Navigation: Loans > Loan Screens > Transactions Screen Group > EZPay Screen > Using the EZPay Screen > Step 2: Payment Types > Deferment/Hardship >

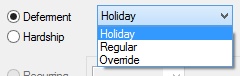

The following Deferment types are available in EZPay. See also the Deferment Transaction topic in the Transactions manual for more information.

•Regular – The standard deferment (usually one month). Regular deferments process as transaction code 2600-13 for most institutions. The number of deferments that can be processed, amount charged for the deferment, and restrictions/requirements for processing a regular deferment depends on the Deferment Code in use at your institution.

•Holiday – Another standard deferment, usually used in special circumstances. Holiday deferments process as transaction codes 2600-23 and 2600-24. This deferment type typically requires a charge.

•Override - This deferment type is rarely used (tran code 2600-11). This deferment type overrides the restrictions set by Institution Options DFRM and DFRL.

•Hardship – This deferment rolls due and maturity dates forward without any charge. Internal policies at your institution dictate what constitutes a qualifying hardship. The system does not enforce the rules or policies governing a hardship deferment. Hardship deferments do not require indicating any Payment Method information. Hardship deferments typically process as transaction code 2600-20. Hardship deferments will be disallowed if the following conditions exist on a customer account:

•The payment method is something other than 3 (precomputed), 5 (line-of-credit), or 6 (interest bearing).

•The loan is service-released (LNRLSD = Y).

•The loan is unopened.

•Institution Option STRN (Allow Special Transactions With SOV Set?) is disabled.

•The loan is a seasonal payment account (the Multiple Payment Application field is marked on the Loans > Account Adjustment screen).

The Hardship Deferment transaction performs the following actions:

•Advances the due date one month.

•Advances the maturity date if Institution Option RMTD (Roll Maturity Date on Deferment) is enabled.

•Advances the loan term.

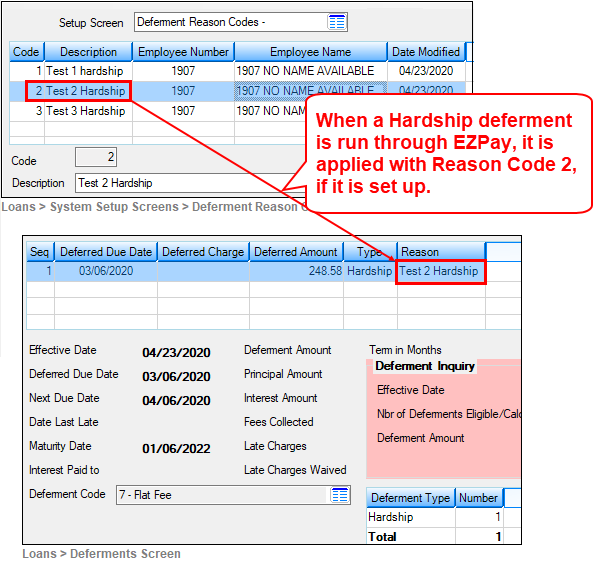

•Updates the Loans > Deferments screen with the deferment information.

•The account is given a deferment modifier (D0DMOD) and reason code (D0DFRE) of 2 (Hardship). Note that Deferment Reason Code 2 is reserved for Hardship Deferments made from EZPay. Any Hardship deferments run from here will be given Deferment Reason Code 2, as shown below: