Navigation: Loans > Loan Screens > Cards and Promotions Screen >

All purchases (promotions) under the same line-of credit account must have a single payment Due Date. Only one payment is required to cover all promotions, and the Cards and Promotions screen will show how each payment is applied to each promotion.

For example, if a borrower established a promotional low-interest loan for 18 months to buy a motorcycle, then one month later took out some additional line-of-credit from the loan to purchase new tires for the motorcycle, each purchase would likely have different opened dates, different promotional expiration dates, and/or different interest rates. But they will have the same Billing Date and Due Date, and their combined minimum payment (if more than one promotion) will add up to their total Minimum Payment Due.

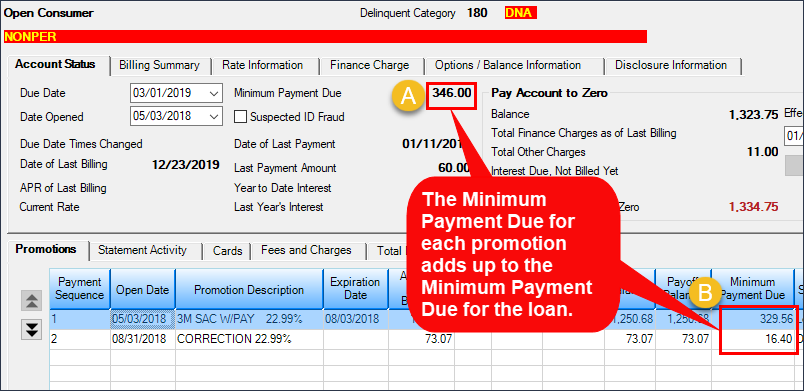

•The fields in the top half of the screen will show the total amount of payment for the whole loan (see A below).

•The fields in the bottom half of the screen will show the payment for each promotion or line-of-credit (see B below). The payment amount due for each promotion adds up to the total amount due reflected in the top half of the screen.

Loans > Cards and Promotions Screen

Loosely defined, the Minimum Payment Due is the payment amount due that billing cycle so the borrower does not incur a late charge. If there is more than one promotion on a loan, each minimum payment of each promotion adds up to the total amount of Minimum Payment Due on the loan.

The requirements for Minimum Payment Due vary widely depending on your institution's preferences and loan types. For example, one promotion may require interest-only payments for the first 12 months. Another promotion may have no interest or no payments for the first 12 months. A third promotion may include a low-interest rate for the first six months, then bump up to a higher rate the rest of the term of the loan.

The following key fields are very important in determining the Minimum Payment Due:

•Payment Type: This is a loan-level field, not promotion-level field. There are seven different Payment Types, but only three of them can be used with line-of-credit card loans. (Regular consumer line-of-credit can use all seven.) The Payment Type designates how the Minimum Payment Due is calculated. See the Payment Type field definition for more information.

•Payment Percent of Balance: If the Payment Type selected is for a percentage of the balance, this is the percentage used to make that calculation; may use Actual Balance or Original Balance on the loan. See Payment Percent of Balance for more information.

•Finance Charges: Not all Payment Types require finance charges (interest acquired that month, or the "I" in P/I Constant) to be part of the Minimum Payment Due to roll the Due Date (minimum amount required to not get a late charge). However, if the Payment Application dictates that interest is paid first, payment amounts may go toward unpaid interest (finance charges) before funds go toward the Principal Balance. Note: The Entire Payment Rolls Due Date option may also force the Due Date to roll if the total amount of the payment equals the Minimum Payment Due, regardless of the Payment Application. Also review the Roll Due Date Within option for information on partial payments that may still roll the Due Date.

•Minimum Payment Due: This field may be a bit confusing, because there's the Minimum Payment Due (calculated) required each frequency on the loan (as displayed on the Account Status tab), but then there's the Minimum Payment Due (LNRLMD) that shows on the Finance Charge tab. The two fields are not to be confused, because they are not the same! Some Payment Types require a percentage of the loan balance or the Minimum Payment Due entered on the Finance Charge tab. Whichever of the two is greater, that's the amount of the Minimum Payment Due (on the Account Status tab) that payment frequency.

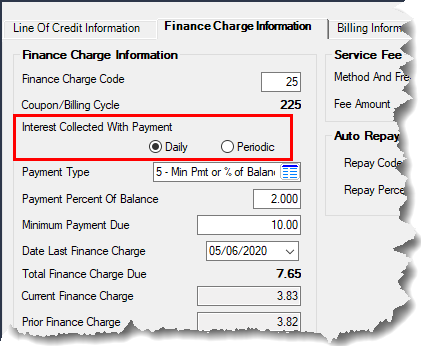

Collecting Interest With Payment

There's one more tricky option to be aware of and that is the Interest Collected with Payment option, which is found on the Loans > Line-of-Credit Loans screen, not on the Cards and Promotions screen. That option can be set to Daily or Periodic, and it will affect how much interest is collected when a payment is made. It does not affect how finance charges are calculated.

•If set to Daily (simple interest), the amount of interest collected with a payment is calculated from date of payment to date of payment on the loan. •If set to Periodic, the amount of interest is collected with a payment is calculated from Due Date to Due Date.

See the Payment Type field description for more information regarding this option.

See example below:

|

If a customer makes a payment that meets the Minimum Payment Due, the Due Date of the loan advances and the account will not receive a late charge the next time late charges are assessed for that frequency. The Roll Due Date Within, Payment Application, Entire Payment Rolls Due Date, and other loan-level options still apply to promotional line-of-credit loans.

First example:

The Roll Due Date Within option is set to "90 percent," and the Minimum Payment Due is $100. A customer makes a payment that month of only $90. The Due Date will still roll to the next Due Date and the account will not incur a late charge when the system applies late charges. The reason being that the remaining $10 owed is within 90 percent of $100 of the Minimum Payment Due.

The Payment Application is very important when setting up how your institution wants payments applied for line-of-credit card accounts. If interest is to be paid first (first in the Payment Application order), all payment amounts will go to unpaid interest before any amounts go toward principal.

Second example:

An LOC card loan incurred $50.00 in finance charges (interest) last billing cycle. The Minimum Payment Amount for this loan is based on the P/I Constant of $25. The borrower brings in a $50 payment. If the Payment Application field is set to pay interest first, the entire $50 will go toward finance charges first. Therefore, the full P/I Constant payment will not be met because the funds went toward finance charges, and the Due Date will not roll. If the customer doesn't make another payment of at least $25 by the Due Date + Grace Days, they will be assessed a late charge. (Assuming the Entire Payment Rolls Due Date option is not set.)

Take this same example but set the Payment Application to pay principal first, then interest, and then late charges. The P/I Constant would be met first, then any remaining funds would go toward paying off the finance charges (interest) (if there were no late charges). The Due Date would roll and the borrower would not incur a late charge. |

Finance charges are the amount of interest accrued that month for each promotion. If finance charges are not paid the month in which they are due, they are rolled over into the next month. Certain Payment Types require the finance charges be part of the Minimum Payment Due. The Payment Application also affects whether payments are applied first to finance charges (interest), before paying down principal (or P/I Constant). See Options to Roll the Due Date above.

Additionally, there are other options that will affect the finance charges. One option, Roll Charges into Balance, will roll the finance charges into the loan balance each month, so unless the payment made is more than the finance charges incurred, the balance will always go up.

Any additional funds included with a payment goes toward paying down the highest interest rate balance on the loan. However, if there is a same-as-cash purchase that includes deferred interest that will be applied to the account once the number of days designated in the SAC is expired, the system will first pay down the balance of the SAC. In other words, whichever balance is most advantageous to the borrower, the system will apply additional funds to that balance. This is governed by the Consumer Financial Protection Bureau. See this link for more information on the current Regulation Z requirements: https://www.consumerfinance.gov/policy-compliance/rulemaking/regulations/1026/53/

See Promotion Period Expiration Date for a description of same-as-cash offers. |

If making payments on a line-of-credit with promotional balance, it's best to use the EZPay screen for ACH and credit/debit card payments. See EZPay Payment Submission Process for more information.

If the payment is made with cash or check, you must use the LOC Card Payments transaction (tran code 2600-45) within CIM GOLDTeller. A regular payment transaction from CIM GOLDTeller will not work. You will get the following error message if you attempt to make a regular payment in CIM GOLDTeller on an LOC card loan:

"CANNOT PROCESS ON CARD LOAN"

See the LOC Card Payments transaction for more information.

Payoffs

If the payment is enough to pay off the loan, you should use the Loans > Payoff screen to finish paying off the loan. Or you can use the Pay to Zero payoff option on the EZPay screen. See these links for more information:

•Payoff Screen •Payoffs in EZpay •Pay to Zero in EZPay |