Navigation: Deposit Screens > Account Information Screen Group > Funds Holds Screen > Uncollected Funds and Deposit Delay tab >

Deposit Delay field group

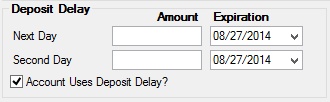

Use this field group to view and edit Deposit Delay information for the customer deposit account. In order to access deposit delay options, the Account Uses Deposit Delay? field (mnemonic DMDDEP) in this field group must be marked. When that field is marked, no interest is calculated for the checks deposit, based on the number of days your institution uses for Next Day (Local) or Second Day (Non-Local) checks.

Certain institution options must be enabled for deposit delay to work properly on the customer account. A work order must be submitted to GOLDPoint Systems to activate these options, which are explained in greater detail on the Deposit Delay Institution Options help page.

On the Uncollected Funds and Deposit Delay tab, each Amount field corresponds to an Expiration date field located to its immediate right. These date fields indicate when the deposit delay holds expire and the system begins accruing interest on the delayed amounts.

Use the Amount fields in this field group to indicate the amounts of Next Day (Local) and Second Day (Non-Local) funds that have a hold on the interest being accrued (mnemonic DUDDAM, DUDDLE, DUDDNA, DUDDNE). The number of days for Next Day holds is determined by Deposit Funds Holds Option NDLC, while the number of days for Second Day holds is determined by Deposit Delay Institution Option NDNL. The amounts in these fields are subtracted from the Current Account Balance field when interest is accrued.

If no uncollected funds amounts are entered in the teller transaction in the Next Day (Local) or Second Day (Non-Local) fields and the customer account uses deposit delay, all checks will be held as Next Day funds by default. If some amounts are entered but not the total amount of the checks, the difference will also be held as Next Day funds. For example, your institution requires non-local checks that are more than $2,000 to be held for five days until funds are available to deposit delay customers. Additionally, your institution requires Local checks to be held two days until funds are available to deposit delay customers. In GOLDTeller, the teller enters the total amount of the check ($5,000) in the Tran and Check In fields, but then enters $3,000 of the check into the Non-Local field to be held for five days. The funds on the $3,000 are available to the customer in five days, but the other $2,000 are available in two days (due to the Local hold still required for deposit delay customers).

If the customer account is a memo account (the Memo Post Account field on the Deposits > Account Information > Additional Fields screen is marked) deposit delay will not be entered online. It will be entered when the proof transaction is sent (in memo posting, transaction tickets are collected, scanned, and sent in a file to GOLDPoint Systems for processing in the afterhours).