Navigation: Loans > Loan Screens > Deferments Screen >

Extensions field group

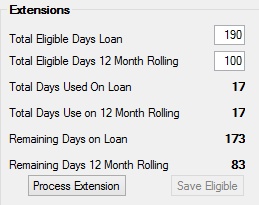

Use the Extensions field group on the Deferments screen to view and edit extension information on the customer loan account, if your institution allows extensions. If your institution wants this feature to be available, contact GOLDPoint Systems. Institution Option IUEX must be enabled for this field group to appear on this screen. The following is an example of this field group:

Extensions are a simple way to extend the loan's due date by a specific number of days. The system uses total number of days, not business days. This is a convenient feature you can offer customers who may be struggling to make a loan payment. An extension is similar to a deferment, but it doesn't cost the borrower any money. Your institution determines how many days the due date can be extended for the life of the loan, as well as on a yearly basis. As the loan's due date is extended, so is the maturity date.

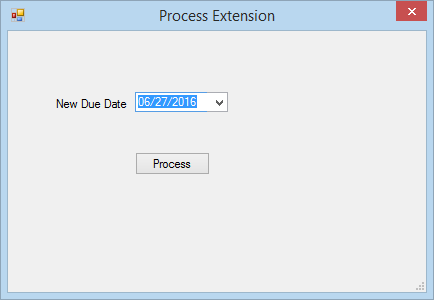

To process an extension using this field group, click ![]() . The system displays the following dialog box:

. The system displays the following dialog box:

In the New Due Date field, select the new due date for the next loan payment, then click ![]() . The Due Date field will display the new due date you selected, and the Maturity Date will also advance by the number of extended days.

. The Due Date field will display the new due date you selected, and the Maturity Date will also advance by the number of extended days.

Processing an extension also automatically updates the Current Installment Number field (on the Loans > Account Information > Account Detail screen) with the appropriate number of frequency cycles surpassed by the extension. For example, if the loan frequency is bi-weekly and the loan is extended by 15 days, the Due Date is increased by 15 days (over one frequency) which means the Current Installment Number is increased by 1.

If you have the proper security clearance, you can change the number of extension days eligible in the Total Eligible Days Loan and Total Eligible Days 12 Month Rolling (see Field-level Security). If you do change the numbers in these fields, be sure to click ![]() to save your changes.

to save your changes.

The fields in the Extensions field group are described in the following table:

Field |

Description |

||

|

Mnemonic: M1TDLN |

This field indicates the total number of days the customer is allowed to extend over the life of the loan. If you have the proper security, you can change the information in this field (see Field-level Security). The numbers in this field are determined by your institution's policies regarding extensions and transferred over when loans are originated.

|

||

Total Eligible Days 12 Month Rolling

Mnemonic: M1TDYR |

Use this field to indicate the total number of days the customer is allowed to extend in a one-year period.

|

||

|

Mnemonic: M1DULN |

This is the total number of days the customer has extended the Due Date over the life of the loan. This information is calculated by the system each time an extension is processed on the account. For example, if an extension is processed for 10 days from the current Due Date, this field will reflect "10." If another extension is processed four months later for 20 days from the Due Date, this field will reflect "30" (10 + 20). |

||

Total Days Use on 12 Month Rolling

Mnemonic: M1DUYR |

This is the total number of days the customer has extended during the current year. This information is calculated by the system each time an extension is processed on the account. This number clears once 12 months have passed from the first extension processed on the account. However, once the account reaches the Total Eligible Days Loan amount, no more extensions are allowed.

For example, a loan has 180 Total Eligible Days on the life of the loan, and 180 Eligible Days for 12 Month Rolling. In February, the account owner requests that their loan be extended for 60 days. After the extension is processed, the Total Days Used on Loan and Total Days Used on 12 Month Rolling both display "60." The next February, the system clears out the Total Days Used on 12 Month Rolling, but retains the "60" on the Total Days Used on Loan. In March of the next year, the account owner requests an extension for 20 days. The Total Days Used on Loan would then reflect "80" (60 + 20), and the Total Days Used on 12 Month Rolling would reflect "20." Once either the Total Days Used on Loan or Total Days Used on 12 Month Rolling limits are reached, the account owner is no longer allowed extensions. |

||

Remaining Days on Loan |

This is the total number of days eligible for extensions for the remaining life of the loan. After an extension is processed, the system subtracts the number of days extended from the amount in this field.

For example, if an extension is processed for 20 days, and this field displays 90, the system subtracts 20 from 90 and displays "70." |

||

Remaining Days 12 Month Rolling |

This is the total number of days eligible for extensions during the current year. After an extension is processed, the system subtracts the number of days extended from the amount in this field.

For example, if an extension is processed for 20 days, and this field displays 90, the system subtracts 20 from 90 and displays "70." After the first extension is processed on an account and a year goes by (and the maximum amount of extensions has not been met), the system restores this number to the original default, which is the same number as in the Total Eligible Days 12 Month Rolling. |

Field-level security for this field group can be adjusted on the Loans > System Setup Screens > Field Level Security screen. Select “FPM1 – Miscellaneous Loan Record Fields” in the Record Type field and locate the following mnemonics: M1TDYR (Total Days Allowed Per Year), M1TDLN (Total Days Allowed Per Loan), M1DUYR (Number Days Used Per Year), and M1DULN (Number Days Used Per Loan). Restrict or allow access to these fields as necessary.