Navigation: Loans > Loan Screens > Bankruptcy and Foreclosure Screen Group > Bankruptcy Detail Screen > Field Descriptions > Actions and Dates field group >

Relief/Lift of Stay

A relief or lift of stay is a notice sent to your institution from the Bankruptcy Courts notifying you that they have determined that your institution is allowed to continue to collect from the debtor during bankruptcy. With both Chapter 7 and 13 bankruptcies, debtors are granted an immediate relief from creditors trying to collect from the debtor. A Motion for Relief of Stay can be filed by your institution requesting that the borrower continue making payments during bankruptcy proceedings. If the Bankruptcy Courts allow the relief of stay, a notice is sent to your institution notifying you of the decision. When that happens, you can run the Relief/Lift of Stay transaction, which will cause the account to resume collecting payments and other changes (see Results of Relief/Lift of Stay below).

|

Note: The Relief/Lift of Stay radio button is only available in the Actions and Dates field group if the Display Reaffirmation Dates Only field on the Loans > Bankruptcy and Foreclosure > Bankruptcy Options screen is left blank.

Update: In CIM GOLD version 7.9.4, this has been updated so the Relief/Lift of Stay radio button is always displayed regardless of whether or not that option is set. Contact your GOLDPoint Systems account manager if you would like the newest version of CIM GOLD. |

|---|

The following steps explain how to run the Relief/Lift of Stay transaction. These steps assume you've already run the Bankruptcy transaction.

1.Select the box next to the name (or names) in the top list view table for which the Relief of Stay has been granted.

2.Select the Relief/Lift of Stay radio button.

3.Enter a transaction date in the field to the right of the radio button. This is the date the Bankruptcy Court notice indicated your institution can start resuming payments.

4.Click <Verify Transaction> to open the Verify Accounts dialog. See the following example highlighting these steps:

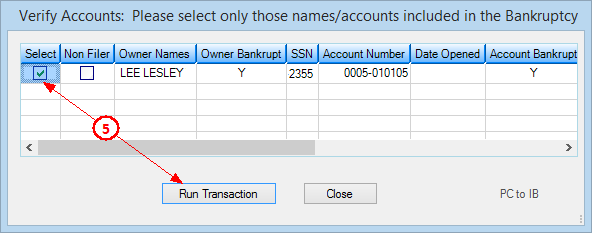

5.Select the appropriate account(s) and click <Run Transaction>, as shown below.

Results of Relief/Lift of Stay

Once the Relief/Lift of Stay transaction has been run, the following actions occur on the account:

•The Do Not Send Statements for This Account box is unchecked. Note: An option must be set to resume sending statements. See Options below.

•Statement Cycle is put back from bankruptcy history.

•The Advertise box is checked. Note: An option must be set to resume advertising. See Options below.

•The Phone Restriction field will be changed to "0 - No Restrictions" indicating employees can call the borrower. Note: An option must be set to clear the Phone Restriction, as described in Options below.

•The Email Restriction field will be changed to "0 - No Restrictions" indicating employees can call the borrower. Note: An option must be set to clear the Email Restriction, as described in Options below.

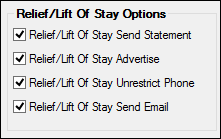

You can set up additional options that affect the results of the Relief/Lift of Stay transaction through the Bankruptcy Options screen in the Relief/Lift Of Stay Options field group. See the following descriptions:

Relief/Lift Of Stay Options Field Group on the Bankruptcy Options Screen

Option |

Description |

|---|---|

Relief/Lift of Stay Send Statement

Mnemonic: BIRSSS |

When the Bankruptcy transaction is run, the system checks the Do Not Send Statement field. In other words, the account owner no longer receives statements. If this box is checked and then you run the Relief/Lift of Stay transaction, the system will uncheck the Do Not Send Statement field and the account owner will resume receiving statements, if applicable. |

Relief/Lift of Stay Advertise Mnemonic: BIRSAD |

When the Bankruptcy transaction is run, the system checks the Advertise field. In other words, the account owner no longer receives advertisements. If this box is checked and then you run the Relief/Lift of Stay transaction, the system will uncheck the Advertise field and the account owner will resume receiving advertisements, if applicable. |

Relief/Lift of Stay Unrestrict Phone

Mnemonic: BIRSUP |

When the Bankruptcy transaction is run, the system flags phone numbers with a restriction of "13 - Contact Attorney Only." However, if this box is checked, and then you run the Relief/Lift of Stay transaction, the system will change the Phone Restriction to "0 - No Restrictions." Therefore, your employees and collectors can continue calling the borrower concerning late or missed payments. |

Relief/Lift of Stay Send Email

Mnemonic: BIRSSE |

When the Bankruptcy transaction is run, the system flags email addresses with a restriction of "1 - No Email Allowed." However, if this box is checked, and then you run the Relief/Lift of Stay transaction, the system will change the restriction to "0 - No Restriction." Therefore, your employees and collectors can continue emailing the borrower concerning late or missed payments, advertisements, or notices. |