Navigation: Loans > Loan Screens >

The Loan > Deferments screen displays deferment history for qualified accounts where loan payments were deferred during the course of the loan. This screen is for informational purposes only. To actually assess a deferment on a loan, you must process the Deferment transaction through the CP2 screen, Make Loan Payment screen, the EZPay screen, or directly through CIM GOLDTeller (according to your institution's settings).

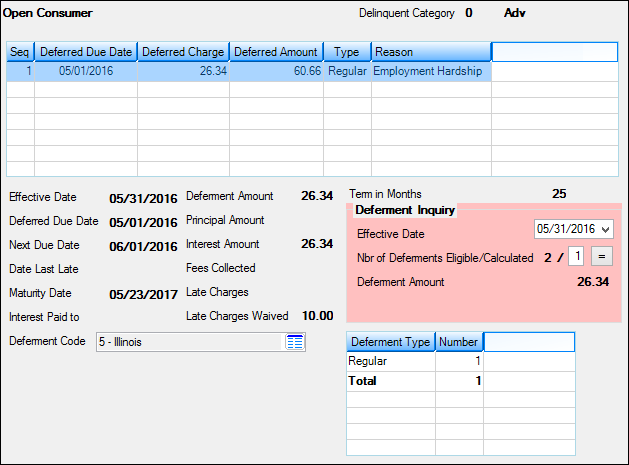

Loans > Deferments Screen

|

Note: If your institution uses extensions (and Institution Option IUEX is enabled), the Extensions field group also appears on this screen. |

|---|

Your institution's policies determine how many deferments are allowed on a loan per year and per the life of the loan. See the Deferment Options help page for more information.

Depending on State regulations, your institution's policies, and the type of deferment (holiday, hardship, etc.), a charge may be incurred on the loan for the deferment:

•If your institution charges for a deferment, use either the Deferment Payment transaction (tran code 2600-11), Deferments By Code transaction (tran code 2600-13), or Deferment with Reason transaction (tran code 2600-35) in CIM GOLDTeller. Or if set up properly, you can use the Loans > Transactions > Make Loan Payment or EZPay screen. The amount to charge for deferments is based on state regulations and your own institution's interpretation of those regulations, as well as your institution's policies. The Deferment Code field determines how your institution charges for regular deferments. (And some Deferment Codes do not require a charge.) Regular deferments cause the term of the loan to increase by the number of deferments applied, as well as advance the Due Date by the number of deferments. For example, if the loan term is for 30 months and you apply two deferments on the account, the loan term increases to 32 months, the Maturity Date moves out tow months, and the Due Date is advanced by two months.

•If you do not want to charge for deferments, you can use the Loans > Transactions > CP2 screen, the No Rules deferment (tran code 2600-17), or a Hardship deferment through EZPay. Also, certain Deferment Codes do no require a charge, if your institution allows those deferments. The Loan Term, Maturity Date, and Due Date will advance one month by the number of deferments made, but there will not be a charge assessed. You must be set up with security and certain institution options to use these types of deferments.

|

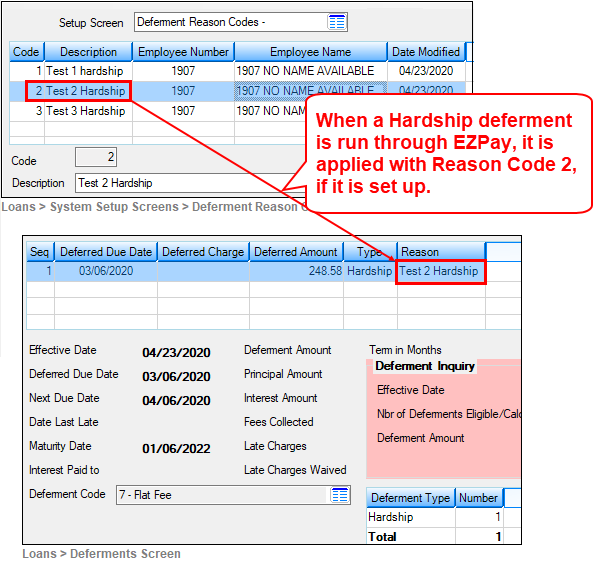

Deferments can be run from the EZPay screen, but certain EZPay options must first be set up. Additionally, different types of deferments can be run, such as the Hardship, Holiday, or Regular deferment.

If your institution prefers to use a specific Deferment transaction code for regular deferments, GOLDPoint Systems may need to set up some back-end programming to tie the deferment transaction code preferred by your institution to the Regular deferment run the EZPay, as shown below:

Your GOLDPoint Systems account manager can help you set up other EZPay options involved with running deferments through EZPay. See the Deferment Options help in EZPay for more information about the different options. |

|

Note: If you select certain types of deferments from the EZPay screen (such as a hardship deferment), the system will not charge for the deferment. You must have certain EZPay options set up to determine which types of deferments are allowed through EZPay. See the Deferment Options help page for more information. |

|---|

The fields on this screen are as follows:

Field |

Description |

||

The list view at the top of this screen displays the history of deferred loan payments tied to this account.

•The Seq column (DOCNTR) displays the sequence number of deferred payments (i.e., "1" means the first payment, "2" the second payment, etc.).

•The Deferred Due Date column (DODUDT) displays the date the regular loan payment is deferred to.

•The Deferred Charge column displays the charge amount applied to the loan for this deferment. Not all deferment types require a deferment charge, such as hardship and holiday deferments. Some institutions require a flat fee charge for regular deferments, while other states require specific calculations when requiring a deferment charge. See the Deferment Code help for more information. The amount in this column is subtracted from the regular loan payment to arrive at the amount in the Deferred Amount column, as explained below.

•The Deferred Amount column (TODFAM) displays the amount of the regular principal and interest payment that has been deferred after the Deferment transaction was run. This amount is calculated by subtracting the Deferred Charge amount from the regular principal and interest payment.

•The Type column displays the type of deferment this is. Possible deferment types include holiday, hardship, regular, and override.

•The Reason column displays the reason for the deferment. Nothing is displayed in this column unless the deferment was run with a Deferment Reason from one of the following transactions: •Deferment Payment Transaction (tran code 2600-11) •Deferment By Code Transaction (tran code 2600-13) •No Rules Deferment (tran code 2600-17) •Deferment with Reason (tran code 2600-35) •Fee Reg Deferment (tran code 2600-50)

Deferment Reason Code 6 should be reserved for natural or declared disasters for credit reporting purposes. |

|||

|

Mnemonic: D0DTEF |

This is the date the Deferment transaction was run on this account. Deferments are made through either the Make Loan Payment or EZPay screen. You can also run Deferment transactions through CIM GOLDTeller. See the Loan Deferments screen general help for more information. |

||

|

Mnemonic: D0DUDT |

This is the date the regular loan payment is deferred to. For example, if you set up a deferment through the Loans > Transactions > EZPay screen on March 24, 2018, and the Due Date on the loan was March 17, 2018, the payment would be deferred for one month (if payment frequency is monthly) and the next date the payment would be due would be April 17, 2018. Therefore, 04/17/2016 would appear in the Deferred Due Date field.

No payment will be due on the date indicated in this field. However, interest will accrue as normal. |

||

|

Mnemonic: D0DUNX |

This is the date of the next regular payment that is due. This date will be one frequency out from the Deferred Due Date above. No payment will be due on the Deferred Due Date. However, interest will accrue as normal. |

||

|

Mnemonic: D0LTDT |

This is the date the borrower was most recently late in making the loan payment. This field may be blank if the borrower has always been on time in making loan payments. |

||

|

Mnemonic: D0MATD |

This field is system-entered after a deferment transaction is made on an account. This is the date the deferment matures. For example, if the current Due Date is 12-27-2017, and the account owner makes a deferment on 12-23-2017,

If your institution wants the Maturity Date advanced after a deferment transaction is processed, enable Institution Option OP08-RMTD (Roll Maturity Date on Deferment). |

||

|

Mnemonic: D0PDTO |

This is the date, calculated with each payment, up to which interest has been paid on the loan. This date is not used for interest calculation purposes anywhere in GOLDPoint Systems, but is provided on this screen for loan servicing convenience. After a Deferment transaction is run, the system updates the Interest Paid to field with the Effective Date on the Deferment transaction.

See the Date Interest Paid to description on the Loans > Account Information > Account Detail screen for more information on this field. |

||

|

Mnemonic: MLDFRC |

The Deferment Code field displays the method by which the Deferment Amount (see below) is calculated. See Deferment Codes for more information. |

||

|

Mnemonic: D0DFAM |

This field displays the amount of payment the customer paid when the Deferment transaction was run. The amount in this field can be zero (0). Depending on the type of loan this is, the amount in this field can either be applied to principal, interest, or both (see below).

Some states require a charge to the account in order to make a deferment. See the help for the Deferment Code to see how the system calculates the Deferment Amount to be paid based on what is in the Deferment Code field. Certain deferment types also do not require a deferment charge, such as hardship and holiday deferments. |

||

|

Mnemonic: D0PAMT |

This field displays the amount of the Deferment transaction that was applied toward the principal of the loan. Not all Deferment transactions require a payment (charge) amount, so this field may be blank. |

||

|

Mnemonic: D0IAMT |

This field displays the amount of the Deferment transaction that was applied toward the interest on the loan. Not all Deferment transactions require a payment (charge) amount, so this field may be blank. |

||

|

Mnemonic: D0LFEC |

This field displays whether any additional fees were collected with this Deferment transaction. Fees can include late charges, processing fees, etc. Fees are different from the Deferment Amount collected (see above). |

||

|

Mnemonic: D0LCAM |

This field displays the amount of late charges paid, if any, when the Deferment transaction was run.

•See help for the Collect Late Charges When Current field on the Loans > Account Information > Account Detail screen for detailed information about collecting late charges for the current month when payments are more than one month past due.

•See also Special Late Charge Assessment and Grading for information about special late charge assessment and grading. |

||

|

Mnemonic: D0LCCW |

This field displays any late charges that were waived when the Deferment transaction was run. Depending on the Deferment Code, some deferments do not collect late charges. |

||

|

Mnemonic: D0TERM |

This field contains the term of the loan in months. As Deferment transactions are run, the number in this field may be increased by the number of deferments processed. (Depending on whether Institution Option RMTD is enabled).

For example, if this loan was to be paid off in 60 months, but you ran a Deferment transaction twice over the course of this loan, this field would increase to "62;" thereby causing the borrower to pay two additional months on the loan to make up for the two months of deferred payments.

|

||

Deferment Inquiry field group |

See Deferment Inquiry field group for more information. |

||

Extensions field group |

See Extensions field group for more information. |

||

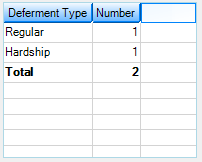

The list view at the bottom-right of this screen displays the type of deferments made since the loan was opened, the total number of each type of deferment, and a total for all deferments of every type. Possible deferment types of deferments are Regular, Holiday, Hardship, and Override. This list view is for informational purposes only. It cannot be file maintained. See the following example:

|

See also:

See Deferments in the EZPay screen help

Make Loan Payment screen, Deferments

Deferment Transactions in the Transactions manual in the CIM GOLDTeller User's Guide.

|

Record Identification: The fields on this screen are stored in the FPD0 record (Loan Deferments). You can run reports for this record through GOLDMiner or GOLDWriter. See FPD0 in the Mnemonic Dictionary for a list of all available fields in this record. Also see field descriptions in this help manual for mnemonics to include in reports. |

|---|

In order to use this screen, your institution must:

•Subscribe to it on the Security > Subscribe To Mini-Applications screen.

•Set up employees and/or profiles with either Inquire (read-only) or Maintain (edit) security for it on the CIM GOLD tab of the Security > Setup screen. |