Navigation: Loans > Loan Screens > Transactions Screen Group > EZPay Screen >

This section of the EZPay manual provides information about navigating the EZPay screen and using it to process/schedule payments, payoffs, and deferments. Remember that employees must be set up as tellers in order to use this screen (when the screen is first opened, a prompt to enter the user's teller number appears). See help for the Deposits > Definitions > Teller Information screen for more information about the teller setup process.

|

Note: This section of the manual will be of most interest to employees and tellers who use the screen to process payments for your institution's customers. For more information about the complex system of related CIM screens, GOLDPoint Systems-monitored IMAC tables, event letters, transaction codes, and loan reports that work together behind the scenes to make EZPay function, see EZPay Settings and Options. |

|---|

Payment Submission Process

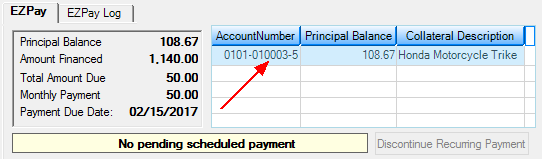

There are four basic steps to submitting a payment from the EZPay screen once an account is selected from the Accounts list at the top of the screen (shown below). Follow the links below for more information about each of these steps. If you encounter any error messages during the payment submission process, see Troubleshooting for information about how to resolve them.

•Step 4: Submitting the Payment

Optional Fields, Links, Tabs, and Lists

Depending on your institution's settings, some fields, links, tabs, and lists might be available on this screen which are helpful but not necessarily essential to processing payments in EZPay. Open the toggles below to see more information about these features.

The NSF Information field group (shown below) appears at the bottom of the EZPay screen. This field group displays the date the first non-sufficient fund was assessed on the account in the last 12 months, the count (number) of all non-sufficient funds assessed in the last 12 months, and the number of all non-sufficient funds assessed over the Lifetime of the account. See the following example of this field group:

Assessing a non-sufficient fund is usually accompanied by a payment transaction reversal. Your institution will get a transmission back from either the bank you do business with or the FRB notifying you of any payments that are returned due to non-sufficient funds in the payee's account. When this occurs, someone at your institution will need to reverse the payment from the account and assess a non-sufficient funds fee, if your institution's policies require it. The transactions you would use to assess a non-sufficient fee are as follows:

•Correction to Walk-in Payment transaction (2600-05) •Correction to Mail-in Payment transaction (2600-04) •Correction to No Advance Payment transaction (2600-09) •Reverse Payment with NSF (tran code 2608-01) •NSF–Renewed Account (tran code 2660-01)

See the NSF Fields field group on the Loans > Account Information > Account Detail screen > Late/NSF tab for more information. |

Blue links appear to the right of the NSF Information fields. These links open the following CIM GOLD screens as separate dialogs so other account information can be adjusted or referenced while the user is working in EZPay:

|

Depending on your institution's settings, the EZPay Log and Card Log tabs can be available on this screen. Use these tabs to view EZPay and card payment transaction history for the selected customer account.

See the help pages linked below for more information about these tabs.

|

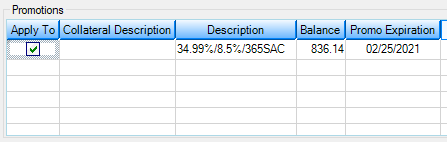

If the account is a line-of-credit loan, the Promotions list will appear above the NSF Information fields. Any promotions that are available to the customer will appear in this list and can be applied to their payment by marking the adjacent checkbox field (see example below).

|