Navigation: Loans > Loan Screens > Account Information Screen Group > ARM Information Screen > ARM Detail tab >

Rate Information field group

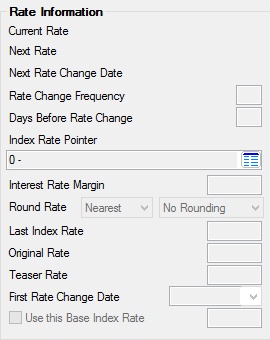

The Rate Information field group on the ARM Detail tab of the ARM Information screen contains rate information for the account.

The fields in this field group are as follows:

Field |

Description |

|||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Mnemonic: LNAMRT or LNRATE |

This field contains the rate at which interest is accrued on the loan. A rate of 12% would be displayed as “12.00000.” This is the interest rate on loans that use payment method 7 or payment method 6 with the Use ARM Fields checkbox checked.

File maintenance to this field is done on the ARM Rates & P/I Tables tab. The GOLDWriter mnemonic for this field is LNAMRT. However, LNRATX is the loan effective rate, which means if you use this mnemonic, the system will use the effective rate based on the type of loan (i.e., payment method 7 would use LNAMRT, LIP would use LNLRAT, and LNRATE would be used for all other loans). |

|||||||||||||||||||||||||||

|

Mnemonic: LNAMNA

|

This field contains the next rate to be used for this loan. It becomes effective with the payment due on the Next Rate Change Date below. This rate rolls into the Current Rate (above) when the payment associated with this rate is posted. File maintenance to this field is done on the ARM Rates & P/I Tables tab.

Prepayments The system can only accept prepayments up to the installment associated with the next rate change date. The loan cannot advance beyond the next rate change date unless a rate exists in the Next Rate field.

When the prepayment is posted, the system will move the rate in this field to the Current Rate field . The Next Rate field will be left blank until the next rate is calculated.

|

|||||||||||||||||||||||||||

|

Mnemonic: LNAMDT |

This field contains the date of the next rate change on the loan in MMDDYY format. File maintenance to this field is done on the ARM Rates & P/I Tables tab. All rates will roll automatically in accordance with the rate change frequency and this date.

|

|||||||||||||||||||||||||||

|

Mnemonic: LNAMFQ |

Enter the frequency (in months) the rate will change on this loan. A six-month change would be entered as “6.” This field must be greater than zero. For loans that do not have rate changes for the first 3, 5, 7, or 10 years, but yearly thereafter, refer to Two-Step Loans. |

|||||||||||||||||||||||||||

|

Mnemonic: LNAMAD |

Enter the number of days prior to a rate change that you want the new rate to be calculated and the notice of the change to be generated. |

|||||||||||||||||||||||||||

|

Mnemonic: LNAMPT and RTCL34 |

Select the index rate pointer to be used for this account. Index rate pointers and descriptions are institution-defined and entered in Loans > System Setup Screens > Interest Rate Table screen. |

|||||||||||||||||||||||||||

|

Mnemonic: LNAMOF |

This field is used in conjunction with the Index Rate Pointer above. It can be either positive or negative to allow points above or below the index rate. |

|||||||||||||||||||||||||||

|

Mnemonic: LNRRND, LNRRTQ, LNNRRS, and LNRR10; LNRDUP and LNRDDN |

Two fields control how rates are rounded each time a new rate is calculated. See below for more information.

|

|||||||||||||||||||||||||||

|

Mnemonic: LNAPIN |

This is the last index rate used (pulled from the ARM Rates & P/I Tables tab). This is the interest rate used on this loan before the Current Rate above. If this field is blank, then this is the first interest rate for this loan.

The interest rate margin would have been added to or subtracted from this rate to determine the actual loan rate. This rate is used on the rate change notice to the borrower when disclosing the last index. File maintenance of this field should be done with caution.

For delinquent loans the index rate appearing here does not match the rate for the delinquent payment. It displays the rate as if the loan were current. To see the rate for the delinquent payment you must look in the history of the loan. It will appear in the history as “LST RT IND.” |

|||||||||||||||||||||||||||

|

Mnemonic: LNAMOA |

This is the original note rate or the original fully indexed rate on ARM loans with a Teaser Rate (see below). This field will be used in the rate change notice to the borrower if the notice requires the original note rate.

Original fully indexed rate means the full value of the current market index plus the Interest Rate Margin (see above), at the time the loan is made. For example, if the index rate is 4.5%, and the loan has a margin of 1%, the fully indexed rate would be 5.5%.

The Original Rate field is used to calculate the new interest rate if the Use This Base Index Rate checkbox field below is marked.

This rate can also be used in the deferred fees and income calculations with amortization method 3 (interest method), depending on institution options. |

|||||||||||||||||||||||||||

|

Mnemonic: LNTSRT |

This is a memo field that displays the teaser rate. This rate is only used on the CMR Report (FPSRP117). When a loan is originated, the teaser rate would have been entered in the Current Rate field above.

|

|||||||||||||||||||||||||||

|

Mnemonic: LN1ROL |

This is the date the loan changes rates for the first time. It can be manually entered or the “open loan” tran 680 will automatically place the date in the Next Rate Change Date field above into this field if this field is blank. This date is only used on the CMR Report (FPSRP117).

A GOLDWriter work field, LNWLMTH, is available that calculates the number of months between the open date and the First Rate Change Date. |

|||||||||||||||||||||||||||

|

Mnemonic: LNBSIN and LNBINX |

If the Use This Base Index Rate field is checked (Yes), the Base Index field (unnamed field to the right of the Use This Base Index Rate checkbox) and the Original Rate field will be used to calculate the new interest rate on the loan.

|