Navigation: Loans > Loan Screens > Account Information Screen Group > Precomputed Loans Screen >

Amortization of Interest to G/L field group

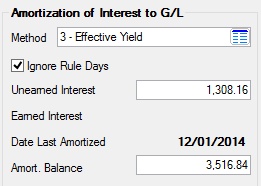

The Amortization of Interest to G/L field group on the Precomputed Loans screen displays the amount your institution collects when interest payments are made by borrowers, and that amount is amortized into your institution's General Ledger. The method your G/L uses to calculate the interest earned may be different than the method used to amortize interest earned for the borrowers.

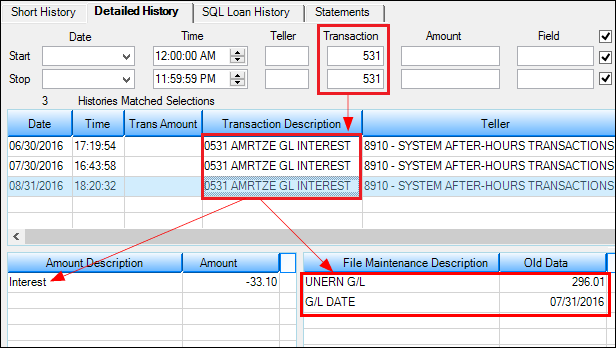

The system automatically amortizes precomputed interest to the G/L based on the amortization method in the Method field. When the system amortizes precomputed interest, you can view the date and amount amortized on the Loans > History screen > Detailed History tab by searching for transaction code 0531, as shown below:

|

Note: Update function 33 must be set to amortize the interest to the General Ledger. Also, the Precomputed Interest Amortization report (FPSRP215) shows the amortization of interest. Amortization to the G/L usually occurs at monthend. However, there is an institution option available that when set, finalizes the General Ledger Unearned Interest (below) at payoff instead of waiting until monthend. If you would like this option set, contact your GOLDPoint Systems account manager. The option is named FOPT GLFL (Use G/L Finalization). |

|---|

The fields in this field group are as follows:

Field |

Description |

|

Mnemonic: LN78AM |

See Amortization Methods for more information. |

|

Mnemonic: LN78IR |

This field allows you to mark accounts that will ignore the Rebate Rule Days when amortizing to the General Ledger. For example, if the account is opened on the 16th of the month, and the Rebate Rule Days field is set to “15” and this field is checked, the system will amortize to the G/L the first month the account is opened, not the following month.

The default for this field is a blank box. |

|

Mnemonic: LN78CG |

This is a system-entered field, but can be file maintained if needed (in very rare occasions). It is calculated by subtracting the Earned Interest amount below from the Original Unearned Interest amount. This is the amount of interest that has yet to be earned on this precomputed loan when borrowers make monthly loan payments to principal and interest.

Institution Option: An option is available that when set, finalizes the General Ledger Unearned Interest at payoff instead of waiting until monthend. If you would like this option set, contact your GOLDPoint Systems account manager. The option is named FOPT GLFL (Use G/L Finalization). |

|

Mnemonic: WKTOT |

This is a system-entered field that is not file maintainable. It is the amount of interest that has been earned by your institution since the date the loan was opened up to the date last amortized. On the amortization date, interest for the month is calculated and posted to the General Ledger. Also see help for the Method field above to see how the system amortizes interest. |

|

Mnemonic: LN78AD |

This field contains the date the interest was last amortized to the G/L. The actual amortization is done to the first of the next month. |

|

Mnemonic: LN78AB |

This is the balance of the loan used to calculate the interest amortization. This amount usually matches the same amount in the Original Principal Before Add-Ons field. |