Navigation: Deposit Screens > Account Information Screen Group > Customer Directed Transfers Screen Group > Customer Directed Transfers Screen > Customer Directed Transfer Procedures >

Enabling Sweep Accounts

In order for sweep accounts to work properly, certain functions need to be enabled on the Deposits > Account Information > Additional Fields screen (for both accounts):

•Mark the Sweep Funds In/Out fields to indicate that the system should allow funds to sweep in and out of the customer account.

•Use the Negative Limit field to indicate the amount of funds that can be drawn on the customer account before funds are swept into it.

•Use the Minimum Balance Limit field to indicate the dollar amount that needs to be swept into the customer account to reach the minimum balance when the Negative Limit is reached.

•If a loan account is involved in the sweep, see the Sweep Loan Transfers section below.

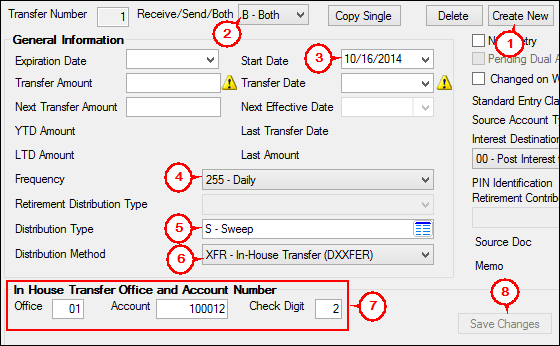

Additionally, you will need to set up the Customer Directed Transfers screen accordingly in order to sweep funds from one internal deposit account to another internal deposit account:

1.Click <Create New> to set up a new CDT record.

2.Set the Receive/Send/Both field to "B - Both."

3.Enter the Start Date as today's date.

4.Set the Frequency field to "255 - Daily."

5.Set the Distribution Type field to "S - Sweep."

6.Set the Distribution Method field to "XFR - In-house Transfer."

7.In the In House Transfer Office and Account Number field, enter the account number of the other deposit account where transfers should sweep in and out of when account balances go negative.

8.Click <Save Changes>.

Now the system will automatically process the sweep when the account balance goes negative. The amount of the sweep is determined by how much is needed to bring the account to the Minimum Balance Limit (specified on the Deposits > Account Information > Additional Fields screen).

You can sweep funds into a loan account to reduce the principal on the loan, or you can sweep funds from a loan account to increase the balance on a deposit account.

This feature requires certain settings on the Customer Directed Transfers screen:

•"B - Both" must be selected in the Receive/Send/Both field.

•The Frequency field must be set to "007 - Every 7 Days From Orig Xfer" or "255 - Daily."

•A value in the Start Date field is required.

•The Distribution Type field must be set to "S - Sweep."

•The Distribution Method field must be set to either "XFR - In-House Transfer" or "ACH - Automated Clearing House."

•The applicable ACH account number (if the Distribution Method field is set to "ACH - Automated Clearing House") or account number (if the Distribution Method field is set to "XFR - In-House Transfer") must be set up with the loan account information.

Additionally, the Sweep Funds In/Out fields on the Additional Fields screen must be marked. The loan account must be an open line-of-credit (LOC) loan to receive a payment from the deposit account. There can be only one loan sweep in and one loan sweep out CDT per account.

If the Coupon/Bill Code field on the Loans > Account Information > Additional Loan Fields screen is set to "10 - LOC Statement" or "18 - PM5 Laser Statement" and the loan is connected to a CDT sweep account (loan transfer), the sweep does not include interest and only pays the principal portion. Interest should be billed in the regular billing statement (make sure the loan is set up to create a bill and receipt or auto pay).

In order to sweep funds to a deposit account, the Sweep Funds In field on the Additional Fields screen must be marked. The loan account must be an open LOC loan.

When a primary deposit account is used to sweep to multiple deposit accounts and the primary account sweep is to an open LOC loan account, GOLDPoint Systems will process that loan sweep after all other deposit sweeps.

Sweep Loan Transfers: Afterhours

During afterhours, the Payable Balance of the deposit account (from the Deposits > Account Information > Account Information screen) and the Principal Balance of the loan account (from the Loans > Account Information > Account Detail screen) will be compared. The lower amount will become the transfer amount. This amount will post as a field credit tran code 510 (for more information about tran codes, see the tran code description table in Appendix D.2 in the Other > GOLD Services Manual of DocsOnWeb). No interest amounts will post from the checking account. If the Payable Balance is greater than the Principal Balance, only the amount of the Principal Balance will be used to make the payment transfer. If the Payable Balance is less than or equal to the Principal Balance, only the amount of the Payable Balance will be used to make the payment transfer.

If the Payable Balance of the deposit account falls below zero during afterhours processing, a transfer transaction will be created to bring the Payable Balance to zero. The transfer amount will post as a field debit tran code 500. If there is not enough credit left in the LOC loan to cover the amount needed for the transfer, the remaining credit from the loan will be used.

It is possible to sweep to an investment deposit account with funds left over in the master sweep account after an LOC loan sweep has been satisfied. To enable this feature, enter "B - Both" in the Receive/Send/Both field, "S - Sweep" in the Distribution Type field, and "XFR - In-House Transfer" in the Distribution Method field on the Customer Directed Transfers screen. |

Sweep account transactions will appear on the Customer Directed Transfers Transaction Report (FPSDR070). Failed transactions will appear on the Deposit System Error and Exception List report (FPSDR105).

See also:

General Ledger Sweeps in the General Ledger Account Number field group