Navigation: Deposit Screens > Account Information Screen Group > Interest Fields Screen > Interest Fields tab >

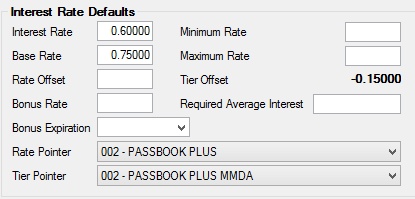

Interest Rate Defaults field group

Use this field group to view and edit interest rate defaults that are set on the customer deposit account based on product codes. They can be customized based on user security, but are generally changed by rolling products. For more information about product codes, see help for the Deposits > Definitions > Product Codes screen. For more information about product rolls, see help for the Deposits > Account Information > Roll Schedules screen.

The fields on this screen are only file maintainable if the customer account uses the interest feature (the Interest field on the Deposits > Account Information > Account Information screen is marked and IN appears in the Features list at the top of most CIM GOLD screens). Interest features can also be adjusted for individual customer accounts in the Interest Fields field group on the Account Information screen.

The fields in this field group are as follows:

Field |

Description |

|

Mnemonic: DMRATE |

This field contains the interest rate currently being paid on the customer account. This field is always positive. A separate rate, taken from Institution Option NGAR, is charged when the account is negative. The Allow Negative Interest field must be marked in order to have a negative balance.

File maintenance is not allowed on this field if the customer account is a certificate account (the Certificate field on the Deposits > Account Information > Account Information screen is marked) in grace. During a grace period, the interest rate may not be changed. |

|

Mnemonic: DMBSRT |

This field contains the base interest rate for the customer account based on its Rate Pointer below. A base rate can also be used on accounts where a higher rate than the default rate is used. A rate offset is then calculated. Each time the rate pointer is changed on the Deposits > Definitions > Rate Table screen, the value in this field will change. Each time the value in this field changes, the Interest Rate field above will change accordingly. This field can also be adjusted manually. |

|

Mnemonic: DMROFF |

Use this field to indicate an offset used when calculating the Interest Rate (above) on the customer account. It may be a positive or negative value.

For non-certificate accounts (the Certificate field on the Deposits > Account Information > Account Information screen is left blank), the rate offset will remain on the account until it is manually removed or the offset can be automatically removed when it is rolled into a different product. Product roll features can be adjusted for individual customer accounts on the Deposits > Account Information > Roll Schedules screen.

To clear a rate offset on a certificate account, mark the Conditional Offset box for the term of the account. When a mature or roll is processed, and the Conditional Offset field is marked, then this rate offset will be removed from the customer account. |

|

Mnemonic: DMBNRT |

Use this field to indicate a bonus offset used when calculating the Interest Rate (above) on the customer account. If no expiration date is entered in the Bonus Expiration field belw, this bonus rate will never expire on the account. |

|

Mnemonic: DMBNDT |

Use this field to indicate the date when the Bonus Rate offset indicated above will no longer be used to calculate the Interest Rate (above) on the customer account. If this field is left blank, the bonus rate will never expire. |

|

Mnemonic: DMRPTR |

Use this field to indicate the rate pointer to use on the customer account. Rate pointers are ID numbers that specify an interest rate and tell the system if and when the rate for all customer accounts using the rate pointer will change. Rate pointers are created on the Deposits > Definitions > Rate Table screen.

Maturing certificates and product rolls may change this field. Features for individual customer certificate accounts can be adjusted on the Certificate Fields tab of the Deposits > Account Information > Additional Fields screen as well as the Certificate Fields field group on the Account Information screen. Product rolls are entered on the Deposits > Account Information > Roll Schedules screen. |

|

Mnemonic: DMTPTR |

Use this field to indicate the tier pointer to use on the customer account. Rate tiers influence the calculation of a customer account's interest rate by indicating the offsets or rates that will be used based on the balance of the account. Rate tiers are set up on the Deposits > Definitions > Rate Tiers screen but can be adjusted for individual customer accounts on the Tier Table tab.

Once a selection is made in this field, information for the selected Tier Pointer will be displayed on the Tier Table tab. |

|

Mnemonic: DMRTMN, DMRTMX |

Use these fields to indicate the minimum and maximum interest rates allowed on the customer account. These rates will override any interest rates calculated in the afterhours that fall below the minimum or above the maximum value. |

|

Mnemonic: WKRATE |

This field contains the tier rate offset indicated by the selection in the Tier Pointer field (see above). If a bonus or bump rate is used on the customer account, those rates are added into this field. If Minimum and Maximum rates are used above and charges are made that take the rate beyond the limits established by those rates, the difference will also be added to the offset field.

This field is only a calculation used to add up to the customer account interest rate. It may be a positive or negative value. When a new interest rate is calculated based on a balance or tier change, this field is used in the calculation of the new rate. This field is changed by the system only as the rate and balance changes.

Rate tiers influence the calculation of a customer account's interest rate by indicating the offsets or rates that will be used based on the balance of the account. Rate tiers are set up on the Deposits > Definitions > Rate Tiers screen but can be adjusted for individual customer accounts on the Tier Table tab. |

|

Mnemonic: DMBALI |

Use this field to indicate a minimum average account balance required to post interest on the customer account. Interest will post on the account only if the zero average balance (the APY average balance calculation) for the cycle is above the value entered in this field.

This option is only available if the customer account is not a certificate account (the Certificate Fields field on the Deposits > Account Information > Account Information screen must be left blank) and the Interest Frequency field is set to "099 - Use Statement Frequency." Additionally, the Interest Balance Code field must be set to "02 - Cycle Average Balance."

When using Interest Balance Code 02, variable interest rates cannot be used. Interest is recalculated at the end of the Statement Cycle (from the Deposits > Account Information > Account Information and Additional Fields screens) based on the average account balance. Rate pointers must first be set up on the Deposits > Definitions > Rate Table screen before they can be used on this screen. |

*The Interest Rate is calculated as follows:

Base Rate |

+ |

Tier Offset |

+ |

Bonus Rate |

+ |

Rate Offset |

+ |

Bump Rate |

= |

Interest Rate |