Navigation: Loans > Loan Screens > Transactions Screen Group > EZPay Screen > Using the EZPay Screen > Step 2: Payment Types >

Select the Deferment or Hardship radio button (if you have the proper field level security) to process deferments using EZPay. Deferments are not generally run through EZPay unless your institution has specifically requested the function to be available.

A deferment allows you to advance an account's due date without requiring a full payment amount from the customer. Deferments are generally used to offer customers relief during unforeseen/extraneous circumstances (loss of job, medical emergency, etc). Deferments do not remove the payment requirements on a loan, they merely delay the payment requirements for a period of time.

Running a deferment often results in a small charge to the customer, although some deferment types can be processed at no cost. The amount that will be charged for a deferment is determined by the Deferment Code used by your institution (see the linked help on the Loans > Deferments screen for more information).

Once the desired radio button is selected and any necessary additional information is entered (see bullet points below), proceed to Step 3: Payment Amount. If you encounter any error messages during the payment submission process, see Troubleshooting for information about how to resolve them.

|

Note: Remember that the appearance and available functions of these fields will vary depending on which IMAC options have been set up specifically for your institution (as explained on the Deferment Options help page).

Processing deferments in EZPay also requires several institution options to be set up. See the Institution Options help page for more information. |

|---|

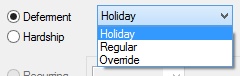

•If the Deferment radio button is selected, drop-down fields to the right of the button will become available. Use these drop-down fields to indicate the type of deferment being processed (Holiday, Regular, or Override; see Deferment Types for more information about each of these selections) as well as the number of deferments to process. Note that the field for indicating a number of deferments only appears if your institution uses the Allow Multiple Regular Deferments option (EZAMRD). The number of deferments that can be processed will depend on the deferment type as well as which Deferment Code is in use at your institution. When processing multiple deferments, the system will charge once per process rather than once per deferment. The total amount of processing the deferment (amount for deferment plus fees*) will display to the right of these fields as well as in the Payment Amount field group

•If the Hardship radio button is marked, the drop-down field to the right of the button will become available. Use this drop-down field to indicate the number of frequencies to defer payment. Hardship deferments do not require indicating any payment method information (in other words, Step 1 can be ignored). See Deferment Types for more information about hardship deferments.

*The Charge Convenience Fee on Deferments option (EZCFDF) can be used if your institution wants to charge convenience fees when processing deferments in EZPay. Fee amounts will depend on your institution's convenience fee settings, either on the EZPay IMAC Table (see Setup and Cards) or the Loans > System Setup Screens > EZPay Convenience Fees screen.

|

Special Option to Prevent Reporting Deferments to Credit Bureaus: An institution option is available that will not report deferments of any kind to the credit repositories during monthend Credit Reporting. This option, OP32 NRDF, stops the K4 Segment of the Credit Reporting transmission to not be included. The K4 Segment (Deferred Payments) is used to report deferments, but that will not be included if the NRDF option is set. Any Special Comments that accompanied some deferments (such as natural disaster (AW) or hardship (CP)) are also not included in the Credit Reporting transmission. Contact your GOLDPoint Systems account manager if your institution would like this option set up.

Remember: Setting this option does not change previously reported deferments before the option was set. For example, if this option is turned on this month for your institution, but last month loans were reported with a deferment, the past deferments are still reported. Going forward after the option is set, loans in deferment are no longer reported in the K4 Segment (Deferred Payments) of the Credit Report transmission.

See the Credit Report and transmission (FPSRP184) topic for more information. |

|---|