Navigation: Deposit Screens > Account Information Screen Group > Additional Fields Screen > Additional Fields tab >

Retention Periods field group

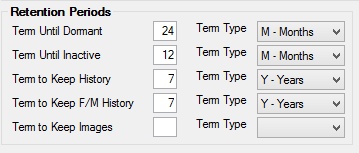

Use this field group to view and edit the length of retention periods on the customer account. Retention periods specify how long an account is kept active. Time periods to retain history information in the system can be adjusted for your whole institution on the Deposits > Definitions > System History Retention screen.

The left fields in this field group are used to indicate numeric values, while the corresponding Term Type fields on the right are used to indicate the measurement of time determining the term. For example, in the screenshot below, the Term Until Dormant is indicated as "24" while the Term Type is indicated as "M-Months." This means that the Term Until Dormant is 24 months (2 years). Possible Term Types are Days, Months, or Years.

|

Note: Institution Option OP23 ICCC may affect whether an account goes dormant or inactive. This institution option causes the Last Contact field on the Deposits > Account Information > Activity Information screen to update to the present date each time a customer account receives a periodic interest check, which causes the customer account to stay out of dormant or inactive status. This only applies to customer accounts where interest is paid by check (The Interest Destination field on the Deposits > Account Information > Interest Fields screen reads either “1” or “11”).

This will also keep the account from appearing on the Inactive/Dormant Accounts Report (FPSDR048).

If you would like to set this option for your institution, contact a GOLDPoint System customer service representative or send in a Support Request Form. |

|---|

The fields in this field group are as follows:

Field |

Description |

|

Mnemonic: DMDSTS/DMDSTT |

Use this field to indicate how long to maintain an account without activity until declaring it dormant. Once a customer account is declared dormant, it may not be able to have any transactions or other activity processed against it (depending on settings found on the Deposits > Definitions > Transaction Options screen). |

|

Mnemonic: DMISTS/DMISTT |

Use this field to indicate how long to maintain an account without activity until declaring it inactive. |

|

Mnemonic: DMHSTS/DMHSTT |

Use this field to indicate how long to keep a record of your institution’s monetary transaction history and to determine when this history should be purged from the system. Account history can be viewed on the Deposits > Account Information > History screen. |

|

Mnemonic: DMFSTS/DMFSTT |

Use this field to indicate how long to keep record of your institution's file maintenance history. Account history can be viewed on the Deposits > Account Information > History screen. |

|

Mnemonic: DMGSTS/DMGSTT |

Use this field to indicate when check images should be purged from the system. The term must be greater than or equal to the Statement Cycle (example: Statement Cycle 1 (monthly) must keep images for at least one month). Also, the term may not be greater than the Term to Keep History (example: if keeping history for 3 months, images may not be kept for 4 months).

These fields do not appear on the screen unless the account has the imaged statement feature enabled (Imaged Account is marked). To use the imaged statement option (Imaged Account is marked), contact GOLDPoint Systems to designate a third-party check image processor and enable the necessary system features. For a current list of vendors available for this service, see Ancillary Services in the Other section in DocsOnWeb. If GOLDPoint Systems processes your imaged statements (Institution Option OPTU - FIMG), only statement cycle codes 102-131 can be used with imaged accounts. To learn more about imaged statements, see help for the Deposits > Account Information > Check Imaging screen as well as the Check Imaging Options help page. Imaged statement features can be adjusted for individual customer accounts in the Image Fields field group on the Deposits > Account Information > Statement Fields screen. |