Navigation: Loans > Loan Screens >

Use this screen to move account numbers from one branch at your institution to another. All records associated with the loans will be moved. This screen can also be used to upload accounts acquired from another institution with new account numbers at your institution.

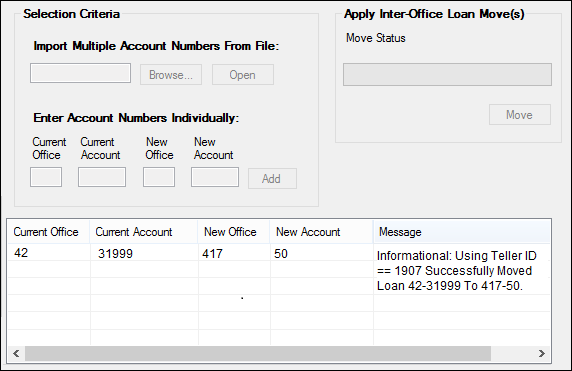

Account numbers are moved by selecting them in the Selection Criteria field group and then pressing the <Move> button in the Apply Inter-Office Loan Move(s) field group. The Account list view displays information about all account numbers designated for moving. You must have security to use this screen.

If there is an existing recurring credit card schedule on an account being moved, that schedule can be transferred to the new account. GOLDWriter or other file types with saved account numbers can be uploaded, or each account number can be entered individually. Closed loans can also be moved using this screen.

|

WARNING: Your GOLDPoint Systems account manager must set up the URL address used to import account numbers in the Configuration Manager before this screen can be used at your institution. |

|---|

You can also use GOLDPoint Systems' GOLDAcquire Plus, GOLD Loan Gateway, or one of our APIs to transfer/board loans into CIM GOLD. See the GOLDAcquire User's Guide in DocsOnWeb for more information.

Loans > Inter-Office Move Screen

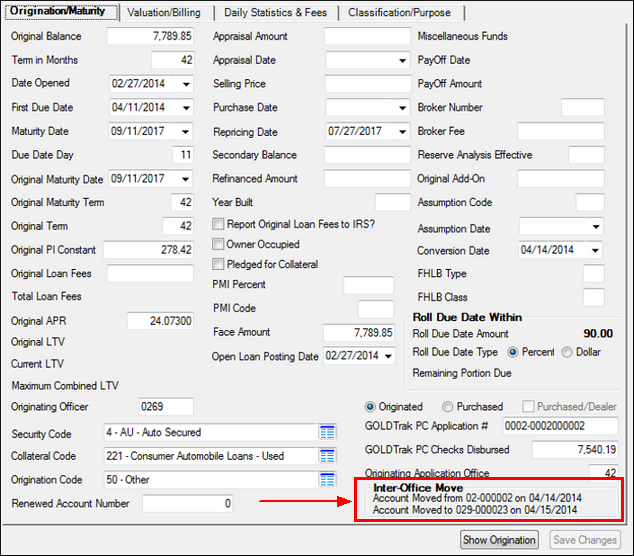

Once an account has been successfully moved to a new account number, the Origination/Maturity tab on the Loans > Account Information > Additional Loan Fields screen displays the old and new account number, as well as the date they moved, in the Inter-Office Move field, as shown below:

Loans > Account Information > Additional Loan Fields Screen, Origination/Maturity Tab

After the move is performed, the "old" Account will remain in the old branch but will be identified as released. The system also places a Hold Code 39 (No annual statement or reported to IRS) and an Action Code 104 (Loan released—awaiting deconvert), as well as the an Action Date of the date of move, on the old account number.

CFLN, FPNT, FPML, CFDH, CFLI, CFLM, CFLT, CFPO, CSOT, CSPP, CSSI, F2QH, F2VN, FPAC, FPAD, FPAV, FPBK, FPBU, FPC0, FPC1, FPC3, FPFC, FPF1, FPFO, FPIL, FPIN, FPIP, FPL1, FPLA, FPLH (see Warning box below), FPLS, FPLX, FPMB, FPMR, FPNI, FPNP, FPP5, FPPI, FPPL, FPPN, FPQA, FPQI, FPQP, FPRB, FPRD, FPSR, FPUF, FPVR. FPAU, CSRE, FPBF, FPBN, FPBY, FPHH, FPHL, FPL3, FPVH, FPVD, FPCK, FPDX, FPPN. |

|

WARNING: The FPLH record uses an automated archiving feature to reduce strain on system processing. FPLH items are archived after two years (24 months). Once an item is archived, loan history will still display it, but the actual records are removed from FPLH. Therefore, if a loan is moved after more than 24 months on the system, only a partial history is moved with it. This will cause the loan to appear out of balance on the History screen as well as in any generated statements.

For this reason, loans that have been open in the system for more than 2 years should not be moved using this screen. |

|---|

The fields on this screen are as follows:

Selection Criteria field group

Apply Inter-Office Loan Move(s) field group

In order to use this screen, your institution must:

•Subscribe to it on the Security > Subscribe To Mini-Applications screen.

•Set up employees and/or profiles with either Inquire (read-only) or Maintain (edit) security for it on the CIM GOLD tab of the Security > Setup screen. |