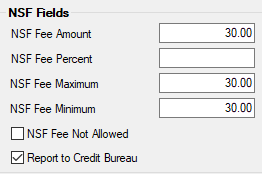

Navigation: Loans > Loan Screens > Account Information Screen Group > Account Detail Screen > Late/NSF tab >

NSF Fields field group

The following fields are found in the NSF Fields field group on the Late/NSF tab of the Account Detail screen.

Non-sufficient funds are assessed on loan accounts one of two ways:

1. |

If a loan payment by check is made to an account, and then later the check is returned due to insufficient funds, you can correct the loan payment and assess a non-sufficient funds fee at the same time using any of the following transactions:

•Correction to Walk-in Payment transaction (2600-05) •Correction to Mail-in Payment transaction (2600-04) •Correction to No Advance Payment transaction (2600-09) •Reverse Payment with NSF (tran code 2608-01) •NSF ACH Payment Reversal (tran code 2608-03) •NSF–Renewed Account (tran code 2660-01)

If you do assess a non-sufficient funds fee with a returned check payment, the system will use the fields in the NSF Fields field group to assess the fee amount.

•If you use the NSF Fee Amount field, you should not use the NSF Fee Percent, Maximum, and Minimum fields. The flat fee amount you enter in the NSF Fee Amount field will be the amount the system charges when assessing a non-sufficient funds fee. See NSF Fee Amount field below for additional information concerning account-level and institution-level fee amounts.

•If you use the NSF Fee Percent field, you should also establish an NSF Fee Maximum and Minimum. For example, if the NSF Fee Percent is set to "5," and the NSF Fee Maximum is "50.00" and NSF Fee Minimum is "10.00", the system will not assess a fee if 5 percent of the P/I Constant is less than $10 or more than $50.

•If the NSF Fee Not Allowed box is checked, even if users check the Assess NSF Fee box on the transactions mentioned above, the system will not assess a non-sufficient fee when the payment is corrected. See the NSF Fee Not Allowed definition below for more information. |

||

2. |

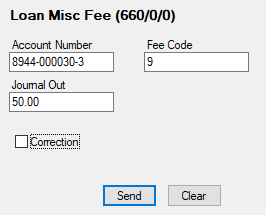

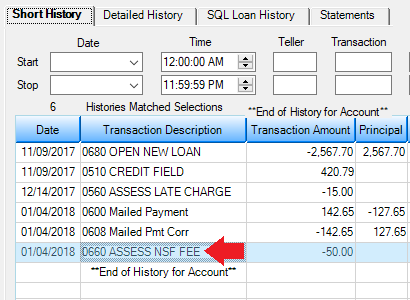

You can manually assess a non-sufficient funds fee on an account using the Loan Misc Fee transaction (tran code 660). However, if you manually assess NSF fees in this manner, the system ignores any options you have set in the NSF Fields field group. For example, checking the NSF Fee Not Allowed box will cause the system to not assess an NSF fee when a payment is corrected; however, if you manually assess a fee using tran code 660 and fee code 9 (NSF fee), the system will still manually assess an NSF fee on an account.

See the following example of tran code 660 with the Fee Code 9 and the amount of the fee displayed, followed by Loan History showing that the NSF fee was applied to the account (even though the NSF Fee Not Allowed box was checked).

Tran Code 660

Loans > History Screen Showing NSF Fee |

Field Descriptions for NSF Fields

Field |

Description |

||

|

Mnemonic: MLNSFA |

This field is used as follows:

1.At the loan level, this field stores the amount the system will charge for a check payment return due to non-sufficient funds.

2.When a correction to any of the following transactions is run, the transaction has a checkbox field, Assess NSF Fee. If the Assess NSF Fee is checkmarked, the system will reverse the transaction and assess the fee amount stored on this screen.

•Correction to Walk-in Payment transaction (2600-05) •Correction to Mail-in Payment transaction (2600-04) •Correction to No Advance Payment transaction (2600-09) •Reverse Payment with NSF (tran code 2608-01) •NSF ACH Payment Reversal (tran code 2608-03) •NSF–Renewed Account (tran code 2660-01)

3.If the NSF Fee Amount field on the loan is blank, the transaction will look at the LNFS-NSF Fee Amount field on the GOLD Services > Institution Options screen > GOLD ExceptionManager tab > Loans tab.

4.If both NSF Fee Amount fields are blank, no fee will be assessed.

If you check the NSF Fee Not Allowed box, you should keep this field blank.

|

||

|

Mnemonic: MLNSFP |

If you want to base the NSF fee on the percentage of the P/I Constant, use this five digit field (with up to two decimal places) instead of the NSF Fee Payment field. The system will calculate the percentage when the following transactions are run (the Assess Fee field on each transaction must be checkmarked in order for the fee to assess):

•Correction to Walk-in Payment transaction (2600-05) •Correction to Mail-in Payment transaction (2600-04) •Correction to No Advance Payment transaction (2600-09) •Reverse Payment with NSF (tran code 2608-01) •NSF–Renewed Account (tran code 2660-01)

If you check the NSF Fee Not Allowed box, you should keep this field blank.

This field can also be used in conjunction with the NSF Fee Maximum and NSF Fee Minimum fields (see definitions below).

|

||

|

Mnemonic: MLNSFH |

This is an amount field used as a maximum amount of NSF fee to assess when any of the transactions listed in the NSF Fee Percent field (see above) are run. For example, if the NSF Fee Percent is set to "5," and the NSF Fee Maximum is "50.00" and NSF Fee Minimum is "10.00", the system will not assess a fee if 5 percent of the P/I Constant is less than $10 or more than $50. |

||

|

Mnemonic: MLNSFL |

This is an amount field used as a minimum amount of NSF fee to assess when any of the transactions listed in the NSF Fee Percent field (see above) are run. For example, if the NSF Fee Percent is set to "5," and the NSF Fee Maximum is "50.00" and NSF Fee Minimum is "10.00", the system will not assess a fee if 5 percent of the P/I Constant is less than $10 or more than $50. |

||

|

Mnemonic: MLNSFN |

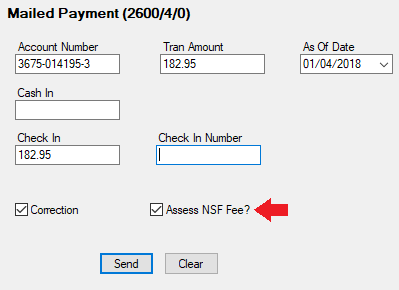

If the NSF Fee Not Allowed box is checked, even if users check the Assess NSF Fee box on the transactions mentioned above, the system will not assess a non-sufficient fee when the payment is reversed.

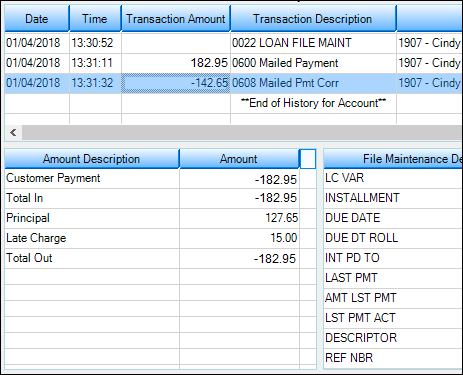

See the following example of a Mailed Payment transaction correction with the Assess NSF Fee box checked, followed by the Loan History screen showing that even though the Assess NSF box was checked, a fee was not assessed (because the account had the NSF Fee Not Allowed box checked).

Mailed Payment Transaction (tran code 2600-04)

History Screen Shows No NSF Fee Assessed

|

||

|

Mnemonic: LNCRBU |

Use this field to indicate whether information about the loan account should be reported to the Credit Bureau. See the Credit Reporting help for more information. |