0 - No deferment

|

No deferment will be used or calculated. This code used to designate California deferments, but that function has since moved to code 33 (see below).

|

1 - Indiana

|

This deferment code is calculated as follows: Unpaid balance (LNPBAL) times the APR divided by 12.

(LNPBAL x (LNAPRO / 12))

The following conditions prevent this deferment code from being allowed on the account:

•The conditions listed in the Warning box at the top of this help page. •The number of deferments calculated exceeds the number of deferments eligible. •Multiple Payment Schedules are in use. •The loan is not a precomputed (payment method 3), interest-bearing (payment method 6), or signature loan (payment method 16). •The loan has already hit the limit for the number of deferments allowed per year (institution option DFRM) or per lifetime of the loan (DFRL). A year is determined by contractual year. An Override deferment can allow these limits to be ignored. •The first payment has not yet been made on the account (institution option DFEX allows this rule to be ignored). •The loan's Payment Method code has been changed over its lifetime (institution option DFEX allows this rule to be ignored). •The loan's payment amount has been modified (institution option DFEX allows this rule to be ignored). •The interest rate on the account is zero (institution option DFEX allows this rule to be ignored). •The loan is a contract (purchased) loan (institution option DFEX allows this rule to be ignored). |

|

2 - Kentucky

|

This deferment code is calculated as follows: Unpaid balance (LNPBAL) times 24% divided by 12.

(LNPBAL x .24 / 12)

The following conditions prevent this deferment code from being allowed on the account:

•The conditions listed in the Warning box at the top of this help page. •The number of deferments calculated exceeds the number of deferments eligible. •Multiple Payment Schedules are in use. •The loan is not a precomputed (payment method 3), interest-bearing (payment method 6), or signature loan (payment method 16). •The loan has already hit the limit for the number of deferments allowed per year (institution option DFRM) or per lifetime of the loan (DFRL). A year is determined by contractual year. An Override deferment can allow these limits to be ignored. •The first payment has not yet been made on the account (institution option DFEX allows this rule to be ignored). •The loan's Payment Method code has been changed over its lifetime (institution option DFEX allows this rule to be ignored). •The loan's payment amount has been modified (institution option DFEX allows this rule to be ignored). •The interest rate on the account is zero (institution option DFEX allows this rule to be ignored). •The loan is a contract (purchased) loan (institution option DFEX allows this rule to be ignored). •Force Place Insurance is in use. |

|

3 - Missouri

|

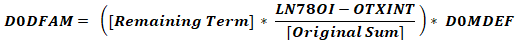

This deferment code is calculated as follows: Finance charge (LN78OI) minus the extension interest (OTXINT) used in precomputed earnings calculation involving the remaining term of the loan (LNTERM).

((LN78OI - OTXINT) / ((LNTERM / 2) x (LNTERM + 1)))

The following conditions prevent this deferment code from being allowed on the account:

•The conditions listed in the Warning box at the top of this help page. •The number of deferments calculated exceeds the number of deferments eligible. •Multiple Payment Schedules are in use. •The loan is not a precomputed (payment method 3), interest-bearing (payment method 6), or signature loan (payment method 16). •The loan has already hit the limit for the number of deferments allowed per year (institution option DFRM) or per lifetime of the loan (DFRL). A year is determined by contractual year. An Override deferment can allow these limits to be ignored. •The first payment has not yet been made on the account (institution option DFEX allows this rule to be ignored). •The loan's Payment Method code has been changed over its lifetime (institution option DFEX allows this rule to be ignored). •The loan's payment amount has been modified (institution option DFEX allows this rule to be ignored). •The interest rate on the account is zero (institution option DFEX allows this rule to be ignored). •The loan is a contract (purchased) loan (institution option DFEX allows this rule to be ignored). •Force Place Insurance is in use. |

|

4 - Tennessee

|

This deferment code is calculated as follows: Principal and interest payment (LNPICN) minus the maintenance fee (MRMFEE) times the remaining term (RTERM) times the APR divided by 12.

((LNPICN - MRMFEE) x RTERM) x (APR / 12)

The next P/I payment (LNPINX) is used instead of the P/I payment (LNPICN) if it exists.

The following conditions prevent this deferment code from being allowed on the account:

•The conditions listed in the Warning box at the top of this help page. •The number of deferments calculated exceeds the number of deferments eligible. •Multiple Payment Schedules are in use. •The loan is not a precomputed or signature loan. •The loan has already hit the limit for the number of deferments allowed per year (institution option DFRM) or per lifetime of the loan (DFRL). A year is determined on a rolling basis. An Override deferment can allow these limits to be ignored. •The first payment has not yet been made on the account (institution option DFEX allows this rule to be ignored). •The loan's Payment Method code has been changed over its lifetime (institution option DFEX allows this rule to be ignored). •The loan's payment amount has been modified (institution option DFEX allows this rule to be ignored). •The interest rate on the account is zero (institution option DFEX allows this rule to be ignored). •The loan is a contract (purchased) loan (institution option DFEX allows this rule to be ignored). •Force Place Insurance is in use. •Fewer than three regular payments have been made on the loan. |

|

5 - Illinois

|

This deferment code uses the interest (LNRATE, or if that is zero, LNAPRO) for the installment period prior to the installment being deferred as computed with an actuarial formula.

((N + 1 - PV (n + 1)) - (N - PVN)) x LNOPIC

((N + 1 - PV^(N+1)) - (N - PV^N)) x LNOPIC

Where “N” is the number of installments (months), “PV” is the present value calculation, and LNOPIC is the original principal and interest payment.

(^ signifies "to the power of")

The following conditions prevent this deferment code from being allowed on the account:

•The conditions listed in the Warning box at the top of this help page. •The number of deferments calculated exceeds the number of deferments eligible. •Multiple Payment Schedules are in use. •The loan is not a precomputed (payment method 3), interest-bearing (payment method 6), or signature loan (payment method 16). •The loan has already hit the limit for the number of deferments allowed per year (institution option DFRM) or per lifetime of the loan (DFRL). A year is determined on a rolling basis. An Override deferment can allow these limits to be ignored. •The first payment has not yet been made on the account (institution option DFEX allows this rule to be ignored). •The loan's Payment Method code has been changed over its lifetime (institution option DFEX allows this rule to be ignored). •The loan's payment amount has been modified (institution option DFEX allows this rule to be ignored). •The interest rate on the account is zero (institution option DFEX allows this rule to be ignored). •The loan is a contract (purchased) loan (institution option DFEX allows this rule to be ignored). •Force Place Insurance is in use. •Fewer than three regular payments have been made on the loan. |

|

6 - Pennsylvania

|

This deferment code calculates 1.5% of the unpaid principal balance to use as the deferment charge. If your institution prefers, GOLDPoint Systems can hard code the percentage of unpaid principal balance used in this calculation based on Loan Type. For example, Type 2 loans can be set up to charge 1% of unpaid principal balance with this deferment code while Type 1 loans charge 2%. Contact GOLDPoint Systems for more information.

The following conditions prevent this deferment code from being allowed on the account:

•The conditions listed in the Warning box at the top of this help page. •The number of deferments calculated exceeds the number of deferments eligible. •Multiple Payment Schedules are in use. •The loan is not a precomputed or signature loan. •The loan has already hit the limit for the number of deferments allowed per year (institution option DFRM) or per lifetime of the loan (DFRL). A year is determined by contractual year. An Override deferment can allow these limits to be ignored. •The first payment has not yet been made on the account (institution option DFEX allows this rule to be ignored). •The loan's Payment Method code has been changed over its lifetime (institution option DFEX allows this rule to be ignored). •The loan's payment amount has been modified (institution option DFEX allows this rule to be ignored). •The interest rate on the account is zero (institution option DFEX allows this rule to be ignored). •The loan is a contract (purchased) loan (institution option DFEX allows this rule to be ignored). •The account is frozen (Hold Code 60). •The account is in credit counseling. |

|

7 - Flat Fee

|

This code simply uses the amount defined by institution option DFFF – Deferment Flat Fee Amount as the deferment charge. This code cannot be used to process more than 3 consecutive deferments unless the deferment is designated as a Holiday deferment.

For line-of-credit card loans, only one deferment is allowed in a twelve-month period, and only two deferments are allowed in a 60-month period.

The following conditions prevent this deferment code from being allowed on the account:

•The conditions listed in the Warning box at the top of this help page. •The number of deferments calculated exceeds the number of deferments eligible. •Multiple Payment Schedules are in use. •The loan is not a line-of-credit, precomputed, interest-bearing, or signature loan. •The loan has already hit the limit for the number of deferments allowed per year (institution option DFRM*) or per lifetime of the loan (DFRL). A year is determined by contractual year. An Override deferment can allow these limits to be ignored. •The first payment has not yet been made on the account (institution option DFEX allows this rule to be ignored). •The loan's Payment Method code has been changed over its lifetime (institution option DFEX allows this rule to be ignored). •The loan's payment amount has been modified (institution option DFEX allows this rule to be ignored). •The interest rate on the account is zero (institution option DFEX allows this rule to be ignored). •The loan is a contract (purchased) loan (institution option DFEX allows this rule to be ignored). •Fewer than three regular payments have been made on the loan.* •General Category code 81, 83, 84, or 86 is active. These codes are additional designations for repossession and charge-off (in addition to the codes specified in the Warning box at the top of this help page). •The Due Date is more than 30 days in the past.*

*These restrictions can be ignored if the deferment is designated as a Holiday deferment.

|

|

8 - No Fee

|

This deferment code does not charge any monetary amount. It will only advance the Due Date and will also advance the Maturity Date if institution option RMTD is enabled.

The following conditions prevent this deferment code from being allowed on the account:

•The conditions listed in the Warning box at the top of this help page. •The number of deferments calculated exceeds the number of deferments eligible. •Multiple Payment Schedules are in use. •The loan is not a precomputed, interest-bearing, or signature loan. •The loan has already hit the limit for the number of deferments allowed per year (institution option DFRM) or per lifetime of the loan (DFRL). A year is determined by contractual year. An Override can allow these limits to be ignored. •The first payment has not yet been made on the account (institution option DFEX allows this rule to be ignored). •The loan's Payment Method code has been changed over its lifetime (institution option DFEX allows this rule to be ignored). •The loan's payment amount has been modified (institution option DFEX allows this rule to be ignored). •The interest rate on the account is zero (institution option DFEX allows this rule to be ignored). •The loan is a contract (purchased) loan (institution option DFEX allows this rule to be ignored). •Force Place Insurance is in use. |

|

9 - Wisconsin

|

This deferment code compares the amount of interest due to half of the current payment amount. The greater of the two values will be used as the deferment charge. If it is determined that 1/2 of the current payment due is greater than the interest due, the transaction will apply the amount first to satisfy all interest due, then apply the rest to principal.

The following conditions prevent this deferment code from being allowed on the account:

•The conditions listed in the Warning box at the top of this help page. •The number of deferments calculated exceeds the number of deferments eligible. •Multiple Payment Schedules are in use. •The loan is not a interest-bearing or signature loan. •The loan has already hit the limit for the number of deferments allowed per year (institution option DFRM) or per lifetime of the loan (DFRL). A year is determined by contractual year. An Override deferment can allow these limits to be ignored. •The first payment has not yet been made on the account (institution option DFEX allows this rule to be ignored). •The loan's Payment Method code has been changed over its lifetime (institution option DFEX allows this rule to be ignored). •The loan's payment amount has been modified (institution option DFEX allows this rule to be ignored). •The interest rate on the account is zero (institution option DFEX allows this rule to be ignored). •The loan is a contract (purchased) loan (institution option DFEX allows this rule to be ignored). •Force Place Insurance is in use. •Fewer than three regular payments have been made on the loan. •The interest rate on the loan has been modified. •The account is an installment loan (General Category 6). |

|

10 - Rule of 78

|

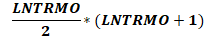

This deferment code is calculated as follows: Original interest (LN78OI) times factor times remaining term, where:

•Factor = (2 / original term (LNTRMO) *(original term (LNTRMO) + 1))+1, and •Remaining term = months difference between loan Due Date (LNDUDT) and the Maturity Date (LNMATD)

|

Note: If Force Place Insurance policies exist on loans that use this deferment code, the system also requires collection of one month's premium amount for the insurance policy.

|

The following conditions prevent this deferment code from being allowed on the account:

•The conditions listed in the Warning box at the top of this help page. •The number of deferments calculated exceeds the number of deferments eligible. •Multiple Payment Schedules are in use. •The loan is not a precomputed or signature loan. •The first payment has not yet been made on the account (institution option DFEX allows this rule to be ignored). •The loan has already hit the limit for the number of deferments allowed per year (institution option DFRM) or per lifetime of the loan (DFRL). A year is determined by contractual year. An Override can allow these limits to be ignored. •The loan's Payment Method code has been changed over its lifetime (institution option DFEX allows this rule to be ignored). •The interest rate on the account is zero (institution option DFEX allows this rule to be ignored). •The loan is a contract (purchased) loan (institution option DFEX allows this rule to be ignored). |

|

11 - APR w/Pro Rata Refund

|

This deferment code is calculated as follows: Unpaid balance times the APR divided by 12.

(LNPBAL x (LNAPRO / 12))

|

Note: If Force Place Insurance policies exist on loans that use this deferment code, the system also requires collection of one month's premium amount for the insurance policy.

|

Refund at Payoff

1.The Months Deferred field (D0MDEF) is calculated at the time of the deferment. It is calculated as follows: principal balance at time of deferment (LNPBAL)/monthly payment at time of deferment (LNPICN). This field is used at the time of payoff.

(D0MDEF=LNPBAL/LNPICN)

2.Months Deferred Earned = months difference between the deferred due date (D0DUDT) and the payoff date

(D0DUDT – payoff date)

3.Number of Deferred Months Remaining = months deferred (D0MDEF) – months deferred earned

Step 1 - Step 2

4.Computation of Pro-Rata factor = Number of deferred months remaining / months deferred (D0MDEF)

Step 3 / Step 2

5.Computation of Refund Due = deferment amount (D0MDEF) * Pro-Rata factor

Step 1 x Step 4

Example

1.Deferral Fee (calculated at deferment)

Monthly APR (LNAPRO/12)

.26908 / 12 = .022423

Deferral fee for 30 days (LNPBAL * 1)

837.00 * .022423 = $18.77

2.Months Deferred (D0MDEF = LNPBAL/LNPICN) (calculated at deferment)

837.00 / 93.00 = 9

3.Months Deferred Earned (payoff date-DODUDT) (calculated at payoff)

07/02/09 – 04/01/09 = 4

4.Number of Deferred Months Remaining (Step 2 – Step 3) (calculated at payoff)

9 – 4 = 5

5.Computation of Pro Rata Factor (Step 4 / Step 2) (calculated at payoff)

5 / 9 = 55%

6.Computation of Refund Due (Step 1 * Step 5) (calculated at payoff)

$18.77 * 55% = $10.32

The following conditions prevent this deferment code from being allowed on the account:

•The conditions listed in the Warning box at the top of this help page. •The number of deferments calculated exceeds the number of deferments eligible. •Multiple Payment Schedules are in use. •The loan is not a precomputed or signature loan. •The loan has already hit the limit for the number of deferments allowed per year (institution option DFRM) or per lifetime of the loan (DFRL). A year is determined by contractual year. An Override deferment can allow these limits to be ignored. •The first payment has not yet been made on the account (institution option DFEX allows this rule to be ignored). •The loan's Payment Method code has been changed over its lifetime (institution option DFEX allows this rule to be ignored). •The interest rate on the account is zero (institution option DFEX allows this rule to be ignored). •The loan is a contract (purchased) loan (institution option DFEX allows this rule to be ignored). •Force Place Insurance is in use. |

|

12 - Interest or 1/2 Payment

|

This deferment code calculates the interest due to the deferment date and 1/2 of the payment due and uses the lesser of the two. This method calculates and collects a P/I fee with the deferment fee. If an account is past due, the deferment transaction will collect as many P/I fees as necessary to bring the P/I fee current.

|

Note: If Force Place Insurance policies exist on loans that use this deferment code, the system also requires collection of one month's premium amount for the insurance policy.

|

The following conditions prevent this deferment code from being allowed on the account:

•The conditions listed in the Warning box at the top of this help page. •The number of deferments calculated exceeds the number of deferments eligible. •Multiple Payment Schedules are in use. •The loan is not an interest-bearing loan (payment method 6). •The loan has already hit the limit for the number of deferments allowed per year (institution option DFRM) or per lifetime of the loan (DFRL). A year is determined by contractual year. An Override can allow these limits to be ignored. •The first payment has not yet been made on the account (institution option DFEX allows this rule to be ignored). •The loan's Payment Method code has been changed over its lifetime (institution option DFEX allows this rule to be ignored). •The interest rate on the account is zero (institution option DFEX allows this rule to be ignored). •The loan is a contract (purchased) loan (institution option DFEX allows this rule to be ignored). |

|

13 - Alternate Flat Fee

|

This deferment code simply uses the amount entered in the Deferment Flat Fee field (MLDFFF) as the deferment charge. This field is not available for access in CIM GOLD and must be file maintained in the FPML record by your institution's GOLDPoint Systems account manager.

This flat fee amount is separate from the flat fee amount used in Institution Option DFFF.

|

Note: If Force Place Insurance policies exist on loans that use this deferment code, the system also requires collection of one month's premium amount for the insurance policy.

|

The following conditions prevent this deferment code from being allowed on the account:

•The conditions listed in the Warning box at the top of this help page. •The number of deferments calculated exceeds the number of deferments eligible. •Multiple Payment Schedules are in use. •The loan is not a precomputed, interest-bearing, or signature loan. •The loan has already hit the limit for the number of deferments allowed per year (institution option DFRM) or per lifetime of the loan (DFRL). A year is determined by contractual year. An Override can allow these limits to be ignored. •The first payment has not yet been made on the account (institution option DFEX allows this rule to be ignored). •The loan's Payment Method code has been changed over its lifetime (institution option DFEX allows this rule to be ignored). •The interest rate on the account is zero (institution option DFEX allows this rule to be ignored). •The loan is a contract (purchased) loan (institution option DFEX allows this rule to be ignored). |

|

14 - Add-On Rate with Pro Rata Refund

|

This deferment code charges the daily amount of interest the loan would have collected during deferment based on the original interest rate on the loan (LNORTE). It is calculated as follows: Unpaid Principal Balance times the Original Interest Rate divided by 12.

LNPBAL x LNORTE / 12

|

Note: If Force Place Insurance policies exist on loans that use this deferment code, the system also requires collection of one month's premium amount for the insurance policy.

|

The following conditions prevent this deferment code from being allowed on the account:

•The conditions listed in the Warning box at the top of this help page. •The number of deferments calculated exceeds the number of deferments eligible. •Multiple Payment Schedules are in use. •The loan is not a precomputed or signature loan. •The loan has already hit the limit for the number of deferments allowed per year (institution option DFRM) or per lifetime of the loan (DFRL). A year is determined by contractual year. An Override can allow these limits to be ignored. •The first payment has not yet been made on the account (institution option DFEX allows this rule to be ignored). •The loan's Payment Method code has been changed over its lifetime (institution option DFEX allows this rule to be ignored). •The interest rate on the account is zero (institution option DFEX allows this rule to be ignored). •The loan is a contract (purchased) loan (institution option DFEX allows this rule to be ignored). |

|

15 - Signature No Fee

|

This code is a no-fee deferment for signature loans (payment method 16). This code advances the due date, maturity date, paid-to date, and term.

The following conditions prevent this deferment code from being allowed on the account:

•The conditions listed in the Warning box at the top of this help page. •The number of deferments calculated exceeds the number of deferments eligible. •Multiple Payment Schedules are in use. •The loan is not a signature loan. •The loan has already hit the limit for the number of deferments allowed per year (institution option DFRM) or per lifetime of the loan (DFRL). A year is determined by contractual year. An Override can allow these limits to be ignored. •The first payment has not yet been made on the account (institution option DFEX allows this rule to be ignored). •The loan's Payment Method code has been changed over its lifetime (institution option DFEX allows this rule to be ignored). •The loan's payment amount has been modified (institution option DFEX allows this rule to be ignored). •The interest rate on the account is zero (institution option DFEX allows this rule to be ignored). •The loan is a contract (purchased) loan (institution option DFEX allows this rule to be ignored). •Force Place Insurance is in use. •Fewer than three regular payments have been made on the loan. •The loan is more than one payment past due. •The loan is past maturity. |

|

16 - TEBO

|

Description coming soon.

|

17 - New Mexico, Oklahoma, Georgia

|

This deferment code is not currently in use.

|

18 - Alabama

|

This deferment code is not currently in use.

|

19 - Texas

|

This deferment code calculates the amount of precomputed interest due based on the account's Interest Rebate Method using the deferment Effective Date. This deferment code rolls the maturity date if institution option RMTD is enabled.

Example

Deferment Effective Date – 2/14/2018

Calculated Interest Rebate – 250.00

The prior month's interest rebate is calculated by subtracting one month from the deferment effective date:

Deferment Effective Date minus 1 month – 1/14/2018

Calculated Interest Rebate – 285.00

The deferment amount is the difference between the prior month's interest refund and the current month's interest refund:

285.00 - 250.00 = 35.00

The following conditions prevent this deferment code from being allowed on the account:

•The conditions listed in the Warning box at the top of this help page. •The number of deferments calculated exceeds the number of deferments eligible. •Multiple Payment Schedules are in use. •The loan is not a precomputed loan. •The loan has already hit the limit for the number of deferments allowed per year (institution option DFRM) or per lifetime of the loan (DFRL). A year is determined on a rolling basis. An Override can allow these limits to be ignored. •Fewer than three regular payments have been made on the loan. •The loan is past maturity. |

|

20 - Oklahoma

|

This deferment code is calculated as follows: APR (LNAPRO/12) x the amount deferred (the loan payment) x period of deferral (which is the loan term minus the number of installments made).

(LNAPRO / 12) x LNPICN x (LNTERM - LNINNO)

Example

18-month loan. Payments are $100 with six payments made. Customer is in the 7th month of payments. APR is 18%.

(18% / 12) x 100 x 7 = $10.50 deferral charge.

The following conditions prevent this deferment code from being allowed on the account:

•The conditions listed in the Warning box at the top of this help page. •Multiple Payment Schedules are in use. •The loan has already hit the limit for the number of deferments allowed per year (institution option DFRM). A year is determined on a rolling basis. An Override can allow this limit to be ignored. •The loan is more than one payment past due. •The Face Amount of the loan is less than $2500. |

|

21 - South Carolina

|

This deferment code is not currently in use.

|

22 - Tennessee

|

This deferment code is not currently in use.

|

23 - Georgia

|

This deferment code is not currently in use.

|

24 - NM, So. Carolina, Texas

|

This deferment code is not currently in use.

|

25 - NC, AL, NM, TX

|

This deferment code is not currently in use.

|

26 - Balboa

|

This deferment code calculated the deferment amount as one percent (truncated, not rounded) of the account’s current principal balance. See tran code 2600-50 in the Transactions manual for more information.

The following conditions prevent this deferment code from being allowed on the account:

•The conditions listed in the Warning box at the top of this help page. •The number of deferments calculated exceeds the number of deferments eligible. •Multiple Payment Schedules are in use. •The loan is not a precomputed or interest-bearing loan. •The loan has already hit the limit for the number of deferments allowed per year (institution option DFRM) or per lifetime of the loan (DFRL).* A year is determined by contractual year. •The first payment has not yet been made on the account (institution option DFEX allows this rule to be ignored). •The loan's Payment Method code has been changed over its lifetime (institution option DFEX allows this rule to be ignored). •The loan's payment amount has been modified (institution option DFEX allows this rule to be ignored). •The interest rate on the account is zero (institution option DFEX allows this rule to be ignored). •The loan is a contract (purchased) loan (institution option DFEX allows this rule to be ignored). •Force Place Insurance is in use. •The loan is more than one payment past due.* •Fewer than 9 regular payments have been made on the account.* •Fewer than 9 regular payments have been made since the last deferment.* •Institution 328 Only: Fewer than 9 regular payments have been made since Action Code 230 or 231 was set on the account.* •The Face Amount of the loan is less than $2500.*

* These restrictions can be ignored if the deferment is designated as a Holiday deferment or an Override. Only one holiday deferment is allowed per calendar year, and only in November or December.

|

|

27 - Tennessee

|

This deferment code does not collect late charges. One deferment is allowed in a 12-month period, and two deferments are allowed in a 60-month period (a year is determined on a rolling basis, with day one of the year being the effective date of the first deferment). This deferment code is calculated as follows: [(Current payment amount – (the institution’s maintenance fee / the account’s original term)) x (remaining term) x (interest rate / 12)].

(LNPICN – (OTMNTA/LNTRMO)) x RTERM x (LNRATE/12)

For interest-bearing (payment method 6) loans, the deferment amount will simply be equal to the accrued interest on the account.

For real estate loans, the deferment amount will be the smallest of the following amounts:

•The result of the above calculation •The accrued interest (on interest-bearing accounts) •30% of the account’s original P/I

The following conditions prevent this deferment code from being allowed on the account:

•The conditions listed in the Warning box at the top of this help page. •Multiple Payment Schedules are in use. •Fewer than three regular payments have been made on the loan. •The loan is past maturity. •The loan uses Reserves. |

|

28 - North Carolina

|

This deferment code was designed to run with the Fee Reg Deferment transaction (tran code 2600-50). If you run the Deferment Inquiry (tran code 2270-01) first, it will automatically bring up transaction code 2600-50. This deferment code can also be run manually with other deferment transactions. Contact your institution's GOLDPoint Systems account manager to request any transaction changes.

•If this code is set and the account’s next P/I payment is zero, the system will set the deferment amount as [(Remaining term + 1) x (the current payment amount) x 1.5%].

•If this code is set and the account’s next P/I payment is anything other than zero, the system will set the deferment amount as the total of all remaining payments multiplied by 1.5%. The remaining term is calculated using the current maturity date.

This deferment code will waive the late fee for the deferred payment unless all or part of the late fee has already been paid. In that case, the lesser of the late fee amount or the balance of Late Charges Due (LNLATE) will be waived instead.

This deferment code is allowed for delinquent accounts and accounts with a future Due Date. Late fees will be waived back to the Due Date being deferred.

The following conditions prevent this deferment code from being allowed on the account:

•The conditions listed in the Warning box at the top of this help page. •The number of deferments calculated exceeds the number of deferments eligible. •Multiple Payment Schedules are in use. •The loan is not a precomputed, interest-bearing, or signature loan. •The loan has already hit the limit for the number of deferments allowed per year (institution option DFRM) or per lifetime of the loan (DFRL). This rule follows a calendar year. An Override deferment can allow these limits to be ignored. •Fewer than four regular payments have been made on the loan. •Fewer than three months have passed since the last deferment (if the loan frequency is monthly). •The loan is past maturity. |

|

29 - Lesser of Interest or 1/2 Payment

|

The deferment amount is equal to either the Accrued Interest on the account or one-half of the account’s P/I Constant, whichever is smaller.

The following conditions prevent this deferment code from being allowed on the account:

•The conditions listed in the Warning box at the top of this help page. •The number of deferments calculated exceeds the number of deferments eligible. •Multiple Payment Schedules are in use. •The loan is not an interest-bearing or signature loan. •The loan has already hit the limit for the number of deferments allowed per year (institution option DFRM) or per lifetime of the loan (DFRL). A year is determined on a rolling basis. An Override deferment can allow these limits to be ignored. •The first payment has not yet been made on the account (institution option DFEX allows this rule to be ignored). •The loan's Payment Method code has been changed over its lifetime (institution option DFEX allows this rule to be ignored). •The loan's payment amount has been modified (institution option DFEX allows this rule to be ignored). •The interest rate on the account is zero (institution option DFEX allows this rule to be ignored). •The loan is a contract (purchased) loan (institution option DFEX allows this rule to be ignored). •The account’s General Category is set to code 80 or higher. These codes are additional designations for repossession and charge-off (in addition to the codes specified in the Warning box at the top of this help page). •The loan has been open for less than 90 days. •The Due Date is over 30 days ago or after the last day of the current month. •The loan is past maturity. •This deferment code has already been used 3 times over the lifetime of the loan. |

|

30 - Tennessee Citizen

|

This code calculates similarly to code 27 above, but with a few extra restrictions (see Exceptions below). Deferment refunds for this code (performed on a 360 basis) operate as follows: Refunds are calculated on the Due Date (D0DUDT) prior to the running of the deferral up to the value in the current maturity (LNMATD). This calculation is performed for every deferment charged on a loan. The refund for the new method should be based on the Deferred Due Date (D0DUDT) through the new maturity date at the time of deferment (D0MATD + 1 frequency).

Example

Field

|

Description

|

D0DUDT

|

7/9/2016

|

D0DUNX

|

8/9/2016

|

Payoff Date

|

7/15/2016

|

D0MATD

|

8/4/2017

|

New Maturity Date

|

9/4/2017

|

D0DFAM

|

33.44

|

Elapsed Days

|

6

|

Total Days Deferred

|

415

|

Earned Factor

|

0.01445783

|

Earned Factor Calc

|

0.48346988

|

Refund

|

32.96

|

Elapsed Days (Excel Calc = Days360(Deferred Due Date(D0DUDT),Payoff Date)) = 6 Days

Total days Deferred (Excel Calc = Days360(Deferred Due Date(D0DUDT),Deferred Maturity Date (D0MATD) + 1 Freq)) = 415 Days

Earned Factor (Elapsed Days/Total Days Deferred) = .014457831

|

Note: If earned factor is greater than or equal to 1, there is no rebate.

|

Earned Factor Calculation (Earned Factor * Deferment Amount (D0DFAM) = 32.96

The following conditions prevent this deferment code from being allowed on the account:

•The conditions listed in the Warning box at the top of this help page. •The number of deferments calculated exceeds the number of deferments eligible. •Multiple Payment Schedules are in use. •The loan is not a precomputed, interest-bearing, or signature loan. •The loan has already hit the limit for the number of deferments allowed per year (institution option DFRM) or per lifetime of the loan (DFRL). A year is determined on a rolling basis. An Override deferment can allow these limits to be ignored. •The first payment has not yet been made on the account (institution option DFEX allows this rule to be ignored). •The loan's Payment Method code has been changed over its lifetime (institution option DFEX allows this rule to be ignored). •The loan's payment amount has been modified (institution option DFEX allows this rule to be ignored). •The interest rate on the account is zero (institution option DFEX allows this rule to be ignored). •The loan is a contract (purchased) loan (institution option DFEX allows this rule to be ignored). This restriction does not apply to institution 354. |

|

31 - Default/Ext Chrg

|

This code functions identically to code 13 above with a couple extra restrictions (see below). This code will appear in system history as "Default/Extension."

The following conditions prevent this deferment code from being allowed on the account:

•The conditions listed in the Warning box at the top of this help page. •The number of deferments calculated exceeds the number of deferments eligible. •Multiple Payment Schedules are in use. •The loan is not a precomputed, interest-bearing, or signature loan. •The loan has already hit the limit for the number of deferments allowed per year (institution option DFRM) or per lifetime of the loan (DFRL). A year is determined by contractual year. An Override deferment can allow these limits to be ignored. •The first payment has not yet been made on the account (institution option DFEX allows this rule to be ignored). •The loan's Payment Method code has been changed over its lifetime (institution option DFEX allows this rule to be ignored). •The loan's payment amount has been modified (institution option DFEX allows this rule to be ignored). •The interest rate on the account is zero (institution option DFEX allows this rule to be ignored). •The loan is a contract (purchased) loan (institution option DFEX allows this rule to be ignored). •Force Place Insurance is in use. •The account is not at least 10 days delinquent. |

|

32 - Interest-only Deferment

|

This deferment code was designed to run with the Deferment transaction 2600-13. It will post all deferment charges as interest. If you run the Deferment Inquiry (tran code 2270-01) first, it will automatically bring up tran code 2600-13. (Note: GOLDPoint Systems programmers can chain any Deferment transaction to follow the Deferment Inquiry transaction. Contact your GOLDPoint Systems client solutions specialist to have this set up.) This deferment posts all accrued interest up to the Effective Date entered on the Deferment transaction.

This deferment code can be run on delinquent accounts.

The following conditions prevent this deferment code from being allowed on the account:

•The conditions listed in the Warning box at the top of this help page. •The number of deferments calculated exceeds the number of deferments eligible. •Multiple Payment Schedules are in use. •The loan is not a precomputed or signature loan. •The loan has already hit the limit for the number of deferments allowed per year (institution option DFRM) or per lifetime of the loan (DFRL). This rule follows a calendar year. An Override deferment can allow these limits to be ignored. •Fewer than four regular payments have been made on the loan. •Fewer than three months have passed since the last deferment (if the loan frequency is monthly). •Force Place Insurance is in use. •The loan is past maturity. |

|

33 - California

|

The amount used by this deferment code is simply 1% of the unpaid balance.

The following conditions prevent this deferment code from being allowed on the account:

•The conditions listed in the Warning box at the top of this help page. •The number of deferments calculated exceeds the number of deferments eligible. •Multiple Payment Schedules are in use. •The loan is not a precomputed, interest-bearing, or signature loan. •The loan has already hit the limit for the number of deferments allowed per year (institution option DFRM) or per lifetime of the loan (DFRL). A year is determined by contractual year. An Override deferment can allow these limits to be ignored. •The first payment has not yet been made on the account (institution option DFEX allows this rule to be ignored). •The loan's Payment Method code has been changed over its lifetime (institution option DFEX allows this rule to be ignored). •The loan's payment amount has been modified (institution option DFEX allows this rule to be ignored). •The interest rate on the account is zero (institution option DFEX allows this rule to be ignored). •The loan is a contract (purchased) loan (institution option DFEX allows this rule to be ignored). •Force Place Insurance is in use. |

|

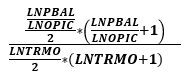

34 - Illinois (2)

|

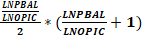

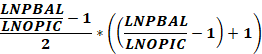

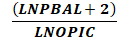

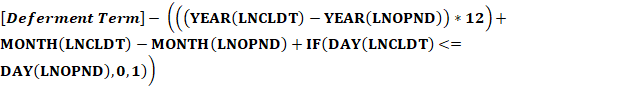

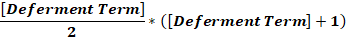

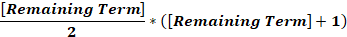

To calculate the deferment amount for this deferment code, certain terms must be defined:

Factor

|

Definition

|

Remaining Term 1:

|

|

Remaining Term 2:

|

|

Original Sum:

|

|

Remaining Sum 1:

|

|

Remaining Sum 2:

|

|

Factor 1:

|

|

Factor 2:

|

|

Factor Difference:

|

[Factor 1] - [Factor 2]

|

Deferment Amount:

|

LN78OI x [Factor Difference] x D0MDEF

|

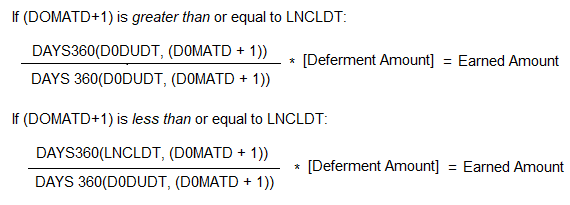

Deferment Days = Number of days between the old Due Date (D0DUDT) and the new Maturity Date (D0MATD +1) based off a 360-day calendar.

DAYS360(D0DUDT, (D0MATD + 1))

Earned Days = Number of days between the old Due Date (D0DUDT) and the Payoff Date (LNCLDT) based off a 360-day calendar.

DAYS360(D0DUDT, LNCLDT)

Earned Amount = Earned days divided by deferment days multiplied by the Deferment Amount (calculated above).

Earned Days / Deferment Days * Deferment Amount

Refund Amount = The Earned Amount subtracted from the Deferment Amount.

Deferment Amount - Earned Amount

Example

Principal Balance (LNPBAL) = $1,000

Original Principal and Interest Payment (LNOPIC) = $100

Loan Term = 12

Original Unearned Interest (LN78OI) = $200

Number of payments deferred (D0MDEF) = 1

Deferment amount would be:

Factor 1 = .7051 (rounds to four digits)

Factor 2 = .2885 (rounds to four digits)

Factor Difference = .4166

Deferment Amount = $200 * .4166 * 1 = $83.32

Payoff Refunds

If the loan is paid off during the deferment, the customer may get some of the deferment amount back. The amount refunded back to the borrower is calculated as follows:

|

Tip: The system will calculate all this for you. However, if you wanted to manually test to see if what the system calculated matches what you calculate, a quick and easy way to figure out the Deferment Days is to use the Day Different Calculator found under the Miscellaneous system in CIM GOLD. Select the Use 360-Day Base radio button, enter the old Due Date (D0DUDT) in the Start Date field and the new Maturity Date (D0MATD + 1) in the End Date field, then the system will display the Number of Days. You can use that number in this calculation.

|

Example

Deferment Amount = $83.32

Old due date (D0DUDT) = 11-01-2017

New maturity date is (D0MATD +1) = 02-01-2018

Payoff Date = 11-27-2017

Refund Amount =

26 / 90 * 83.32 = 24.0702

83.32 - 24.0702 = $59.25

The following conditions prevent this deferment code from being allowed on the account:

•The conditions listed in the Warning box at the top of this help page. •The number of deferments calculated exceeds the number of deferments eligible. •Multiple Payment Schedules are in use. •The loan is not a precomputed, interest-bearing, or signature loan. •The loan has already hit the limit for the number of deferments allowed per year (institution option DFRM) or per lifetime of the loan (DFRL). A year is determined on a rolling basis. An Override deferment can allow these limits to be ignored. •The first payment has not yet been made on the account (institution option DFEX allows this rule to be ignored). •The loan's Payment Method code has been changed over its lifetime (institution option DFEX allows this rule to be ignored). •The loan's payment amount has been modified (institution option DFEX allows this rule to be ignored). •The interest rate on the account is zero (institution option DFEX allows this rule to be ignored). •The loan is a contract (purchased) loan (institution option DFEX allows this rule to be ignored). This restriction does not apply to institution 354. •Force Place Insurance is in use. |

|

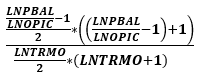

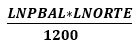

35 - Indiana (2)

|

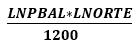

This deferment code calculates the deferment amount as follows: Multiply the Principal Balance (LNPBAL) at the time of the deferment by the Original Interest Rate (LNORTE), and divide that figure by 1200.

Deferment Days: The number of days between the old due date (D0DUDT) and the new maturity date (D0MATD +1) based off a 360-day calendar (rolling, except for Institution 354 which uses anniversary).

DAYS360(D0DUDT,(D0MATD+1))

Earned Days: This number varies according to whether or not the new maturity date is is less than the payoff date.

•If the new maturity date (D0MATD + 1) is less than or equal to the payoff date (LNCLDT), the system uses the number of days different between the old due date and the new maturity date, based on a 360-day calendar.

•If the new maturity date (D0MATD +1) is more than or equal to the payoff date (LNCLDT), the system uses the number of days different between the payoff date and the new maturity date, based on a 360-day calendar.

If (D0MATD+1) ≤ LNCLDT (payoff date):

Then use DAYS360(D0DUDT,(D0MATD+1))

Else use DAYS360(LNCLDT,(D0MATD+1))

Earned Amount

Divide the number of Earned Days by the number of Deferment Days and multiply that figure by the Deferment Amount.

Refund Amount: Deferment Amount - Earned Amount

Example

Principal Balance (LNPBAL) = $750

Original Interest Rate (LNORTE) = 18.99

Deferment Amount = 750 * 18.99 / 1200 = $11.87

Payoff Refunds

If the loan is paid off during the deferment, the customer may get some of the deferment amount back. The amount refunded back to the borrower is calculated as follows:

|

Tip: The system will calculate all this for you. However, if you wanted to manually test to see if what the system calculated matches what you calculate, a quick and easy way to figure out the days different is to use the Day Different Calculator found under the Miscellaneous system in CIM GOLD. Select the Use 360-Day Base radio button, enter the old due date (D0DUDT) in the Start Date field and the new maturity date (D0MATD + 1) in the End Date field, then the system will display the Number of Days. You can use that number in this calculation.

|

Example 1

Old Due Date = 11-01-2017

New Maturity Date = 02-01-2018

Payoff Date = 12-11-2017

Deferment Days = 90

Earned Days = 90

Earned Amount = 1 * 11.87 = 11.87

Refund Amount = 0

Example 2

Old Due Date = 11-01-2017

New Maturity Date = 02-01-2018

Payoff Date = 12-11-2018

Deferment Days = 90

Earned Days = 50

Earned Amount = 6.59

Refund Amount = 5.28

The following conditions prevent this deferment code from being allowed on the account:

•The conditions listed in the Warning box at the top of this help page. •The number of deferments calculated exceeds the number of deferments eligible. •Multiple Payment Schedules are in use. •The loan is not a precomputed, interest-bearing, or signature loan. •The loan has already hit the limit for the number of deferments allowed per year (institution option DFRM) or per lifetime of the loan (DFRL). A year is determined by contractual year for institution 338, and on a rolling basis for all other institutions (day one of the year being the effective date of the first deferment). An Override deferment can allow these limits to be ignored. •The first payment has not yet been made on the account (institution option DFEX allows this rule to be ignored). •The loan's Payment Method code has been changed over its lifetime (institution option DFEX allows this rule to be ignored). •The loan's payment amount has been modified (institution option DFEX allows this rule to be ignored). •The interest rate on the account is zero (institution option DFEX allows this rule to be ignored). •The loan is a contract (purchased) loan (institution option DFEX allows this rule to be ignored). This restriction does not apply to institution 354. •Force Place Insurance is in use. |

|

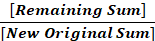

36 - Missouri (2)

|

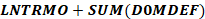

This deferment code is calculated by subtracting the extension interest (OTXINT) from the original interest (LN78OI) and then dividing by the original sum. That value is then multiplied by the remaining term to determine the deferment amount.

If running multiple deferments, multiply the deferment amount by the number of deferments (D0MDEF) and round to 2 decimal places.

Remaining Term:

Original Sum:

Deferment Term:

Remaining Term:

New Original Sum:

Remaining Sum:

Refund Factor:

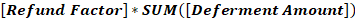

Refund Amount:

|

37 - Louisiana

|

This deferment code uses the lesser of two calculations:

•Unpaid balance (LNPBAL) x (Original Balance (LNORTE) / 12)

•PI Constant (LNPICN) / 2

|

Note: Insurance premiums are not included when calculating the deferment amount. The maximum amount to charge for the deferment will not be more than half of the regular payment amount, and the deferment amount is non-refundable, even if the account is paid off during the deferment.

|

The State of Louisiana allows for 2 deferments per 12-month period and 4 deferments over the life of the loan.

The following conditions prevent this deferment code from being allowed on the account:

•The conditions listed in the Warning box at the top of this help page. •The number of deferments calculated exceeds the number of deferments eligible. •Multiple Payment Schedules are in use. •The loan is not a precomputed loan. •The loan has already hit the limit for the number of deferments allowed per year (institution option DFRM) or per lifetime of the loan (DFRL). A year is determined on a rolling basis. An Override deferment can allow these limits to be ignored. •The first payment has not yet been made on the account (institution option DFEX allows this rule to be ignored). •The loan's Payment Method code has been changed over its lifetime (institution option DFEX allows this rule to be ignored). •Fewer than three regular payments have been made on the loan. •The loan's payment amount has been modified (institution option DFEX allows this rule to be ignored). •The interest rate on the account is zero (institution option DFEX allows this rule to be ignored). •The loan is a contract (purchased) loan (institution option DFEX allows this rule to be ignored). •Force Place Insurance is in use. •The loan is past maturity. |

|

38 - Louisiana Quarter

|

This deferment code uses the lesser of two calculations:

•Unpaid balance (LNPBAL) x (Original Balance (LNORTE) / 12)

•PI Constant (LNPICN) / 4

|

Note: Insurance premiums are not included when calculating the deferment amount. The maximum amount to charge for the deferment will not be more than one-fourth of the regular payment amount, and the deferment amount is non-refundable, even if the account is paid off during the deferment.

|

The State of Louisiana allows for two deferments per 12-month period and four deferments over the life of the loan.

The following conditions prevent this deferment code from being allowed on the account:

•The conditions listed in the Warning box at the top of this help page. •The number of deferments calculated exceeds the number of deferments eligible. •Multiple Payment Schedules are in use. •The loan is not a precomputed loan. •The loan has already hit the limit for the number of deferments allowed per year (institution option DFRM) or per lifetime of the loan (DFRL). A year is determined on a rolling basis. An Override deferment can allow these limits to be ignored. •The first payment has not yet been made on the account (institution option DFEX allows this rule to be ignored). •The loan's Payment Method code has been changed over its lifetime (institution option DFEX allows this rule to be ignored). •The loan's payment amount has been modified (institution option DFEX allows this rule to be ignored). •The interest rate on the account is zero (institution option DFEX allows this rule to be ignored). •The loan is a contract (purchased) loan (institution option DFEX allows this rule to be ignored). •Force Place Insurance is in use. •Fewer than three regular payments have been made on the loan. •The loan is past maturity. |

|

39 - Louisiana Net

|

This deferment code is calculated as follows:

[Principal Balance (LNPBAL) – Interest Rebate] x [Original Rate (LNORTE) / 12]

The Interest Rebate used in this calculation can be determined for a given customer account by viewing that account’s Payoff Quote. The State of Louisiana allows for 2 deferments per 12-month period and 4 deferments over the life of the loan.

The following conditions prevent this deferment code from being allowed on the account:

•The conditions listed in the Warning box at the top of this help page. •The number of deferments calculated exceeds the number of deferments eligible. •Multiple Payment Schedules are in use. •The loan is not a precomputed loan. •The loan has already hit the limit for the number of deferments allowed per year (institution option DFRM) or per lifetime of the loan (DFRL). A year is determined on a rolling basis. An Override deferment can allow these limits to be ignored. •The first payment has not yet been made on the account (institution option DFEX allows this rule to be ignored). •The loan's Payment Method code has been changed over its lifetime (institution option DFEX allows this rule to be ignored). •The loan's payment amount has been modified (institution option DFEX allows this rule to be ignored). •The interest rate on the account is zero (institution option DFEX allows this rule to be ignored). •The loan is a contract (purchased) loan (institution option DFEX allows this rule to be ignored). •Force Place Insurance is in use. •Fewer than four regular payments have been made on the loan. |

|

40 - Daily Per Diem

|

This deferment code uses the current daily per diem and multiplies it against the number of days in the month of the Due Date to determine the deferment charge.

•If the calculated amount of the deferment amount is greater than the Interest Accrued to Today, collect the accrued interest due and apply the remaining amount to the principal.

•If the calculated amount is less than the Interest Accrued to Today, apply the deferment charge against the accrued interest. Any accrued interest not collected will update Accrued Interest (LNACIN) with the remaining accrued interest with the Date Last Accrued updated to today (the day the Deferment transaction was processed).

The calculation that displays in CIM GOLD works as follows:

Calculated Deferment Amount

•If Month(LNDUDT) = 1,3,5,7,8,10,12, then current daily per diem * 31 •If Month(LNDUDT) = 2 and the Due Date is not in a leap year, then current daily per diem * 28 •If Month(LNDUDT) = 2 and the Due Date is in a leap year, then current daily per diem * 29 •If Month(LNDUDT) = 4,6,9,11, then current daily per diem * 30

The transaction will post as follows:

If Calculated Deferment Amount is greater than Accrued Interest to Today, then collect Accrued Interest and apply the difference between Calculated Deferment Amount and Accrued Interest to Today as Principal.

If Calculated Deferment Amount less than or equal to Accrued Interest to Today, then collect Accrued Interest up to the amount of the Calculated Deferment Amount.

Example

Transaction Date = 6/14/2018

Current Due Date (LNDUDT) = 3/15/2018

Daily Per Diem (calculated) = 2.50

Accrued Interest to Today (calculated) = 70.61

1.Calculated Deferment Amount

Month (3/15/2018) = 3; March has 31 days

31 * 2.50 (daily per diem) = 77.50

2.Posting Deferment Amount

Calculated Deferment Amount > Accrued Interest to Today (77.50 > 70.61)

Deferment Interest = 70.61

Deferment Principal = 6.89 (77.50 – 70.61)

New Accrued Interest (LNACIN) = 0

New Date Last Accrued (LNDLAC) = 6/14/2018

If the daily per diem was 2.00 in the example above, here would be the results:

1.Calculated Deferment Amount

Month (3/15/2018) = 3; March has 31 days 31 * 2.00 (daily per diem) = 62.00

2.Posting Deferment Amount

Calculated Deferment Amount <= Accrued Interest to Today (62.00 <= 70.61)

Deferment Interest = 62.00

Deferment Principal = 0.00

New Accrued Interest (LNACIN) = 8.61 (70.61 – 62.00)

New Date Last Accrued (LNDLAC) = 6/14/2018

Institution Options

The following institution options pertain to this code:

•CLDF (Calculate Deferment Fields in Loan Work Fields). This option must be enabled at your institution in order to use this code. •RMTD (Roll Maturity Date on Deferment). This option must be enabled at your institution in order to use this code. •STRN (Allow Special Transactions with SOV Set)

The following conditions prevent this deferment code from being allowed on the account:

•The loan is a precomputed loan. •Fewer than six regular payments have been made on the loan. •The account’s General Category is set to code 80 or higher. These codes are additional designations for repossession and charge-off (in addition to the codes specified in the Warning box at the top of this help page). •The account is Charged Off (Hold Code 2) •The interest rate on the account is zero (institution option DFEX allows this rule to be ignored). •The due date is more than 60 days ago. •The loan is past maturity. |

|

41 - Ohio

|

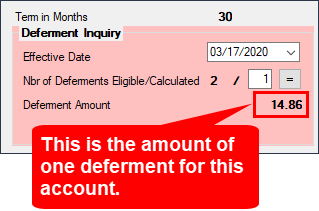

This deferment code is similar to code 19 above, except it prorates the deferment refund amount between the deferment Effective Date (D0DTEF) and the Deferment Next Due Date (D0DUNX). It calculates the amount of precomputed interest due based on the accounts’ Interest Rebate Method using the deferment Effective Date.

Example

Deferment Effective Date – 2/14/2018

Calculated Interest Rebate – 250.00

The prior month's interest rebate is calculated by subtracting one month from the deferment effective date:

Deferment Effective Date minus 1 month – 1/14/2018

Calculated Interest Rebate – 285.00

The deferment amount is the difference between the prior month's interest refund and the current month’s interest refund:

285.00 - 250.00 = 35.00

Rebate of Deferment Charge on Payoff

If the loan is paid off during the deferment date, the system will refund a calculated amount of the deferment charge. To calculate the refund, the system determines the number of eligible days by calculating the number of days between the Deferment Effective Date (D0DTEF) and Deferment Next Due Date (D0DUNX). The number of days calculated is based on the loan interest basis calculation code (LNIBAS). For example, if LNIBAS is 101 (365/365), then the number of days will be calculated on a 365 basis. If LNIBAS is 102 (360/360), then the number of days will be calculated on a 360 basis.

The system then calculates the number of days remaining between the effective payoff date and Next Due Date (D0DUNX) of the deferment using the same interest basis as the eligible days. Note: If the Payoff Date is equal to or greater than the Next Due Date, there is no refund.

The system then divides the remaining days into the eligible days to get the refund percentage. Then the refund percentage is multiplied by the deferment amount to calculate the refund back to the customer at payoff.

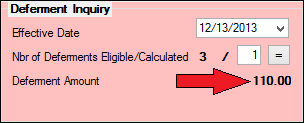

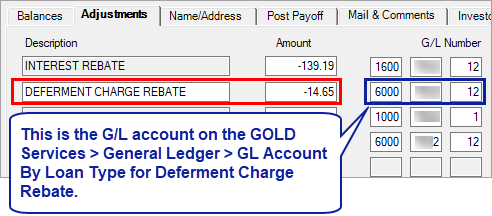

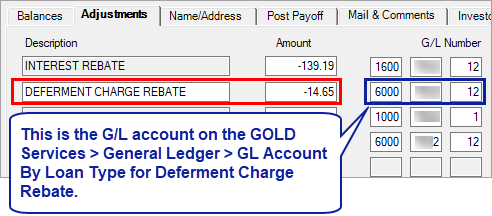

The refunded amount will show on the Adjustments tab of the Loans > Payoff screen as DEFERMENT CHARGE REBATE (see below):

Loans > Payoff Screen > Adjustments Tab

The calculation works as illustrated in the following example:

Interest Calculation Method (LNIBAS) – 101 (365/365)

Deferment Effective Date (D0DTEF) – 2/14/2018

Deferment Next Due Date (D0DUNX) – 3/14/2018

Deferment Amount – 35.00

Payoff Effective Date – 3/02/2018

Eligible Days

3/14/2018 – 2/14/2018 = 28

Remaining Days

3/14/2018 – 3/02/2018 = 12

Refund Percentage

12 / 28 = 42.86%

Refund Amount

42.86% * 35.00 = 15.00

Institution option RMTD (Roll Maturity Date on Deferment) affects this code.

The following conditions prevent this deferment code from being allowed on the account:

•The conditions listed in the Warning box at the top of this help page. •The number of deferments calculated exceeds the number of deferments eligible. •Multiple Payment Schedules are in use. •The loan is not a precomputed, interest-bearing, or signature loan. •The loan has already hit the limit for the number of deferments allowed per year (institution option DFRM) or per lifetime of the loan (DFRL). A year is determined on a rolling basis. An Override deferment can allow these limits to be ignored. •The first payment has not yet been made on the account (institution option DFEX allows this rule to be ignored). •The loan's Payment Method code has been changed over its lifetime (institution option DFEX allows this rule to be ignored). •The loan's payment amount has been modified (institution option DFEX allows this rule to be ignored). •The interest rate on the account is zero (institution option DFEX allows this rule to be ignored). •The loan is a contract (purchased) loan (institution option DFEX allows this rule to be ignored). •The account is frozen (Hold Code 60). •Action Code 23 and 53 are in place on the account (locked for payoff or reversal/reapply). •Force Place Insurance is in use. |

|

42 - Kentucky (2)

|

This deferment code is calculated as follows: Unpaid balance (LNPBAL) times 24% divided by 12. This code functions similarly to code 2 above, with a few extra restrictions (see below).

(LNPBAL X .24 / 12)

The following conditions prevent this deferment code from being allowed on the account:

•The conditions listed in the Warning box at the top of this help page. •The number of deferments calculated exceeds the number of deferments eligible. •Multiple Payment Schedules are in use. •The loan is not a precomputed, interest-bearing, or signature loan. •The loan has already hit the limit for the number of deferments allowed per year (institution option DFRM) or per lifetime of the loan (DFRL). A year is determined on a rolling basis. An Override deferment can allow these limits to be ignored. •The first payment has not yet been made on the account (institution option DFEX allows this rule to be ignored). •The loan's Payment Method code has been changed over its lifetime (institution option DFEX allows this rule to be ignored). •The loan's payment amount has been modified (institution option DFEX allows this rule to be ignored). •The interest rate on the account is zero (institution option DFEX allows this rule to be ignored). •The loan is a contract (purchased) loan (institution option DFEX allows this rule to be ignored). •Force Place Insurance is in use. •Fewer than three regular payments have been made on the loan. |

|

43 - Missouri (3)

|

This deferment code is calculated as follows: The finance charge (LN78OI) minus the extension interest (OTXINT) used in precomputed earnings calculation involving the remaining term of the loan (LNTERM). This code functions similarly to code 3 above, with a few extra restrictions (see below).

((LN78OI - OTXINT) / ((LNTERM / 2) x (LNTERM + 1)))

The following conditions prevent this deferment code from being allowed on the account:

•The conditions listed in the Warning box at the top of this help page. •The number of deferments calculated exceeds the number of deferments eligible. •Multiple Payment Schedules are in use. •The loan is not a precomputed, interest-bearing, or signature loan. •The loan has already hit the limit for the number of deferments allowed per year (institution option DFRM) or per lifetime of the loan (DFRL). A year is determined on a rolling basis. An Override deferment can allow these limits to be ignored. •The first payment has not yet been made on the account (institution option DFEX allows this rule to be ignored). •The loan's Payment Method code has been changed over its lifetime (institution option DFEX allows this rule to be ignored). •The loan's payment amount has been modified (institution option DFEX allows this rule to be ignored). •The interest rate on the account is zero (institution option DFEX allows this rule to be ignored). •The loan is a contract (purchased) loan (institution option DFEX allows this rule to be ignored). •Force Place Insurance is in use. •Fewer than three regular payments have been made on the loan. |

|

44 - Indiana (3)

|

This deferment code is calculated as follows: Multiply the Principal Balance (LNPBAL) at the time of the deferment by the Original Interest Rate (LNORTE), and divide that figure by 1200. This code functions similarly to code 35 above, with a few extra restrictions (see below).

This deferment also rebates a calculated amount of the deferment charge were the account to be paid off during deferment. If the loan is paid off during the deferment, the customer may get some of the deferment amount back. The amount refunded back to the borrower is calculated as follows:

Number of days between the old due date (D0DUDT) and the new maturity date (D0MATD +1) based off a 360-day calendar (rolling, except for Institution 354 which uses anniversary)

DAYS360(D0DUDT(D0MATD+1))

The following conditions prevent this deferment code from being allowed on the account:

•The conditions listed in the Warning box at the top of this help page. •The number of deferments calculated exceeds the number of deferments eligible. •Multiple Payment Schedules are in use. •The loan is not a precomputed, interest-bearing, or signature loan. •The loan has already hit the limit for the number of deferments allowed per year (institution option DFRM) or per lifetime of the loan (DFRL). A year is determined on a rolling basis. An Override deferment can allow these limits to be ignored. •The first payment has not yet been made on the account (institution option DFEX allows this rule to be ignored). •The loan's Payment Method code has been changed over its lifetime (institution option DFEX allows this rule to be ignored). •The loan's payment amount has been modified (institution option DFEX allows this rule to be ignored). •The interest rate on the account is zero (institution option DFEX allows this rule to be ignored). •The loan is a contract (purchased) loan (institution option DFEX allows this rule to be ignored). •Force Place Insurance is in use. •Fewer than three regular payments have been made on the loan. |

|

45 - TideWater

|

Some details of this deferment code are different depending on the Payment Method (LNPMTH) of the account in question. These differences are as follows:

•For interest-bearing loans (payment method 6), there must be a minimum of four regular payments made on the account in order to be eligible for this deferment code.

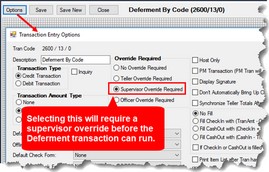

•For line-of-credit loans (payment method 5), there must be a minimum of three regular payments made on the account in order to be eligible for this deferment code. Additionally, the account must currently have a Principal Balance (LNPBAL) greater than $300 and the last Payment Due (as of last billing cycle) of at least $75. Tip: If you are a supervisor at an institution and want to override this requirement in certain situations, you will need to use the No Rules Deferment transaction (tran code 2600-17) instead. Additionally, if you want to require that there be supervisor approval anytime this transaction is run, you can set up the Deferment transaction (tran code 2600-13) to include a supervisor override, as shown in Figure 1 below. See the Transaction Entry Options topic in the CIM GOLDTeller User's Guide for information on how to apply a supervisor override.

Rules and restrictions for this deferment include:

•The deferment must bring the account current. An account that is one month past due is eligible for one deferment. An account that is two months past due is eligible for two deferments but must be run with the same effective date (a "double deferment"). Two deferments with the same effective date are the maximum allowed. An account that is more than two payments past due is no longer eligible for a deferment.

Note: The system only allows one deferment to be run at a time. You will need to run two deferment transactions back-to-back with the same Effective Date. Do not attempt to run one Deferment transaction with a Transaction Amount of two deferment amounts. If you attempt to do that, the system will run the one deferment, but the extra amount that you may have assumed would go to the second deferment will go toward paying down the Principal Balance and not to a second deferment amount.

•At least 30 days must have passed since the last deferment.

•At least four months must have passed since the last hardship deferment. Hardship deferments are different from regular deferments in that they usually do not require a fee or charge. They are only available if your institution allows them. See the Deferment topic in the EZPay manual on DocsOnWeb for more information about Hardship deferments.

•No more than two deferments allowed within a 12-month rolling period (not annual period). A rolling period means the most recent deferment date determines when the next deferment is available. For example, if deferments were made on 5/15/20 and 7/15/20 and institution option DFRM is set to "2," another deferment would not be available again until 5/15/21 (not 01/01/2021, which would be annual).

•This deferment advances any applicable Promotion Period Expiration Date (NLEXDT) by one cycle for payment method 5 loans. The date will reverse if this deferment is corrected.

•The charge for this deferment is a flat fee amount entered in Institution Option DFFF. However, if you want to adjust the charge based on the loan type, at origination, conversion, or purchase, make sure the system is set up with the Deferment Flat Fee (MLDFFF) for the amount your institution wants to charge for deferments. MLDFFF is not found on any screen in CIM GOLD, but you can view the deferment amount for each loan on the Loans > Deferments screen, as shown below:

For example, you could have institution option DFFF be set up with "100.00," so if the account did not have MLDFFF set up, the system would charge $100.00 for a deferment. However, you could have other accounts, such as Line-of-Credit loans, where MLDFFF is set to "25.00." In that case, the system would charge $25.00 to run a deferment on those type of loan accounts.

•The Maturity Date rolls to the next month with the number of deferments. •Deferments not allowed if loan has scheduled payments set up on the account (LNPMSC = Yes) (see Payment Schedule tab for payment method 6 or Reage/Payment Schedule tab for payment method 5).

The following conditions prevent this deferment code from being allowed on the account:

•The conditions listed in the Warning box at the top of this help page. •The number of deferments calculated exceeds the number of deferments eligible. •Multiple Payment Schedules are in use. •The loan is not a precomputed, interest-bearing, line-of-credit, or signature loan. •The loan has already hit the limit for the number of deferments allowed per year (institution option DFRM) or per lifetime of the loan (DFRL). An Override deferment can allow these limits to be ignored. •The first payment has not yet been made on the account (institution option DFEX allows this rule to be ignored). •The loan's Payment Method code has been changed over its lifetime (institution option DFEX allows this rule to be ignored). •The loan's payment amount has been modified (institution option DFEX allows this rule to be ignored). •The interest rate on the account is zero (institution option DFEX allows this rule to be ignored). •The loan is a contract (purchased) loan (institution option DFEX allows this rule to be ignored). •Force Place Insurance is in use. •Less than 30 days have passed since the last deferment. •Less than four months have passed since the last Hardship deferment. •If the account is an interest-bearing loan: Fewer than four regular payments have been made on the loan. •If the account is a line-of-credit loan: Fewer than three regular payments have been made on the loan.

|

|

Tip: If you are a supervisor at an institution and want to override these last two requirements in certain situations, you will need to use the No Rules Deferment transaction (tran code 2600-17) instead. Additionally, if you want to require that there be supervisor approval anytime this transaction is run, you can set up the Deferment transaction (tran code 2600-11 or tran code 2600-13) to include a supervisor override, as shown below. See the Transaction Entry Options topic in the CIM GOLDTeller User’s Guide for information on how to apply a supervisor override.

Transaction Entry Options Screen under Functions > Administrator Options > Transaction Design, then click <Options>, in CIM GOLDTeller |

|

|

255

|

Deferments not allowed.

|