Navigation: Loans > Loan Screens > Account Information Screen Group > Account Detail Screen > Account tab >

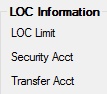

LOC Information field group

The LOC Information field group displays information concerning line-of-credit loans (payment method 5). The following fields are found in this field group on the Account tab of the Loans > Account Information > Account Detail screen.

The fields in this field group are as follows:

Field |

Description |

|||||

|

Mnemonic: LNRLCL |

This field contains the total amount of the line-of-credit and is used as a ceiling for the principal balance. The principal cannot be increased above this limit. The system returns an error message if a transaction attempts to increase the principal over this limit. This is only for line-of-credit loans (payment method 5). See below for more information.

|

|||||

|

Mnemonic: LNSECA, LNSECC, LNSECO |

This is the account number of the deposit account by which this loan is secured. If the loan account is not secured against a deposit account, this field will display zeros. See the Secured by Floating Pledge? field on the Loans > Line of Credit screen.

The length of this field will vary from institution to institution depending on the account number lengths selected by each institution. Before a closed loan is dropped, the system checks if it is an overdraft account or a security account in the Deposit system. If it is, the loan number is removed from the deposit account, and history is written for the deposit account. |

|||||

|

Mnemonic: LNXFRO, LNXFRA, LNXFRC |

This is the account number of the savings account that is used as a transfer account for purposes of overdraft protection or automatic loan repayment. The length of this field will vary from institution to institution depending on the account number lengths selected by each institution.

You can draft loan payments from deposit accounts that have overdraft protection. The system will post the payment and pull the funds from the overdraft account if necessary. The "available balance" is used in the calculation to determine if sufficient funds are available. The overdraft can be advanced from either the same loan for which the payment is being posted, or from another account, based on your institution options. Before a closed loan is dropped, the system checks if it is an overdraft account or a security account in the Deposit system. If it is, the loan number is removed from the deposit account, and history is written for the deposit account. |