Field

|

Description

|

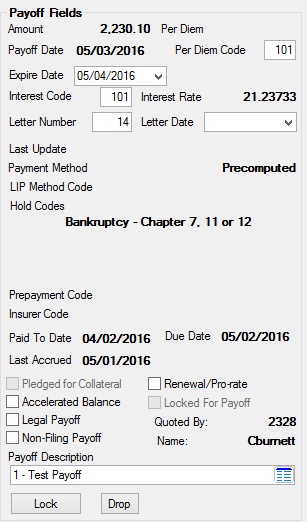

Amount

Mnemonic: POPOFF

|

This field displays the total amount required to pay off the loan, including fees. This amount is calculated using the other fields on the Balances tab and the miscellaneous adjustments specified on the Adjustments tab. An amount greater than or equal to this amount must be entered in either the Cash In or Check In fields on the Post Payoff tab before the payoff transaction can be posted and the loan paid off.

The amount in this field is calculated by the system and is not file maintainable.

Note: The total amount in this field may change if you check or uncheck the Renewal/Pro-rate box. See the definition for that field as to why the amount may change.

|

Payoff Date

Mnemonic: PODATE

|

If the loan is already closed and paid off, this field displays the date the loan was paid off. If the loan account is open, this field defaults to the current date. See below for more information.

This field is updated when the payoff is processed on the Post Payoff tab. A payoff correction code 588 will delete information from this field.

Backdating a Payoff

You can backdate a loan, but it is recommended that a loan only be backdated by six days or less.

To backdate a payoff:

1.Select the backdate from the Effective Payoff Date field and click <Recalc>. The backdated date you selected will appear in this field.

2.Click the <Lock> button. The customer account is now locked for payoff.

3.Access the Post Payoff tab and enter the payoff amount in either the Cash In or Check In fields.

4.Click <Post>. GOLDTeller will launch with the payoff transaction displayed.

5.Change the As of Date on that transaction to the same date you entered in the Effective Payoff Date field.

6.Click <Transmit>. The loan will be paid and closed, and the date in this field will reflect the backdated date. This date also appears on the Loans > Account Information > Account Detail screen. |

Institution Option CLZB automatically closes zero balance payment method 5 loans. At the time the loan is closed, this date is also updated. The close transaction is a file maintenance tran code 22 to field 999 performed in GOLDTeller. The loan will automatically close on the night of the maturity date.

|

|

Per Diem

Mnemonic: PODIEM

|

The value in this field is one day's accrued interest of the Principal Balance plus Deferred Interest (or the LIP Undisbursed Balance if this loan is in process). This field is not valid for precomputed rule of 78.

When the payoff is processed, this value will be added to the payoff Amount for each day after the Payoff Date the payoff actually occurs (see above). The interest calculation method used to this value is specified by the Per Diem Code field below. This field is not file maintainable.

Institution Option POPD allows the amount in this field (and the online payoff letter) to display as three decimals (as opposed to two). Event letters do not use this option.

|

Per Diem Code

Mnemonic: POPDBS

|

This field displays a code number which indicates how the Per Diem value is calculated (see above). See below for a list of possible codes in this field.

Code

|

Description

|

1

|

365/365 days per year, 366 days on leap year

|

2

|

360/360 days per year

|

3

|

365/360 days per year

|

4

|

360/365 days per year

|

5+

|

366/366 days in a leap year

|

101*

|

365/365 days per year, 366 days on leap year

|

102*

|

360/360 days per year

|

103*

|

365/360 days per year

|

104*

|

360/365 days per year

|

105*

|

366/366 days in a leap year

|

+ For a leap year, if the interest period includes two years (such as 12/15/12 to 01/15/13), the period from 12/15/12 (the leap year) to 01/01/13 will use the 366-day basis and the period from 01/01/13 to 01/15/13 will use the 365-day basis.

* This code allows loans to have different due dates or to have interest paid in advance.

|

|

Expire Date

Mnemonic: POEXPD

|

The date in this field has two purposes:

1.It is the date the payoff quote record expires. The system will save the payoff quote record until the afterhours of the date in this field, then the record will automatically be dropped in afterhours processing. This expiration date appears on the Customer Quote.

2.It is the expiration date of the payoff Lock, if the account has been locked. The lock-in will be released after this date.

This date is set up to be the date following the current date the first time a payoff quote record is displayed on the screen.

When the payoff is locked in, the system will place an Action Code 23 and this date will be set as the action date on the Loans > Account Information > Actions, Holds and Event Letters screen. On the night of the expiration date, the system will unmark the ?Locked For Payoff field below and will remove action code 23 and the action date. At this time, the loan payoff will be unlocked and the system will again allow transactions and file maintenance to the loan account.

Institution Option DPON makes the payoff Expire Date the current date. The Expire Date field will no longer be available for file maintenance. This option also makes the system purge all payoff records each night. Note: The system will not drop payoff records with legal holds (Hold Codes 4, 5, 6, 7, 9, 27, or 86).

|

Interest Code

Mnemonic: POIBAS

|

This field displays a code number which indicates how the Accrued Interest value is calculated. Using that code, you can calculate the amount of accrued interest (for interest accruing loans such as payment method 6 and 16), as follows:

See below for a list of possible codes in this field.

Code

|

Description

|

1

|

365/365 days per year, 366 days on leap year

|

2

|

360/360 days per year

|

3

|

365/360 days per year

|

4

|

360/365 days per year

|

5+

|

366/366 days in a leap year

|

101*

|

365/365 days per year, 366 days on leap year

|

102*

|

360/360 days per year

|

103*

|

365/360 days per year

|

104*

|

360/365 days per year

|

105*

|

366/366 days in a leap year

|

+ For a leap year, if the interest period includes two years (such as 12/15/12 to 01/15/13), the period from 12/15/12 (the leap year) to 01/01/13 will use the 366-day basis and the period from 01/01/13 to 01/15/13 will use the 365-day basis.

* This code allows loans to have different due dates or to have interest paid in advance.

|

|

Interest Rate

Mnemonic: LNRATE

|

This field displays the accrual rate used to determine the Per Diem (see above), Accrued Interest, and LIP Accrued Interest values.

|

Letter Number

Mnemonic: POEVNT

|

This field displays a number representing the payoff quote letter that will print during afterhours processing on the Letter Date. A Letter Date (see below) must be indicated before a payoff quote letter will be printed. Letter numbers (and event letters) must be set up by GOLDPoint Systems before they can be used in this field.

This letter is generated through the GOLD EventLetters system. For more information, see the Event 14 Loan Payoff Event section in the GOLD EventLetters manual on DocsOnWeb.

When the customer letter is set up to be printed in the afterhours or printed online, the loan payoff can be Locked so that the customer guarantees the payoff Quote.

Customer letters can also be set up to print during the afterhours processing. They are set up through the GOLD EventLetters system. (See GOLD EventLetters in DocsOnWeb for details.) Once the letter is established in GOLD EventLetters, the letter number and date are entered on this screen.

If a payoff record has not been created and a payoff event letter is requested using this and the Letter Date fields, the letter will not be created and will appear as a reject on the Event Letter Report (FPSRP175).)

|

Letter Date

Mnemonic: POEVDT

|

This field displays the date the customer payoff quote Letter will be printed through the GOLD EventLetters system.

If a payoff record has not been created and a payoff event letter is requested using this and the Letter Number field above, the letter will not be created and will appear as a reject on the Event Letter Report (FPSRP175).)

Institution Option AFLC will calculate one future late charge if enabled. If you set up a payoff quote for a future date and a late charge will be assessed during the time between the current date and the future date, the payoff quote will automatically calculate the Late Charge amount and add it to the payoff amount.

|

Last Update

Mnemonic: POUPDT

|

This field displays the date the payoff record was created or updated.

A payoff record is created any time a field on the Payoff screen is file maintained or the payoff is Locked.

|

Payment Method

Mnemonic: LNPMTH

|

This field displays a code that determines how the system will calculate interest and what rules to follow in processing the customer account payoff. This code is pulled from the Payment Method field on the Account Detail screen. Possible codes in this field are:

Code

|

Description

|

0

|

Conventional loan amortization

|

3

|

Precomputed

|

5

|

Revolving line-of credit

|

6

|

Interest bearing or daily simple interest

|

7

|

Adjustable rate mortgage loan (ARM)

|

16

|

Signature loan

|

You cannot file maintain this field.

|

LIP Method Code

Mnemonic: LNLMTH

|

This field displays a code which determines what interest rate is used to calculate interest and what other rules are followed in processing the payoff on an LIP customer account. In order for an LIP loan to be considered when interest is calculated, this field must contain a number. See below for a list of possible codes in this field.

CODE

|

DESCRIPTION OF LIP METHOD CODES

|

000

|

LIP is no longer in process. All interest is accrued through the regular loan fields. The undisbursed balance is never considered in interest calculations. If LIP disbursements are made, funds will first be disbursed from the customer balance and then from the LIP undisbursed balance. No LIP interest accrual will occur.

|

001

|

The loan is in process. All interest accrual uses the LIP interest rate and interest fields on this screen. Interest is calculated by the LIP Interest Rate field on the Loans > Account Information > Account Detail screen. The formula for calculating this interest is:

(Principal Balance - LIP Customer Balance) x Number of Days / Base x LIP Interest Rate

A principal credit can be made to the loan balance but regular payments (tran 600) with a TOV should be used to make LIP interest payments. However, the interest will continue to accrue using the LIP fields. As disbursements are made from this account, funds will be disbursed first from the customer balance and then from the LIP undisbursed balance.

|

WARNING: If correction tran code 598 is run, the money will be credited to the LIP undisbursed balance and not the customer balance.

|

|

002

|

The loan is both in process and payment. All interest accrual is done using the regular loan interest rate fields on the Account Detail screen. However, all calculations will assume the principal balance to be the loan principal balance on file less the LIP undisbursed balance on file for interest accrual purposes. When LIP disbursements are made, funds will be disbursed first from the customer balance and then the LIP undisbursed balance. You cannot charge the LIP for interest. All interest is billed to the borrower through the loan fields found on the Interest Detail tab of the Account Detail screen. When this code is used, some loan payment methods do not allow for a daily interest accrual. Payment methods 5 (line-of-credit) or 6 (interest bearing) are recommended with this code.

|

100

|

This is the same as 000 except funds are first disbursed from the LIP undisbursed balance until it is reduced to the retention limit, at which time funds will be disbursed from the customer balance.

|

101

|

This is the same as 001 except that funds are first disbursed from the LIP undisbursed balance until it is reduced to the retention limit at which time funds will be disbursed from the customer balance.

|

WARNING: If correction tran code 598 is run, the money will be credited to the LIP undisbursed balance regardless of where the funds were debited from.

|

|

102

|

This is the same as 002 except that funds are first disbursed from the LIP undisbursed balance until it is reduced to the retention limit at which time funds will be disbursed from the customer balance. You cannot charge the LIP for interest.

|

|

Hold Codes

Mnemonic: LNHLD1

|

This field indicates whether the customer account has any active hold codes.

Holds can be placed on an account for various reasons including bankruptcy, foreclosure, refinancing, etc. For a list of available hold codes, see Actions, Holds and Event Letters.

|

Note: The system will not drop payoff records with legal holds (Hold Codes 4, 5, 6, 7, 9, 27, or 86).

|

|

Prepayment Code

Mnemonic: LNPPEN

|

This field displays a code indicating the prepayment penalty (if any) for the customer loan account (as entered on the Prepayment Penalty tab on the Account Detail screen). See Prepayment Codes for more information.

|

Insurer Code

Mnemonic: LNINSU

|

This field displays a code indicating the insurer of the loan account. This information is pulled from the Loans > Account Information > Additional Loan Fields screen. Possible codes in this field are:

| CODE | DESCRIPTION OF INSURER CODE |

| 03 | Other federally-insured or guaranteed loans |

|

Paid To Date

Mnemonic: LNPDTO

|

This field displays the date up to which interest has been paid on the customer loan account. It is recalculated with each payment.

|

Due Date

Mnemonic: LNDUDT

|

This field displays the due date of the next regular loan payment.

|

Last Accrued

Mnemonic: LNDLAC

|

This field displays the date of the last interest accrual (for most loan types).

|

Pledged for Collateral

Mnemonic: LNPLCL

|

This field indicates whether the customer loan account is pledged to FHLB for collateral.

|

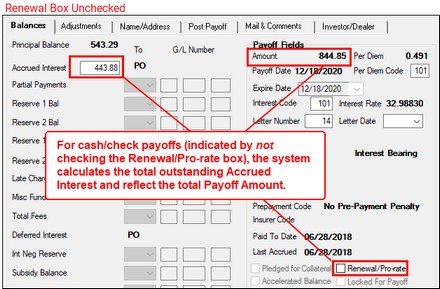

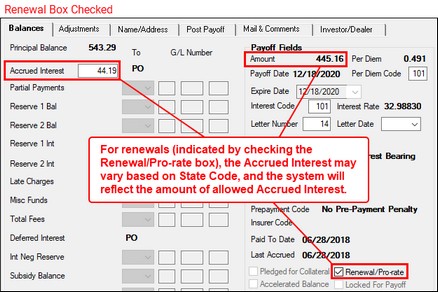

Renewal/Pro-rate

Mnemonic: PORNWL

|

Checking this box indicates the payoff is for a renewal. In other words, the borrower is opening a new loan, while paying off this current loan. Certain states have pro-rated interest requirements for renewal loans. The use of this field varies depending on what type of loan this is.

This field indicates whether precomputed interest will be rebated to the customer for the remainder of the month (multiplying the Per Diem by the number of days remaining in the month) when the loan is paid off.

•If Institution Option CPRP is enabled and this field is marked, all Prepayment penalties will be cleared from the payoff. If Institution Option OP15 IRFP is set and this field is marked, the system will calculate the interest rebate on precomputed accounts the same as it would for a cash payoff. This field will be ignored.

•If the Use Anniversary of 1st Due Date field on the Loans > Account Information > Precomputed Loans screen is marked, the amortization of the unearned interest and the payoff refund is calculated as follows:

•If this field is marked, the interest is pro-rated based on the actual number of days during the period from the date opened to the first due date. After the first due date, the number of days is based on a 30-day month.

•If Institution Option RDPM is enabled and this field is marked, the system will look at the Rebate Rule Days field on the Precomputed Loans screen when calculating an interest rebate. If the loan is paid off before the first due date, the system uses the opened date plus the Rebate Rule Days to determine the date to start refunding. After the first due date, the Rebate Rule Days are added to the day the loan opened or is first due.

|

Note: For institutions 364 and 366, if the precomputed loan account has the Interest Rebate Method on the Precomputed Loans screen equal to 0 or 3 (precomputed loans only), this field will not allow the system to prorate interest even if marked.

|

Also see Per State Renewal Regulations for further details of certain state regulations that may affect waiving of late charges or miscellaneous fees.

|

Some states only allow a certain amount of accrued interest when paying off a loan for the purposes of a new loan (renewal loans). For example, if the account is more than 120 days delinquent, and your institution allows the borrower to open a renewal loan to help clear off and start fresh, your institution may only be allowed to collect 90-days of accrued interest from the delinquent loan at payoff, even though the loan owes more than 90 days of accrued interest.

If the loan you are paying off for a renewal was originated in the state that puts restrictions on accrued interest, the system will automatically calculate the accrued interest allowed and display it in the Accrued Interest field on the Payoff screen.

For example, the following loan was originated in Virginia, one of the states that puts restrictions on accrued interest on renewals. This loan owes more than 90 days of accrued interest. When the user checks the Renew/Pro-rate box, the system recalculates the Accrued Interest and Payoff Amount based on only 90 days of accrued interest. See examples below.

|

Note: For per-state renewal requirements, see Per State Renewal Regulations.

The system bases the state where the loan was originated on the State Code field (LTSTCD), which can be found on the Loans > Statistics & Summary > Tax & Statistics screen.

|

Click to expand.

Click to expand. |

|

Accelerated Balance

Mnemonic: POACBL

|

This field indicates whether the system uses an accelerated rate of calculation to compute any precomputed interest due back to the customer at the time the payoff transaction is processed. This field is only used for precomputed loans (payment method 3). See below for more information.

When marked, this field will change the precomputed interest refund from a normal calculation (such as Rule of 78 or Actuarial) to the following:

Original Interest divided by Original Term times Remaining Term (calculated).

The Remaining Term is computed using fields on the Loans > Account Information > Precomputed Loans screen. The system looks at the Rebate Rule Days and whether the Use Anniversary of 1st Due Date field or the Use Anniversary of Date Opened field is marked. If the Use Anniversary of 1st Due Date field is marked, the system calculates the rebate according to the following rules:

1.The first period for amortization is the period between the Date Opened and the First Due Date.

2.For the following months, each period is calculated from Due Date to Due Date.

3.The Rebate Rule Days field is also used. For instance, if the Due Date is the 5th of a specified month and the Rebate Rule Days field is set to 15, then at payoff the system compares the Due Date day to the Payoff Date on this screen. If the remainder (number of days) is within the Rebate Rule Days (15 or less), the system will not take any interest for the payoff month. If the number of days is 16 or more, interest is earned for the whole month.

4.If the Renewal/Pro-Rate field above is marked, the interest is pro-rated based on the actual number of days during the period from the Date Opened to the First Due Date. After the First Due Date, the number of days is based on a 30-day month.

If the Rebate Rule Days field is zero or blank and the Use Anniversary of Date Opened field is marked instead of the Use Anniversary of 1st Due Date field, then the remaining term is determined from the Date Opened to the anniversary of the Date Opened until the Payoff Date is reached.

The rebate amount, if any, will be displayed on the Adjustments tab.

|

|

?Locked For Payoff

Mnemonic: POLOCK

|

This field indicates whether the payoff quote is Locked. A mark appears in this field if <Lock> has been clicked. See below for more information.

If this field is marked, the system will place a “23” in one of the Action Code fields and the payoff Expire Date above will be entered in the corresponding Action Date field on the Actions, Holds and Event Letters screen. This indicates that the loan record and payoff record are locked. When the payoff quote is locked, all attempts to update the loan record or payoff quote record and all transactions on the loan, except the payoff transaction (from the Post Payoff tab), will be rejected.

If the loan is unlocked during the night of the Expire Date, the system will automatically unlock the payoff and delete the action code 23 and the action date. The loan record and payoff record will no longer be locked.

A reversal of a payoff transaction (588 tran code) will place action code 23 and the Expire Date in the Action Codes/Dates field. The system will not use the reversal date.

When you attempt to lock in a payoff, if there are miscellaneous adjustments that require a G/L number (on the Adjustments tab), make sure the G/L number is tied to those adjustments. Otherwise, the funds will not process.

|

|

Legal Payoff

Mnemonic: MPLGPO

|

Use this field to indicate whether the payoff should be processed using the rules explained on the Legal Payoff rules/examples help page. Also see that help page for examples of legal payoffs.

|

Non-Filing Payoff

Mnemonic: MPNFPO

|

Use this field to indicate whether a Non-Filing Payoff transaction should be run when the payoff is processed. This transaction will perform the following:

•Write "NonFile Payoff" in the history description. •Place Hold Code 96 (Paid account; was a collection. Reported to credit bureau.) on the account. •Hold Code 96 will trigger a Credit Bureau Status Code of 62 during monthend processing.

You should also select "8 - Paid by Non-file" in the Payoff Description field below.

|

Quoted By:

Mnemonic: POQNBR

|

This field displays the employee or teller number of the person who quoted the payoff amount to the customer.

|

Name

Mnemonic: POQNAM

|

This field displays the name of the employee who quoted the payoff amount to the customer.

|

Payoff Description

Mnemonic: MPPOCD

|

Use this field to indicate the institution-defined payoff type for the payoff transaction being processed. This field does not appear on this screen until payoff types are set up on the Loans > System Setup Screens > Payoff Transaction Descriptions screen. See below for more information.

Once the types of payoffs are defined on that screen, the Payoff Description field appears on the Payoff screen, and users can select a type of payoff from this menu.

This information is optional and can be used in credit reporting.

In compliance with credit reporting regulations (FACT-ACT), certain Special Comment codes and Account Status codes can be generated on the customer loan account depending on the Payoff Description selected. In order for this feature to be effective, your institution must create eight payoff description codes on the Payoff Transaction Descriptions screen. The table below displays the Code and Description for each Payoff Transaction Description that must be created as well as the Special Comment Code or Account Status that is generated at monthend when the corresponding Payoff Description is used.

Code

|

Description

|

Special Comment Code

|

1

|

Paid by Co-Maker/Guarantor

|

C

|

2

|

Paid by Company which Originally sold the Merchandise

|

BN

|

3

|

Paid through Insurance

|

BP

|

4

|

Paid by Garnishment

|

AM

|

5

|

Paid by Financial Counseling Program

|

B

|

6

|

Paid from Collateral (or Paid by Sale of Security)

|

AX

|

7

|

Paid by Third Party Collector. This does not set Special Comment code but does set Account Status 62 (collection account).

|

Not applicable

|

8

|

Paid by Non-file

|

S

|

|

|