Field

|

Description

|

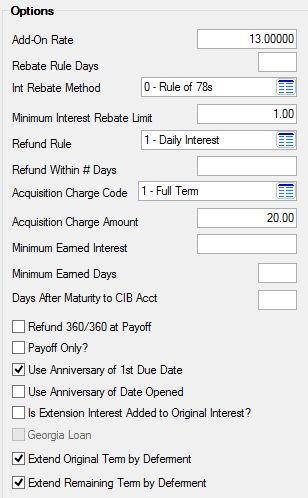

Add-On Rate

Mnemonic: LN78AO

|

This is the add-on interest rate for the precomputed loan. The Add-on Rate is the actual rate used to calculate precomputed loans. However, the FTC requires you to disclose your interest rate in terms of Annual Percentate Rate (APR), even when you use "add-on" methods. This rate can also be used to calculate the G/L earned interest.

|

Rebate Rule Days

Mnemonic: LN78DR

|

This field provides you with a way to control the monthly amortization of interest to your General Ledger. It also controls how rebated interest is calculated at the time of payoff. See below for more information.

Rebated interest at the time of payoff is generally controlled by state regulations. Some states allow the lender to collect a full month’s interest at payoff (1-day rule), while other states use the 15/16-day rule. Enter the number of days in this field, based on the state regulation which controls the loan.

To Amortize Interest to the G/L

If you enter “15” in this field, for example, the system will determine if it is to amortize interest to the General Ledger in the first and last months based on the following rules.

•At monthend, the first month a loan is opened, the system compares the Date Opened to the last day of the month and calculates the number of days. •If the number of days is 15 or less (according to our example), the system will not amortize the first month. •If the number of days is 16 or more, the system will amortize interest the first month.

To Calculate the Rebated Interest

At payoff, the system compares the day portion of the date opened to the payoff date. If the remainder (number of days) is within the Rebate Rule Days (15 or less), the system will not take any interest for the payoff month. If the number of days is 16 or more, interest is earned for the whole month.

Example: The Date Opened is 10-25-10 (the day of the month is the pertinent factor) and the payoff date is 1-17-11. Since more than 15 days have passed between 12-25-10 and 1-17-11, the system would collect a full month of interest for January. Had the number of days between 12-25 and the payoff date been 15 days or less when the payoff was calculated (Loans > Payoff screen), the system would rebate that month's interest to the borrower.

|

Note: In the 15/16-day rule, you cannot charge the borrower for that month’s interest during the first 15 days of each interest month. You can charge the borrower for a full month’s interest if you are 16 days or more into the interest month.

In the 1-day rule, you cannot charge the borrower for that month’s interest until 1 day after the effective day of the interest month.

An interest month is not the actual days of the month; it begins with the day of the loan effective date (day of the month the loan was opened). You do not count the day of the effective date when counting days elapsed. For example, if the loan effective date is 03/02/11, the interest month begins on the 2nd of the month. Using the 1-day rule, you would not be able to charge interest for that month until the day after the effective date. Using the 15/16-day rule, you would not be able to charge interest for that month until 15 days after the effective date.

|

If the Use Anniversary of First Due Date field below is checked, the amortization of the unearned interest and the payoff refund is calculated as follows:

1.The first period for amortization is the period between the Date Opened and the First Due Date. (This could be any number of days; for instance, it could be 10 days, 30 days, or 45 days.)

2.For the following months, each period is calculated from the Due Date day to the Due Date day.

The Rebate Rule Days field is also used. For instance, if the Due Date was on the 5th and the Rebate Rule Days was 15, then at payoff, the system compares the Due Date day to the payoff date. If the remainder (number of days) is within the Rebate Rule Days (15 or less), the system will not take any interest for the payoff month. If the number of days is 16 or more, interest is earned for the whole month.

3.If the Renewal/Pro-Rate field on the Loans > Payoff screen is checked, the loan is paid off before the first due date. The interest is pro-rated based on the actual number of days during that period. (That period is from the Date Opened to the First Due Date.) After the First Due Date, the number of days is based on a 30-day month. |

|

Int Rebate Method

Mnemonic: LN78MF

|

Use this field to indicate the method by which the interest will be amortized and rebated back to the borrower in the event that the loan is paid off early. See Interest Rebate Methods for more information about the possible selections in this field.

|

Minimum Interest Rebate Limit

Mnemonic: LN78RL

|

This field is used to set the minimum interest rebate limit for payoff. For example, if $1.00 is entered in this field, only interest rebates over $1.00 will be allowed.

|

Refund Rule

Mnemonic: MRRULE

|

Use this field to indicate the rule that is applied at payoff to determine the amount of refund. See Refund Rules for more information about the possible selections in this field.

|

Refund Within # Days

Mnemonic: MRWDYS

|

This field is used with refund rules (see above) 1 (Daily Interest) and 3 (Refund All). For refund rule 1, it is the number of days to apply the daily interest rule. For refund rule 3, it is the number of days during which all interest will be refunded.

|

Acquisition Charge Code

Mnemonic: LN78AC

|

This field is used to select the code that will be used in the calculation of the interest rebate for precomputed loans during the payoff quote. See below for more information.

The following codes are available:

01—Full Term

This acquisition charge will be applied to the cash payoff if the Renewal/Pro-Rate field on the Loans > Payoff screen is not checked. The acquisition charge is charged if the payoff occurs before the end of the term (LNTERM).

|

Note: If your institution uses Acquisition Charge Code 01 and Interest Rebate Method 3, the Acquisition Charge Amount (see below) will be subtracted from the Original Unearned Interest amount (prior to calculating the interest rebate) regardless of whether the payoff is a renewal (the status of the Renewal/Pro-Rate field will be ignored).

|

02—First 1/2 of Term

This acquisition charge will be applied to the cash payoff if the Renewal/Pro-Rate field on the Payoffscreen is not checked. The acquisition charge is only charged if the payoff occurs in the first half of the term (LNTERM / 2).

03—1/2 of Term x 90%

The following calculation is used to calculate the rebated interest if the payoff occurs within the first half of the loan term:

(Original Interest (LN78OI) - Acquisition Charge Amount (LN78AA, see below)) X 90%, then amortize amount at rule of 78s.

If the payoff occurs within the last half of the loan term, the following calculation is used for the rebated interest:

Original Interest (LN78OI) X 90%, then amortize amount at rule of 78s. If the acquisition charge is greater than the original finance charge, there is no refund.

Example:

a. Term = 12 months.

b. Original interest = 100.00.

c. Date opened = 12/01/04.

d. Payoff date = 06/03/05.

e. Acquisition charge = $25.00.

f. Calculated amount to amortize refund is (100.00 - 25.00) x 90% = $67.50.

g. Calculated refund is $67.50, amortized at rule of 78s.

Earned is $67.50 - g.

04—Full Term X 10%

Contact GOLDPoint Systems for information concerning this code.

|

|

Acquisition Charge Amount

Mnemonic: LN78AA

|

The charge amount is used in the calculation of rebated interest.

Example:

a. Original finance charge is 100.00.

b. Calculated amount to amortize refund is 100.00 - 20.00 = 80.00.

c. Calculated refund is 80.00, amortized at rule of 78s.

d. Earned is (a - c).

Acquisition charge is $20.00.

If the acquisition charge is greater than the original finance charge, there is no refund.

|

Minimum Earned Interest

Mnemonic: MRMNEI

|

This field is used along with the Minimum Earned Days field below. Information for this field is usually brought over during loan origination. However, if you have proper security, you can make changes to this field. See below for more information.

This optional field displays the minimum amount of interest your institution is allowed to keep (earn) if the loan is paid off early or cancelled. For example, if the borrower opens a loan and pays it off the very next month, the amount of interest earned by your institution would be relatively small. However, if your institution uses the Minimum Earned Interest field, your institution would be able to keep a designated minimum amount displayed in this field if it is greater than the Rebated Interest amount at early payoff or cancellation.

The Minimum Earned Days field determines how long the Minimum Earned Interest amount is valid on the loan. Once the loan has been opened longer than the days in the Minimum Earned Days field, the Minimum Earned Interest amount no longer applies. Instead, the rebated amount is based on the other options involved with your institution’s precomputed loans. If the borrower pays off early and is due back some interest, it will be displayed on the Adjustments tab of the Payoff screen. Once the loan is paid off and closed, the amount that was rebated back to the borrower is displayed in the Rebated Interest field on the Precomputed Loans screen.

To calculate the Minimum Earned Interest at Payoff (if the loan is paid off before the Minimum Earned Days), the system subtracts the amount in this field from the Original Unearned Interest plus any extension interest (OTXINT) and compares it to the Rebated Interest amount.

•If the Original Unearned Interest plus the extension interest minus the Minimum Earned Interest is less than the Unearned Interest at Last Accrued amount calculated at payoff, then the Original Unearned Interest plus the extension interest minus the Minimum Earned Interest is the amount refunded.

•If the Original Unearned Interest plus the extension interest minus the Minimum Earned Interest is more than the Unearned Interest at Last Accrued amount, then the refund is based on the regular calculation (Int Rebate Method above) of the Rebated Interest at payoff. |

|

Minimum Earned Days

Mnemonic: MRMNED

|

This field displays the number of days within which to refund the amount of money from the Minimum Earned Interest field above. State regulations and your institution's interpretation of those regulations determines the number of days to enter in this field (it's usually pulled over during loan origination). If the payoff occurs after the number of days entered in this field (from loan opened date to the payoff date), Minimum Earned Interest is ignored and any refunded amount is determined by the rules set up for precomputed interest. See the Rebated Interest field for more information.

|

Days After Maturity to CIB Acct

Mnemonic: LN78DM

|

Once the precomputed loan reaches the maturity date and still has an outstanding balance, use this field to establish the number of days after maturity when the precomputed loan should be converted to an interest-bearing loan. Once the loan has been converted to an interest-bearing loan, you can choose to charge off some or all of the loan.

Converting Precomputed Loans to Daily Simple Interest

You can convert a precomputed loan to a daily simple interest loan (payment method 6) from three different places in CIM GOLD:

|

1. By clicking <Run PC2IB Transaction> from the Loans > Transactions > CP2 screen on the CP2 tab.

|

2. You can also use the Loans > Transactions > Charge Off Transactions screen, Convert Precomputed to Simple tab.

|

3. From the Loans > Account Adjustment screen, then click <Convert to Interest Bearing>.

|

|

Note: You can skip certain amortizing fees from being included when converting precomputed loans to interest-bearing loans. This option (F1CIBS) is set during loan origination (either through GOLDTrak PC, GOLDTrak Express, or eGOLDTrak) for each fee you do not want included and is only available for precomputed loans (payment method 3).

|

|

For more information, see Convert Precomputed to Daily Simple Interest.

|

Refund 360/360 at Payoff

Mnemonic: LN7830

|

If this field is checked and the loan has Rebate Rule Days (see above), the interest rebate will be refunded using a 360/360-day base.

|

Payoff Only?

Mnemonic: LN78PO

|

Check this box to cause the system to perform the Rebate Rule Days (see above) only in the payoff month. It will always amortize interest to the G/L in the first month.

|

Use Anniversary of 1st Due Date

Mnemonic: LN78AF

|

This field changes the calculation of elapsed months from using the date opened to using the first due date. See below for more information.

The period between the date opened and the first due date is counted as one month. The elapsed period is added from the first due date to the anniversary of the first due date until the payoff date is reached.

In addition, this field works in conjunction with refunding and/or rebating amortizing fees. If the amortizing fee is set to refund at payoff or has a rebate, the elapsed period is calculated from the first due date to the anniversary of the first due date. When this field is checked, no amortizing (of fees) will occur until after the account has passed the first due date. The first month's amortizing will occur at the first monthend after the first due date has passed.

Rebate Rule Days can be used with this option (see above). The only change would be to use the day portion of the first due date rather than the day portion of the date opened.

|

Note: This option changes the renewal. If the payoff is before the first due date, the amount earned in the first period is divided by the number of days from the open date to the first due date and multiplied by the number of days from the open date to the payoff date. If the payoff date is after the first due date, the interest earned in the period of the payoff is divided by the number of days between the due date before and the due date after the payoff and multiplied by the number of days from the due date before the payoff to the payoff date.

|

|

|

Use Anniversary of Date Opened

Mnemonic: LN78DO

|

This field changes the calculation of elapsed months by using the date opened. If this field is checked, the elapsed period is added from the date opened to the anniversary of the date opened until the payoff date is reached. This option should be used if Rebate Rule Days above equals zero and Use Anniversary of 1st Due Date above is not used.

|

Is Extension Interest Added to Original Interest?

Mnemonic: LN78EI

|

Check this box if extension interest should be added to the original interest for this loan. Extension interest is the additional interest charged to the account for extending the due date past thirty days.

|

Georgia Loan

Mnemonic: LN78GA

|

This field will be checked if this loan is a Georgia loan governed by GILA rules. GILA rules affect the amount refunded. See GILA Refunds for more information.

|

Extend Original/Remaining Term by Deferment

Mnemonic: LN78EO, LN78ER

|

|

Note: These checkbox fields are not available until CIM GOLD version 7.9.3. If you would like to use these new fields but have not downloaded the latest CIM GOLD, contact your GOLDPoint Systems account manager. They can run an init to set up these fields for you on the Host record.

|

These checkbox fields affect the amount of precomputed interest returned back to the borrower if the loan is paid off early and if the loan ever had a deferment. If the loan never had a deferment, these fields are not used in the interest rebate calculation at payoff. Only one of these checkboxes can be selected at a time. If the Extend Original Term by Deferment is selected, the Extend Remaining Term by Deferment cannot be selected, and vice versa.

When precomputed interest is rebated back to a customer on payoff, the system uses the Int Rebate Method to determine the amount of interest to amortize each month. Any unearned interest that hasn't been amortized (Rebated Interest) is returned back to the borrower at payoff.

Many Interest Rebate Methods use the Remaining Term or Original Term to calculate the amount to refund back to the customer. All refund methods need to know the Original Term to calculate the monthly earnings. The Remaining Term is used to determine how much to rebate based on the amount of days remaining on the loan subtracted from the Original Term.

For example, Interest Rebate Method 1 (Rule of 78s) uses the following formula to rebate interest:

Rebated Interest = Original Unearned Interest*((Remaining Term*(Remaining Term + 1))/(Original Term * (Original Term + 1)))

But what that formula above does not take into account is deferments. The system does not increase the Remaining Term or Original Term when a deferment is processed. However, when considering unearned interest due back to the borrower, some states require that deferments be taken into account.

For example, certain states require that the interest rebate on precomputed loans that have had any payment deferments during the life of the loan be refunded based off an adjusted term rather than the original term of the loan.

If one of these fields is selected, the system will increase the Original Term or Remaining Term (depending on which box is selected) by the Number of Deferments (MLCNT1) made on the account during the life of the loan, but only during payoff calculation to determine the amount of precomputed interest that is rebated back to the customer. It will not actually increase the Original Term or Remaining Term.

Example:

Precomputed Loan =

•$300 of precomputed interest (Original Unearned Interest) •Original Term = 12 •Remaining Term at payoff = 3 •Deferments made during the life of the loan = 2

Using this example, let's say the Extend Original Term by Deferment is checked. The system would calculate the above scenario as follows:

300 * ((3 * (3 + 1))/14 * (14 + 1))) = $17.10

(You would use 14 instead of 12 because the option designates to increase the Original Term by the two deferments.)

If Extend Original Term by Deferment is not checked, the unearned interest would be calculated as follows:

300 * ((3 * (3 + 1))/12 * (12 + 1))) = $23.07

If Extend Remaining Term by Deferment is checked, the unearned interest would be calculated as follows:

300 * ((5 * (5 + 1))/12 * (12 + 1))) = $57.60

(You would use 5 instead of 3 because the option says to increase the Remaining Term by the two deferments.)

This is just a simple example to explain the concept of how the system uses these two checkboxes.

See also:

Deferments screen

|