Navigation: Loans > Loan Screens > Account Information Screen Group > Additional Loan Fields Screen > Origination/Maturity tab >

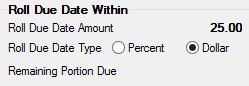

Roll Due Date Within field group

The Roll Due Date Within field group on the Origination/Maturity tab on the Additional Loan Fields screen can only be accessed if the loan has one of the following payment methods:

Precomputed or sum-of-the-digits (payment method 3)

Consumer LOC (payment methods 5, 9, and 10)

Daily simple interest loan (payment method 6)

These fields allow your institution to accept less than the payment amount and have the loan due date "roll" forward by one frequency as it would if the full payment amount had been received.

|

WARNING: These fields should be used with care. |

|---|

The fields in this field group are as follows:

Field |

Description |

|||||||||||

|

Mnemonic: LNDDRA |

This field allows your institution to accept less than the payment amount and have the loan due date "roll" forward by one frequency as it would if the full payment amount had been received. See below for more information.

|

|||||||||||

|

Mnemonic: LNDDRT |

The Roll Due Date Type field works in conjunction with the Roll Due Date Amount field above to allow your institution to accept less than the payment amount and have the loan due date "roll" forward by one frequency as it would if the full payment amount had been received.

When entering data in the Roll Due Date Amount field, you should also select either the Dollars or Percent radio button. For example:

•To enter a value of 80 dollars, enter 80.00 in the Roll Due Date Amount field and select the Dollar radio button.

•To enter a value of 80 percent, enter 80.00 in Roll Due Date Amount this field and select the Percent radio button.

For more information, see help for the Roll Due Date Amount field above. |

|||||||||||

|

Mnemonic: LNRPDU |

This field is used in connection with the Roll Due Date Amount and the Roll Due Date Type fields above. It stores the remaining unpaid portion of the payment. The amount is then added to the total due on the billing statement (Bill and Receipt, Pmt Mth 0, 6, and 7 (Cycled Billing) (FPSRP003) and Bill and Receipt, Pmt Mth 0, 6, and 7 (Variable Billing) (FPSRP155)).

When payments are posted to the loan, the remaining portion due is paid before the roll limit is checked. So, if the payment minus the remaining portion due is less than the roll limit, the due date will not roll.

Example: The payment sent was $100.00, the remaining due is $30.00, and the limit is $80.00. The system will pay the remaining due leaving $70.00 left, which is less than the roll limit of $80.00. The due date will not roll.

Using the same example, but changing the payment amount to $110.00, the system will again pay the remaining due leaving $80.00, which is equal to the roll limit. The due date will roll and the difference between the roll limit and the payment amount will be added to the remaining portion due. |