Navigation: Loans > Loan Screens > Account Information Screen Group > Precomputed Loans Screen >

Loan Information field group

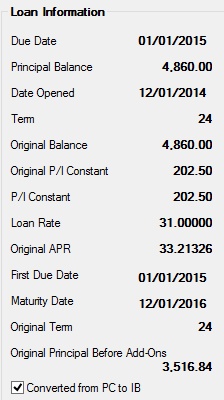

The fields in the Loan Information field group on the Precomputed Loans screen display the current interest, balance, and other details of the loan. These fields are not file maintainable on this screen; however, they are file maintainable on other screen in the loan system or through GOLDTeller transactions.

The following fields are in this field group:

Field |

Description |

|||||||

|

Mnemonic: LNDUDT |

This is the date the next regular payment is due. This field can be file maintained through the Loans > Account Information > Account Detail screen. |

|||||||

|

Mnemonic: LNPBAL |

This field displays the unpaid principal balance of the loan. It can only be entered, changed, or otherwise affected by teller transactions, which means it cannot be file maintained through this screen. Depending on the kind of loan, a transaction may either reduce or increase this balance. |

|||||||

|

Mnemonic: LNOPND |

This field displays, in MMDDYY format, the date the loan was opened or funded. The system automatically supplies this information when a new loan (tran code 680) is performed or the loan is boarded and funded from GOLDTrak PC. For loans with precomputed interest (payment method 3), this field is one of the keys for calculating rebates. Although the system enters the data for this field, it is file maintainable on the Account Detail screen if you have the proper security clearance. |

|||||||

|

Mnemonic: LNTERM |

This field contains the term of the loan in months. It is used in calculating Rebated Interest on loans with precomputed interest (payment method 3).

|

|||||||

|

Mnemonic: LNOBAL |

This field contains the original amount of the loan. On loans with precomputed interest (payment method 3), this amount will include the loan principal plus the add-on amounts. This field is originally entered through loan origination. |

|||||||

|

Mnemonic: LNOPIC |

This field contains the original amount of the principal and interest monthly payment on the loan. This field is originally entered when the loan is initially set up. |

|||||||

|

Mnemonic: LNPICN |

The P/I Constant field contains the portion of the regular payment that is divided between the amount to interest and amount to principal. This field is calculated by the system. |

|||||||

|

Mnemonic: LNRATE |

This is the annual interest rate of this precomputed loan to the nearest three decimal places. The information in this field is set up when the loan is opened. |

|||||||

|

Mnemonic: LNAPRO |

This field displays the original annual percentage rate (APR) of the loan. This field is for informational purposes and is not file maintainable. |

|||||||

|

Mnemonic: LN1DUE |

This field displays the first date the first payment was due on this loan. This field will be in the future if this is a new loan. |

|||||||

|

Mnemonic: LNMATD |

This field contains the date the last payment is due and the loan should be paid off. All loans must have a maturity date or the payment cannot be posted.

Institution Option APML allows a principal increase to be processed if a loan is past the maturity date. It requires a supervisor override (SOV). Institution Option APCO allows a loan payment (tran code 600/608) or an optional loan payment (tran code 690/698) to be processed if a loan has been charged off (hold code 2). |

|||||||

|

Mnemonic: LNTRMO |

This is the original term of the loan (in months) established during the origination of the loan. |

|||||||

Original Principal Before Add-Ons

Mnemonic: LN78OP |

This field displays the original amount of the loan before the unearned insurance and unearned interest are added to it. This field plus the Original Unearned Interest field and any unearned dealer reserve and unearned insurance amounts constitute the financed amount. |

|||||||

|

Mnemonic: LNPCIB |

If this account has been converted from a precomputed to an interest-bearing account, a checkmark will appear in this box. You can also checkmark this box if you or another person at your institution intends to convert this precomputed loan to an interest-bearing loan. This field is for informational purposes only. Open the link below for more information.

Converting Precomputed Loans to Daily Simple Interest

|