Navigation: Deposit Screens > Account Information Screen Group > Interest Fields Screen > Interest Fields tab >

Interest Options field group

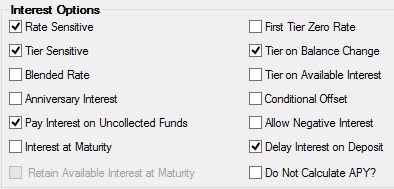

The options in the Interest Options field group on the Interest Fields tab affect interest rate and calculations. Rates and methods should generally be changed by rolling products from one product code to another. For more information about product codes, see help for the Deposits > Definitions > Product Codes screen. For more information about product rolls, see help for the Deposits > Account Information > Roll Schedules screen.

The fields on this screen are only file maintainable if the customer account uses the interest feature (the Interest field on the Deposits > Account Information > Account Information screen is marked and IN appears in the Features list at the top of most CIM GOLD screens). Interest features can also be adjusted for individual customer accounts in the Interest Fields field group on the Account Information screen.

The fields in this field group are as follows:

Field |

Description |

|

Mnemonic: DMVART |

Use this field to indicate whether the customer account is rate sensitive. If this field is marked, the account's interest rate will change when the account's Rate Pointer changes. Rate pointers are ID numbers that specify an interest rate and tell the system if and when the rate for all customer accounts using the rate pointer will change. See the Rate Pointer field for more information.

If this field is not marked, the account's interest rate will not change.

In order to use option "02 - Cycle Average Balance" in the Interest Balance Code field, this field must be left blank. |

|

Mnemonic: DMVATR |

Use this field to indicate whether the customer account uses rate tiers. A Tier Pointer must be designated in order to use this feature. |

|

Mnemonic: DMBLRT |

Use this field to indicate whether the customer account uses a blended interest rate. If an account uses a blended interest rate, different rate values are assigned to different rate tier levels on the account by the Tier Table. The account must be Tier Sensitive (see above) in order to use this feature and a Tier Pointer must be designated. |

|

Mnemonic: DMIANV |

Use this field to indicate whether interest is posted to the customer account on its anniversary date. If option "000 - Never Post Interest" is selected in the Interest Frequency field, the Interest at Maturity field (see below) must be marked in order for this option to be used. Interest will post the night before the day of the month opened based on the information in the Interest Frequency field. For example, if the date opened is 02/07/2014 and the interest frequency is 001, interest will post on the night of the 6th each month.

If the Statement Cycle field (on both the Deposits > Account Information > Account Information and Additional Fields screens) is set to any code other than 1, 6, or 12, or if the Interest Frequency field is set to code 013, 016, or 023, this field cannot be marked. The status of this field affects the Days to Pay Interest Before Month-end/Anniversary field. |

Pay Interest on Uncollected Funds

Mnemonic: DMIUCF |

Use this field to indicate whether the customer account pays interest on uncollected funds (UCF). If this field is marked, interest will accrue on the total balance. If this field is left blank, uncollected funds will be subtracted out of the total balance, and interest will be accrued on each day's resulting balance.

In order to access UCF options, the Account Uses Uncollected Funds field on the Deposits > Account Information > Funds Holds or Additional Fields screen must be marked. To learn more about UCF, see the Uncollected Funds Types and Options help page. |

|

Mnemonic: DMIMAT |

Use this field to indicate whether the customer account will pay interest at maturity. If option "000 - Never Post Interest" is selected in the Interest Frequency field, then interest will only post at maturity. If the Interest Frequency field is set to any other option, interest will post based on the selected frequency and at maturity. |

Retain Available Interest at Maturity*

Mnemonic: DMRAIM |

Use this field to indicate whether Available Interest amounts will clear at maturity for the customer account.

Caution must be used when selecting this field. Most penalty calculations use Available Interest when computing early withdrawal penalties. |

|

Mnemonic: DMT1ZR |

Use this field to indicate whether the customer account will allow interest to be earned on the portion of the account that falls within the first tier level (a mark in this field indicates that interest will not be allowed). The account must be Tier Sensitive (see above) in order to use this feature and a Tier Pointer must be designated on the account.

For example, this field is marked and the first tier balance limit is $50.00. After a transaction, the customer account has a balance of $49.00. Interest will not be accrued on the account because the first $50.00 falls within the first tier. |

|

Mnemonic: DMTRBC |

Use this field to indicate whether the customer account should automatically recalculate its interest rate (according to its rate tier settings) when the account balance changes. The account must be Tier Sensitive (see above) in order to use this feature and a Tier Pointer must be designated. |

Tier on Available Interest* **

Mnemonic: DMTRAI |

Use this field to indicate whether the customer account changes tiers when interest payments raise the balance on the account to another tier level. The account must be Tier Sensitive (see above) in order to use this feature and a Tier Pointer must be designated. |

|

Mnemonic: DMCNOF |

Use this field to indicate whether the amount specified in the Rate Offset field is a conditional offset. If the rate offset is conditional, and the balance on the customer account drops below the account's opening balance, the rate offset will be dropped from the account.

If this field is left blank, the rate offset is considered a permanent offset until the account matures, rolls, or renews. If the account is not a certificate (the Certificate field on the Deposits > Account Information > Account Information screen is left blank), the rate offset can be cleared in a roll to another product. Product roll features can be adjusted for individual customer accounts on the Deposits > Account Information > Roll Schedules screen. |

|

Mnemonic: DMNGIN |

Use this field to indicate whether the customer account should calculate and pay negative interest. Negative interest is calculated by multiplying the interest rate in Institution Option NGAR by the "negative" current account balance and by the Interest Method on the account. The negative interest amount will post as an interest correction to the account with the description "Negative interest posting." |

|

Mnemonic: DMDDEP |

Use this field to indicate whether the customer account uses Deposit Delay. If this field is marked, the system will not pay interest on check deposits until a specified number of days have passed. The possible number of days is determined by your institution and is usually 1 or 2. To learn more about deposit delay for individual customer accounts, see help for the Deposit Delay field group on the Deposits > Account Information > Funds Holds screen.

Other institution options that pertain to deposit delay allow your institution to specify whether to use calendar days or business days and whether to delay the check amount or the deposit amount if these two amounts are different. These institution options are explained further on the Deposit Delay Institution Options help page. |

|

Mnemonic: DMNAPY |

Use this field to indicate whether the system will calculate and display APY values on the next statement for the customer account.

If this field is marked, no APY value will appear on the account's next statement. This field will then be cleared at the start of the next statement cycle. |

*These fields are only valid on certificate accounts (the Certificate field on the Deposits > Account Information > Account Information screen is marked). Features for individual customer certificate accounts can be adjusted on the Certificate Fields tab of the Deposits > Account Information > Additional Fields screen as well as the Certificate Fields field group on the Account Information screen.

**Rate tiers influence the calculation of a customer account's interest rate by indicating the offsets or rates that will be used based on the balance of the account. Rate tiers are set up on the Deposits > Definitions > Rate Tiers screen but can be adjusted for individual customer accounts on the Tier Table tab.