Navigation: Deposit Screens > Account Information Screen Group > Account Information Screen > Features/Options tab >

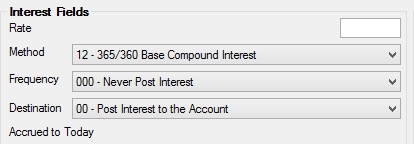

Interest Fields field group

Use this field group on the Features/Options tab of the Account Information screen to view and edit information about interest on the customer deposit account. These fields are only file maintainable if the Interest field is marked.

Interest features can also be adjusted for individual customer accounts on the Deposits > Account Information > Interest Fields screen.

The fields in this field group are as follows:

Field |

Description |

||

|

Mnemonic: DMRATE |

Use this field to indicate the interest rate currently being paid on the customer account.

This field must always be positive. A separate rate, taken from the institution options explained on the Deposit Funds Holds Options help page, is charged when the account is negative. File maintenance is not allowed on this field if the customer account is in grace (for Certificate accounts).

Certain account options affect the status of this field. Account-level options can be set for individual accounts on the Deposits > Account Information > Additional Fields screen. Teller-level options are explained on the Teller Level Options information below.

Interest posting is based on a combination of settings in various fields on the Deposits > Account Information > Interest Fields screen.

|

||

|

Mnemonic: DMINMT |

Use this field to indicate the desired method to pay interest on the customer account. Possible selections in this field are:

01 - 365/365 Base Simple Interest 02 - 365/360 Base Simple Interest 03 - 365/364 Base Simple Interest 04 - 360/360 Base Simple Interest 11 - 365/365 Base Compound Interest 12 - 365/360 Base Compound Interest 13 - 365/364 Base Compound Interest 14 - 360/360 Base Compound Interest 21 - 365/365 Base Continuous Compound Interest 22 - 365/360 Base Continuous Compound Interest 23 - 365/364 Base Continuous Compound Interest 24 - 360/360 Base Continuous Compound Interest

Interest methods using a 365-day base will automatically calculate for 366 days during a leap year. This pertains to any part of a leap year included in the interest calculation.

Interest posting is based on a combination of settings in various fields on the Deposits > Account Information > Interest Fields screen. |

||

|

Mnemonic: DMINFQ |

Use this field to indicate how often interest posts on the customer account.

Interest posting is based on a combination of settings in various fields on the Deposits > Account Information > Interest Fields screen. This field is used when calculating the next date to post interest. Possible selections in this field are:

000 - Never Post Interest 001 - Post Interest Monthly 002 - Post Interest Bi-Monthly 003 - Post Interest Quarterly 006 - Post Interest Semi-Annually 012 - Post Interest Annually 013 - Post Interest Quarterly (January, April, July, October) 016 - Post Interest Semi-Annually (March and September) 023 - Post Interest Quarterly (February, May, August, November) 099 - Use Statement Frequency 204 - Post Every Wednesday and Month-End 206 - Post Every Friday and Month-End 214 - Post Every Wednesday 216 - Post Every Friday 255 - Post interest daily

Interest Frequency codes 013 and 023 are currently available for Passbook Account accounts only (as indicated on the Deposits > Account Information > Additional Fields screen)

Selecting Interest Frequency code 099 will make interest post with the same frequency found in the Statement Cycle field. This code is only valid with Statement Cycle field codes greater than 100 and less than or equal to 131.

If your institution wants the system to post interest on the last day of the year on all accounts where the Frequency code is between 102 and 131, submit a work order requesting institution option OPTP-PIYE be set.

|

||

|

Mnemonic: DMIDST |

Use this field to indicate what to do with interest when it is posted to the customer account. Interest is always posted to the account and then withdrawn when this field indicates a transfer to another account. Possible selections in this field are:

00 - Post Interest to the Account 01 - Pay interest By Check 02 - Transfer Interest By CDT 11 - At Maturity Post to Account, Otherwise by Check 12 - At Maturity Post to Account, Otherwise by CDT

If you want to use code 01, all accounts except those with a Certificate feature must be set up through the Deposits > Customer Directed Transfers > Account Payees screen.

This field is used in the configuration of customer directed interest transfers, as explained on the Interest CDTs help page. |

||

|

Mnemonic: WKACTD |

This field contains the amount of interest that has been accrued to the present date but has not yet posted on the customer account. |