Navigation: Loans > Loan Screens > Cards and Promotions Screen >

Most promotions start off with a low or no-interest rate, then the rate expires after a designated number of months, and the standard, higher rate then applies to the loan balance. There is also a difference between same-as-cash offers versus just a promotional lower interest rate that expires and the new higher-interest rate takes effect.

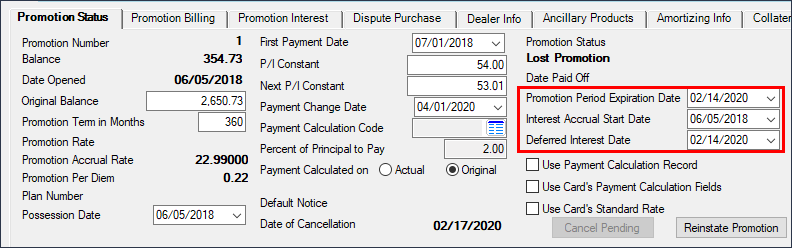

Four important dates determine when the promotional lower-to-no-interest rate expires; when the promotion begins to accrue interest; and when the deferred interest start date applies. The first three fields are found on the Promotion Status tab of the Cards and Promotions screen, as shown below:

Loans > Cards and Promotions Screen > Promotion Status Tab

A fourth field, Billing Date, is also crucial to this process. The Billing Date is when the system calculates the finance charges for the account. If an account loses the promotional interest rate at any time during the billing cycle, the Promotion Accrual Rate field will not reflect the new interest rate until after the Billing Date, even though the loan will start accruing interest at that new rate after the Promotion Period Expiration Date, Interest Accrual Start Date, and/or Deferred Interest Date expire (see video below). Therefore, most institutions make sure the Billing Date days line up with the Promotion Period Expiration Date, Interest Accrual Start Date, and Deferred Interest Date days.

See how the system applies the Standard Rate after the Promotion Period Expiration Date:

Same-as-Cash Promotion:

A same-as-cash promotion means the line-of-credit must be paid in full by the Promotion Period Expiration Date or all interest from the Date Opened to the Promotion Period Expiration Date is then owed on the line-of-credit when the billing runs on the date following the Promotion Period Expiration Date. Additionally, the Interest Accrual Start Date fields must be set to the same date as the Date Opened. That means the loan is deferring all interest owed from the Date Opened to the Promotion Period Expiration Date, but it will come do in the afterhours of the Promotion Period Expiration Date. The Deferred Interest Start Date and Promotion Period Expiration Date should be set to the same date in the future (the number of months after the Date Opened when the loan loses the same-as-cash offer).

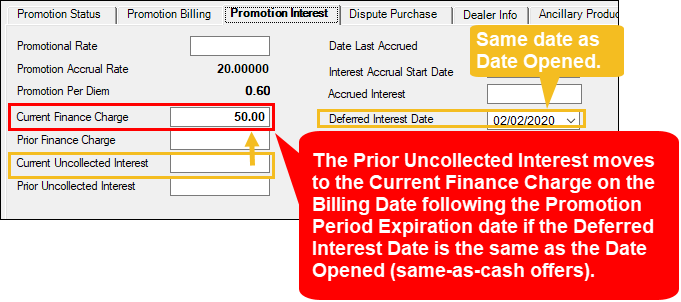

Every billing cycle, the system will accumulate the finance charges (interest) in the Current and Prior Uncollected Interest fields. After the Promotion Period Expiration Date (in the afterhours of the next Billing Date), the system will move the amounts from Current and Prior Uncollected Interest fields and put them in the Current Finance Charge field. The finance charges would then be due. If the borrower is unable to pay off the entire Current Finance Charges that billing cycle, any remaining amount in the Current Finance Charges will be moved to Prior Finance Charges, unless the option to move charges into loan balance is set. (See Roll Charges into Balance on the Options/Balance Information tab.)

If the borrower pays the loan off before the Promotion Period Expiration Date, uncollected interest remains uncollected.

Introductory Low-Interest Rate Promotion:

The system keeps track of the accrued interest amount had the account not had a zero-percent promotional rate, and displays those accrued amounts in the Prior Uncollected Interest field on the Promotion Interest tab on the Cards and Promotions screen. In the afterhours of the Next Billing Date, the system moves the amount in Prior Uncollected Interest to the Current Finance Charge field.

Example: A customer opens a $1,000 same-as-cash purchase on 02/02/2020. The Promotion Period Expiration Date is 04/02/2020, but the Deferred Interest Date is 02/02/2020. The Promotional Interest Rate is 0.00, but the Standard Interest Rate is 20 percent. To make this calculation easy, let's say that no additional purchases or payments were made for the first three months of the opened date. (See Billing Date and Calculating Average Daily Balance for more information on how the system calculates finance charges.) For those first three months, had there not been a zero-percent promotional interest and no payments made, the account would have accrued roughly $50 in interest.

If the line of credit is not paid in full by the 04/02/2020 date, the full $50 of accrued interest is now part of the Current Finance Charge amount when the next Billing Date is run after the Promotion Period Expiration Date, as shown below:

More information to come. |