Field

|

Description

|

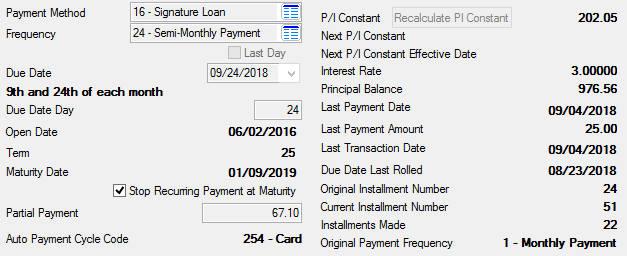

Payment Method

Mnemonic: LNPMTH

|

This field displays the payment method code. The payment method code determines how to calculate interest and what rules to follow in processing the loan account. See below for more information.

This field is pulled from the Loans > Account Information > Account Detail screen.

You can only change the loan frequency for loans with certain payment methods. See the Frequency definition below for more information.

Possible codes in this field are:

Code

|

Description of Method Code

|

0

|

Conventional Loan

|

3

|

Precomputed

|

5

|

Line-of-Credit

|

6

|

Interest Bearing

|

7

|

ARM - Adjustable Rate

|

16

|

Signature Loan

|

|

|

Frequency

Mnemonic: LNFREQ

|

If this is an interest-bearing loan (payment method 6) you can use this field to change the frequency of payments for the borrower. See below for more information.

When you change the frequency of a loan, you must first click  before you can save changes. The principal and interest payment will change based on the payment frequency you select from the Frequency field. before you can save changes. The principal and interest payment will change based on the payment frequency you select from the Frequency field.

Example:

|

A customer has a P/I payment of $200.00, with a loan frequency of "1 - Monthly Payment." The customer wants to change the frequency to bi-weekly payments that are more in accordance with the customer's paycheck. When you select "26 - Bi-Weekly Payment" from the Frequency field, and then click  , the P/I Constant is recalculated at the bi-weekly payment of $100.00 for each bi-weekly payment. , the P/I Constant is recalculated at the bi-weekly payment of $100.00 for each bi-weekly payment.

|

When recalculating the principal and interest payment based on a new payment frequency, the system takes into account the number of days interest and the number of days in the payment period, as well as the remaining balance on the loan (Principal Balance, see below) and the number of payments remaining until the loan reaches maturity.

Additionally, the Due Date below will be affected accordingly when changing the loan frequency, as will the Total Amount Due and Monthly Payment fields on the Loans > Transactions > EZPay screen.

The Last Day checkbox (see below) is also important if using the Floating payment frequency (13).

Also, the Remaining Payments til Maturity field on the Loans > Transactions > CP2 screen will also change based on the Frequency you select. (For example, if a loan has 5 payments left and you change the Frequency from monthly to weekly, the Remaining Payments til Maturity will increase to 20.)

|

|

Note: Not all institutions allow users to change the frequency on loan accounts. The Frequency field has field-level security and you may need special security clearance to make changes.

Additionally, you can limit which frequencies appear in the Frequency field. See the Loans > System Setup Screens > Client Code Setup > Loan Frequencies screen. The frequencies set up on that screen are displayed in this field. Frequencies are generally indicated at loan origination but can be changed using this field, if your institution allows it.

|

For more detailed information concerning each payment frequency, see the following table:

Code

|

Description

|

1

|

Monthly payment

|

2

|

Bi-monthly payment (payment every 2 months)

|

3

|

Quarterly payment (every 3 months)

|

4

|

Payment every 4 months

|

6

|

Semi-annual payment (every 6 months)

|

12

|

Annual payment

|

13

|

Floating: The day of the week of the Due Date (below) and its occurrence in the month determines the floating recurrence. So if the Due Date was set for the third Wednesday of the month, each successive Due Date would be the third Wednesday of the month.

However, if the Last Day box is checked below, the system uses the last occurrence of that day instead of the 4th occurrence.

For example, if the Due Date was set to 04-26-2013 (a Friday) and Last Day was checked, the Due Date for the last week in May would be 05-31-2013 instead of 05-24-13, even though 05-24-13 is the 4th occurrence of Friday (i.e., May has five Fridays, and the system would use the fifth Friday as the Due Date).

Any day 22 or greater can potentially use the Last Day option.

Loans using this frequency will be automatically charged off after 4 payments are missed.

|

24

|

Semi-Monthly: This frequency processes the Due Date of the loan (below) on a 15-day cycle with the exception of when the month does not have at least 30 days. In those months, the end-of-month day is used. The cycle is based on the Due Date Day field below.

Due Date Day is: 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15

Next Due Date Day is: 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30

If the Due Date Day is 31, then the payment follows a cycle of the end-of-month to the 16th of the next month.

EOM - 16 - EOM - 16

Example:

January 31

February 16

February 28

March 16

March 31

April 16

April 30

Also, please note an option that affects this frequency type. It's called Optional Semi Monthly, and it is found in the Options field group on this screen.

|

26

|

Bi-weekly (every 2 weeks on the same day of the week)

|

52

|

Weekly: Seven days will be added to the previous Due Date (see below) to obtain the next due date. If the first payment is on a Wednesday, then every payment will be on Wednesday.

|

|

|

Last Day

Mnemonic: LNLAST

|

Check this box if this borrower wants to use the last day of the month, rather than the fourth occurrence of the day of the week of the month, as the loan payment Due Date (below). This option is only available for Frequency code 13 (floating, see above).

|

Due Date

Mnemonic: LNDUDT

|

This is the current due date of the loan. See below for more information.

Changing the loan frequency will affect this field. For example, if the loan frequency is changed from monthly to weekly, the day of the week will be displayed below this field to indicate the loan is due every week on that day of the week (see example below). Also, the next Due Date will reflect the new weekly frequency date.

Additionally, if you want to set the payment Due Date to be the last day of the month, see the Due Date Day field.

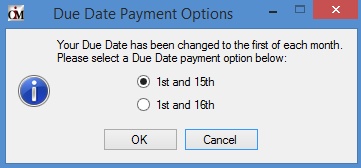

If the Optional Semi Monthly field is marked and this date is changed to the first of the month, the Due Date Payment Options dialog appears. This dialog allows the user to indicate whether the customer's payments will be due on the 1st and 15th or 1st and 16th of each month.

A full payment rolls the due date to the next frequency. However, some fields may affect when or how many times a payment rolls the due date. See these field for more information on options that affect rolling the due date:

Within Due Date Day

Payment Due Date Roll field group on the Loans > Account Information > Account Detail screen > Payment Detail tab

See also:

Changing the Loan Frequency

|

Note: If a user attempts to change the Due Date or Due Date Day and the system displays an error message, it's likely that certain options are set up for your institution which prevent altering due dates and due date days. See the following institution options for more information:

•CDUR •DDCD •DDAO •DDPF •DD27 •MDDD

Additionally, some institutions have requested hard-coded restrictions on changing these fields. Contact your GOLDPoint Systems account manager to see if such restrictions are in place at your institution.

|

|

|

Due Date Day

Mnemonic: LNDUDY

|

Use this field to indicate the date payment is due each month (for example, if "15" is entered in this field, the payment Due Date will be the 15th of each month). See below for more information.

This field is only used if the Frequency field above is set to one of the following:

1 - Monthly Payment

2 - Bi-Monthly Payment

3 - Quarterly Payment

4 - Payment every 4 months

6 - Semi-Annual Payment

12 - Annual Payment

Additionally, this field can be used to specify that the payment is due by the last day of the month. If you want to designate the payment be made by the last day of the month, enter "31" in this field. The system will automatically update the Due Date field above to always reflect the last day of the month. For example, if "31" is entered in the Due Date Day field, the Due Date in February will reflect "02/28/20YY." The system will adjust accordingly each month.

If you change the Due Date Day and then click <Save Changes>, the system automatically updates the Due Date field above accordingly, and vice versa. The Due Date will move to the next month if the indicated Due Date Day is in the future.

See also: Within Due Date Day.

The following institution options affect this field:

|

•OP06 MDDD, Move Due Date Day into Loan Due Date: When this option is enabled, any change to this field will change the Next Due Date. |

•DDCD: This option allows you to set the maximum number of days this field be changed. For example: The Due Date on an account is 1/1/2016, and this option indicates "13." This field can be changed to any number between 2 and 14. If 15 or higher is attempted, an error message will appear. The next due day cannot be greater than 13 days ahead of the Current Due Date. This option can be used in conjunction with option DD27 (see below). |

•OP08 DD27, Due Date Never Greater Than 27: When this option is enabled, employees at your institution cannot file maintain this or the Due Date field to a day greater than 27. |

|

Note: If a user attempts to change the Due Date or Due Date Day and the system displays an error message, it's likely that certain options are set up for your institution which prevent altering due dates and due date days. See the following institution options for more information:

•CDUR •DDCD •DDAO •DDPF •DD27 •MDDD

Additionally, some institutions have requested hard-coded restrictions on changing these fields. Contact your GOLDPoint Systems account manager to see if such restrictions are in place at your institution.

|

|

|

Open Date

Mnemonic: LNOPND

|

This field displays the date the loan was opened or funded. The system automatically supplies this information when a new loan (680 tran code) is performed. For precomputed loans (payment method 3), this field is one of the keys for calculating rebates.

|

Term

Mnemonic: LNTERM

|

This is the term of loan payments to pay off this loan. The term is in months, so if the loan Frequency (above) is changed to something other than months, this number still reflects the number of months to pay off the loan.

|

Maturity Date

Mnemonic: LNMATD

|

This field contains the date the last payment is due and the loan should be paid off. It is pulled from the Maturity Date field on the Loans > Account Information > Account Detail screen.

If the Stop Recurring Payment at Maturity option is selected, recurring payments will be rejected after the loan reaches the Maturity Date. See the definition below for more information.

If Institution Option RMTD is set, the system rolls the Maturity Date each time a deferment is made. Contact your GOLDPoint Systems account manager if you want this option set up for your institution.

|

Stop Recurring Payment at Maturity

Mnemonic: LNASTP

|

Check this box if you want recurring payments to stop once the loan has reached maturity. The system will reject all recurring ACH payments after the Maturity Date. The Afterhours Processing Exceptions Listing report (FPSRP013) lists all ACH payments that rejected because the recurring payment was made after the Maturity Date, and this option is set for that account. A user would then need to remove recurring payments from the account on the EZPay screen and follow your institution's best practices, which could include calling the borrower and setting up future one-time payments to pay off the loan.

The system automatically defaults to halting recurring ACH payments at maturity, but this default can be overridden using this field and Institution Option DSAM.

See also:

•Recurring Payments on the EZPay screen

|

Note: Recurring payment transactions will be stopped only if they are made after the actual Maturity Date. Transactions effective on the Maturity Date will still be posted.

|

|

Applied To Payment/Partial Payment

Mnemonic: LNPRTL

|

This field serves two different purposes, depending on whether or not the account is a simple-interest loan (payment method 6). See below for more information.

•If the loan is a payment method 0 (conventional loan) or 7 (ARM), this field contains funds paid toward the loan but not applied to the loan. For these types of loans, the field is called Partial Payment.

•If the loan is anything but payment method 0 or 7, this field contains the amount that will be applied toward the next payment due. The name of this field is called Applied To Payment.

The details of these differences are explained below.

Partial Payment

When this field is called Partial Payments on payment method 0 and 7 loans, it indicates that this is a monetary field and the money has not been applied toward a payment. Funds are credited to Partial Payments by a teller transaction and remain there until another teller transaction is processed to debit partial payments and post the money somewhere else (usually as a payment).

This field is generally used by the collection department if less than a full payment is collected. Once the remaining portion of the payment

is received, post those funds to Partial Payments, then debit the full payment amount from Partial Payments and credit it as a payment.

Funds in this field are not automatically applied as a payment by the system unless you have one of the institution options enabled (see Partial Payment Options). The Partial Payment Report (FPSRP198) and the Loan Warning Report (FPSRP083) identify accounts that have funds in Partial Payments. Bill and receipt statements subtract the partial payment amounts from the Total Due. Note: Refer to Partial Payment Options for options that allow the system to automatically debit Partial Payments and post them to the loan during the afterhours process.

Option C (RDPP) subtracts the Partial Payments field from the total amount due. However, for daily simple interest loans (payment method 6), the amount in the Applied to Payment field is always subtracted from the total amount due, whether this option is on or not.

Applied To Payment

This field can be file maintained by the user and does not require a teller transaction.

When the account is anything but payment method 0 or 7, you can make a partial payment, and it will be applied to the account. If the amount you paid is less than a full payment, the Due Date will not roll, but the money will be applied to the areas designated by the Payment Application code, such as principal first, then interest, then late charges, etc. The amount that you paid toward the payment due is automatically stored in the Applied to Payment ield and kept track of here until the full payment is satisfied. When the Due Date rolls, the field is cleared out. This field is also used in determining whether a late charge should be assessed when you are using delinquency grading and collecting late charges before principal and interest.

|

|

Note: There is a Curtailment from Partial Payment transaction (tran code 2610-04) that will debit partial payments (tran code 500) and automatically credit the principal balance (tran code 510) as a curtailment at the same time. The same edits (SOV, TOV, etc.) are used as with all other field credit (510) and field debit (500) transactions. This transaction processes each transaction separately, and they will appear in history as two separate transactions.

|

See Also:

For details on partial payments and the institution options that relate to them, see Partial Payment Options.

|

|

P/I Constant

Mnemonic: LNPICN

|

This is the regular monthly payment on the loan. This amount includes principal and any interest. If you change the Frequency for this loan (see above) and click  , the principal and interest payment will be recalculated based on the new frequency payment, the Principal Balance (below) left on the loan, the Interest Rate on the loan (see below), and the remaining payments until the loan reaches maturity. The Remaining Payments til Maturity field is on the Loans > Transactions > CP2 screen, Payment Schedule tab. , the principal and interest payment will be recalculated based on the new frequency payment, the Principal Balance (below) left on the loan, the Interest Rate on the loan (see below), and the remaining payments until the loan reaches maturity. The Remaining Payments til Maturity field is on the Loans > Transactions > CP2 screen, Payment Schedule tab.

|

Next P/I Constant

Mnemonic: LNPINX

|

The next P/I constant replaces the P/I Constant (above) as the amount to divide between principal and interest on a payment when the due date is advanced by the system to be greater than the P/I effective date, which is the date found in the Next P/I Constant Effective Date field below.

If a modified payment schedule is set up for this account using the Payment Schedule tab, this will be the modified amount set up on the payment schedule.

|

Next P/I Constant Effective Date

Mnemonic: LNPIEF

|

This field contains the principal/interest effective date, which is the date that the Next P/I Constant should replace the P/I Constant (see above). This field, in conjunction with the Next P/I Constant field, can be used to make a payment change in the amount of money applied to principal and interest. (This is the payment due date for the new principal and interest payment.)

If this loan has a modified payment schedule (using the Loans > Transactions > CP2 screen, Payment Schedule tab), this will be the next date the payment schedule changes.

|

Interest Rate

Mnemonic: LNRATE

|

This is the current interest rate for the selected loan.

|

Principal Balance

Mnemonic: LNPBAL

|

This field displays the unpaid principal balance of the loan. This field is used when recalculating the principal and interest payment when a loan Frequency is changed (see above).

|

Last Payment Date

Mnemonic: LNDTLP

|

This field shows the date that the last payment was posted. If a payment reversal (tran code 608) occurs, the system will look in the history for the previous last payment date and enter that date in this field. The last payment date is reported to the credit bureau and is updated as payment activity occurs on the loan.

|

|

Note: The loan transaction 590 (Charge LIP Interest to LIP Undisbursed Balance) also updates the date of last payment. However, the reversal of this transaction will not change the last payment date.

|

|

Last Payment Amount

Mnemonic: LNLPMA

|

This is the amount of the last loan payment the account owner made on the Last Payment Date above. See below for more information.

This field indicates the most recent amount paid on the customer account. Each time a payment transaction is run on the account, this field is updated with the amount of the transaction.

If institution option NDLP is not set and a deferment was recently run, this field will display the deferment amount.

For loans that are boarded through GOLDAcquire Plus or GOLD Loan Gateway, an institution option is available that affects whether an amount is transferred into the Last Payment Amount field. If this institution option (OP30 UOLP – Use Origination Payment Amount) is set, when a loan is boarded through GOLDAcquire Plus or GOLD Loan Gateway, the Origination Tracking Final Payment amount (OTLPAM) will transfer into the Last Payment Amount field (LNLPMA) for the loan.

Without this option set, the Open Loan transaction (tran code 680) clears the amount in LNLPMA. If UOLP is set, then the CSOT (Origination Tracking) record will be read and populate LNLPMA with OTLPAM.

The Final Payment amount field (OTLPAM) is found on the Loans > Purchase Disclosure or Original Loan Disclosure screens.

|

|

Last Transaction Date

Mnemonic: LNTRAN

|

This field contains the date of the last transaction on this account. The system supplies this date through the teller transactions, and the field is not file maintainable. This field is also updated by tran code 520 (Assess finance charge) for line-of-credit loans (payment method 5). Backdated Transactions: If a transaction is backdated, this field will display the backdated effective date, not the date the transaction was actually processed.

|

Due Date Last Rolled

Mnemonic: LNROLL

|

This is the date the Due Date (above) was last rolled due to an over payment or the amount in the Applied To Payment field reached a full payment, thereby rolling the Due Date ahead by one frequency. See below for more information.

Institution Option LCDR looks at the Due Date Last Rolled. If it is in the current late charge period, then a late charge will not be assessed. If you would like this option set up for your institution, contact your GOLDPoint Systems account specialist.

The late charge period is from Due Date + Grace Days to Next Due Date + Grace to Due + Grace Days.

For example, if a loan has a Due Date of 05-01-13 with 10 Grace Days, late charges would be assessed on 06-11-13 and 07-11-13

If the borrower makes a payment anytime after 06-11-13, the 07-10 late charge will not be assessed.

(The previous example assumes a monthly payment.)

The next example assumes a payment frequency of weekly with a 10-day grace period.

•The due date is 08-07-13. •The late charge would assess on 08-17-13. •The late charge period for this due date is 08-10-13 to 08-17-13

Due Date

|

Late Charge Assess

|

Late Period

|

08-14-13

|

08-24-13

|

08-17-13 to 08-24-13

|

08-21-13

|

08-31-13

|

08-24-13 to 08-31-13

|

08-28-13

|

09-07-13

|

08-31-13 to 09-07-13

|

If a payment is made on 08-21-13, then the next late charge that could be assessed would be on 08-31-13.

08-21 falls in the late period for the 08-14 due date, so a late charge will not be assessed on 08-24.

|

|

Original Installment Number

Mnemonic: LNOINO

|

This is the original number of payments on the loan when the loan was originated. This field is transferred over from GOLDTrak PC using the NBR_OF_PAYMENT (No. Pmts) field on the application. This information is helpful when researching deferment payments. Also see the help for Current Installment Number below.

|

Current Installment Number

Mnemonic: LNCINO

|

The Original Installment Number (above) and Current Installment Number are the same, and stay the same throughout the life of the loan, unless one or both of the following occurs on the loan:

1.The loan frequency is changed. If the loan frequency is changed, the Current Installment Number increases or decreases accordingly. For example, if the Current Installment Number is 100 for monthly payments, and the Frequency is changed to weekly (see above), the Current Installment Number is increased to 400. However, the Original Installment Number stays the same. The Original Payment Frequency field below displays what the payment frequency was when the loan was originated.

2.If a deferment or loan extension is applied to the loan, the Original Installment Number remains static and the Current Installment Number advances the number of frequency cycles that the account was deferred/extended. Installments/payments that are made that roll the due date update the Installments Made field below. |

Installments Made

Mnemonic: LNINNO

|

This field displays the number of payments made on the loan so far.

|

Original Payment Frequency

Mnemonic: LNFRQO

|

This is the original payment frequency when the loan was originally opened. You can change the frequency using the Frequency field above.

|