |

See below for more information.

|

|||||

|

Mnemonic: RAPCYC |

If you check this box, the recurring loan payment will always occur on the last day of the month according to the frequency. This only works with recurring payment Frequency code 13 (floating payment). |

|||||

|

Mnemonic: RASLAP |

Select this box if you want to stop processing this recurring payment without deleting the record from the system. You might not want to delete the recurring transaction, for example, if you believe the customer may want to resume it at another time. If the customer decides to resume the recurring payment, simply deselect this box and select a new effective date.

|

|||||

|

Mnemonic: LNASTP |

Check this box if you want recurring payments to stop once the loan has reached maturity. The system will reject all recurring ACH payments after the Maturity Date. The Afterhours Processing Exceptions Listing report (FPSRP013) lists all ACH payments that rejected because the recurring payment was made after the Maturity Date, and this option is set for that account. A user would then need to remove recurring payments from the account on the EZPay screen and follow your institution's best practices, which could include calling the borrower and setting up future one-time payments to pay off the loan.

The system automatically defaults to halting recurring ACH payments at maturity, but this default can be overridden using this field and Institution Option DSAM.

See also: •Recurring Payments on the EZPay screen

|

|||||

|

Mnemonic: RABYDU |

If you check this box, the Due Date will be used for the date the recurring payment is processed. When you check this box, the Recurring Effective Date fields become disabled, and the Recurring field and days prior to Due Date Effective fields become enabled. You should then select how many days before the Due Date this customer wants the automatic recurring payment processed.

All Frequency codes greater than 12 automatically cycle by due date. |

|||||

|

Mnemonic: LNACCK |

Check this box if the automatic payment is from a savings account. The ACH transfer codes are determined from this field. This field appears in both possible iterations of the Recurring field group.

|

|

GOLDPoint Systems Only: The Cycle Code field (LNACYC) in the FPLN record must be set to "255" in order for recurring ACH payment records to process correctly. If that field is not set up correctly, customers will not be able to run recurring payments. Even if you set up a recurring payment record (without LNACYC being set to "255"), the system will not read the recurring payment and the system will not pull it.

Use the FPS Host Record Viewer to set the Cycle Code (LNACYC) in the Loan Master record (FPLN). |

|---|